North American Hotels Experience Strong Revenue Growth in 2016

NEW YORK – February 11, 2016 – Hotel industry performance remains strong, with Q4 2015 revenue per available room (RevPAR) increasing 4.0 percent year-over-year, and online and mobile bookings are continuing to drive this growth. According to data from TravelClick’s North American Distribution Review (NADR; Q1 2016), bookings through hotel company websites (Brand.com), online travel agents (OTAs) and in-person travel agents (global distribution systems / GDS) experienced the most growth in bookings in the fourth quarter, continuing the online / mobile trend from earlier in the year. TravelClick’s NADR report aggregates hotel bookings by channel for the transient segment (individual leisure and business travelers).

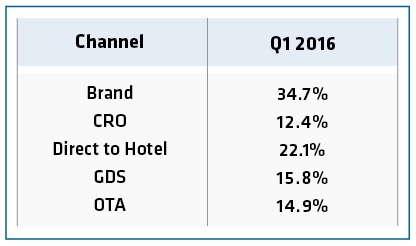

In Q4 2015, the OTA (which includes Expedia.com, Priceline.com, etc.), Brand.com and GDS channels all experienced healthy growth in the transient segment, up 3.5 percent, 4.3 percent and 3.8 percent, respectively. Hotel Direct (calls made directly to the property and walk-in customers) and calls to a hotel’s 800-number (the CRO channel) decreased by -7.2 percent and -4.4 percent, respectively. Average daily rates (ADR) across all channels also increased 2.4 percent compared to Q4 2014. Based on reservations that are currently on the books for Q1 2016, TravelClick expects to see additional positive growth, particularly for the OTA and Brand.com channels, when the quarter is complete (see chart below).

“As we kick off 2016, it’s increasingly clear that the OTA, Brand.com and GDS channels are continuing to experience the significant growth that began last year. Consumers are rapidly migrating from landlines and desktops to booking more and more reservations via digital channels and mobile devices,” said John Hach, TravelClick’s senior industry analyst. “It’s also important to note that the GDS channel continues to produce the highest room rate growth in the quarter, up 2.4 percent year-over-year.”

Share of Transient Rooms Sold by Channel

For Q1 2016, transient ADR is ahead by 3.6 percent, with the Hotel Direct channel generating the highest ADR growth, up 5.6 percent. In Q1, ADR is also growing 4.0 percent for CRO, 3.3 percent for OTA, 3.0 percent for GDS and 2.3 percent for Brand.com.

The TravelClick North American Distribution Review is based on data for 25 major North American markets, comprising 231 million annual room nights and $37 billion in annual room revenue.