By Marc Greeley

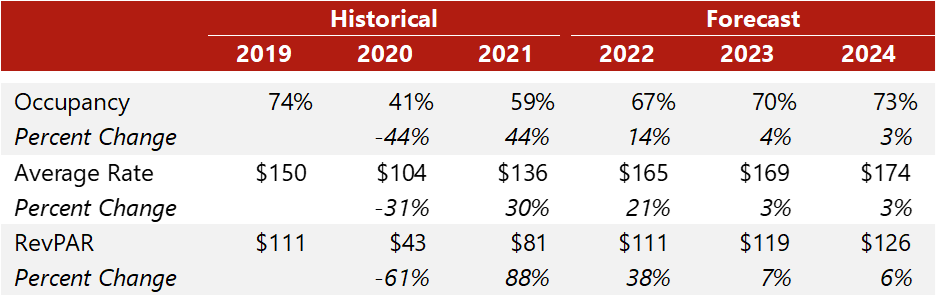

Due to the COVID-19 pandemic, Nashville realized one of the steepest lodging depressions of U.S. major markets, followed by an accelerated recovery in the second half of 2021. While there is still a way to go before reaching full recovery, lodging demand has already reached levels that even the most positive forecasts at the peak of the pandemic did not project, supported by the breadth of economic investments and the city’s reputation as a major leisure destination. Uncertainty surrounding rising inflation and interest rates, and the resulting hint of a looming recession, is an ongoing consideration when analyzing Nashville’s long-term growth outlook. The local hotel market’s reliance on leisure demand, one of the first segments affected when consumer buying power is hindered, may result in subdued growth in the next several years. However, the diversity of the local economy and significant long-term investment projects should offset these potential economic issues in the short term. The historical performance and our forecast of Nashville lodging metrics are shown below.

Major factors contributing to our forecast are summarized as follows:

- Nashville realized a surge of travel in the latter half of 2021, evidenced by a significant increase in airport passenger traffic, which nearly reached 2018 levels. While some of this growth was due to a modest return of corporate travel, hotel operators in the market reported that visitors were primarily leisure oriented. As many international travel destinations were unavailable to Americans in 2021 and as vaccines became widely available, a wave of domestic travel ensued. Leisure travel growth may slow in the second half of 2022 and 2023, as many international destinations have opened their borders to Americans; nevertheless, the breadth of tourism anchors in the city will continue to drive demand in this segment. Moreover, reports from the Metropolitan Nashville Airport Authority show that passenger volume is anticipated to exceed 2019 levels in 2023. The ongoing $1-billion BNA Vision airport renovation and expansion should further bolster passenger growth in the coming decade.

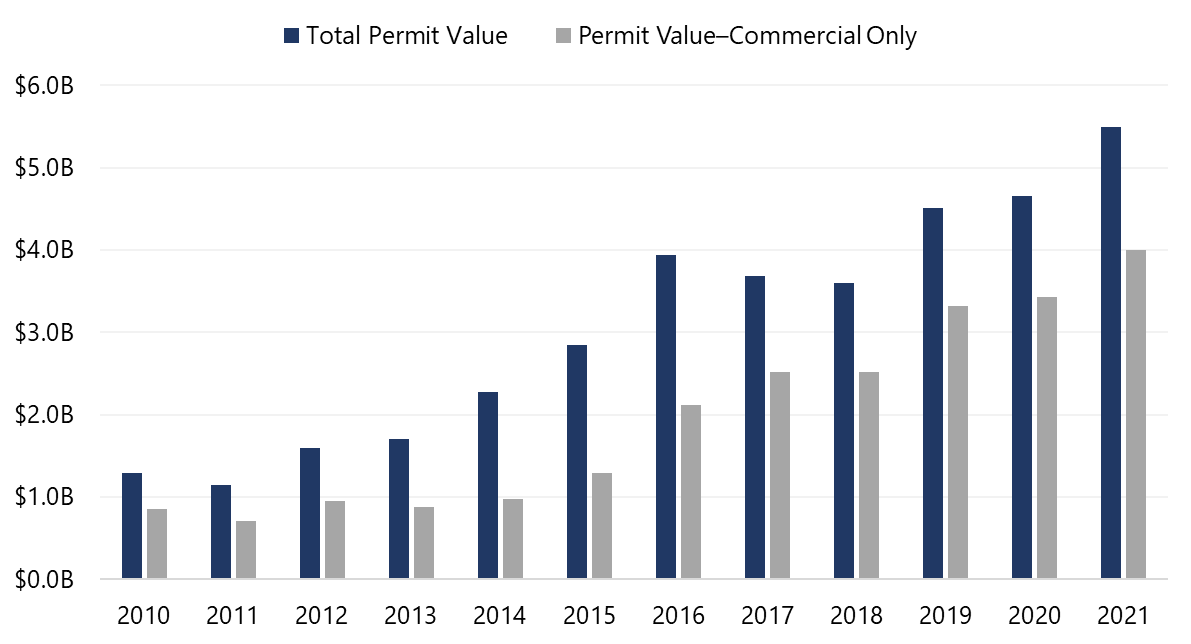

- Economic investment continues to set new records. In the summer of 2021, Oracle announced plans to construct a sprawling $1.3-billion, 1.2-million-square-foot campus on Nashville’s East Bank that will create 8,500 new jobs. The Oracle campus has already become a catalyst for ancillary development along the East Bank. Preliminary plans to build a new stadium for the Tennessee Titans NFL team are underway. The new stadium would replace the existing Nissan Stadium and would be the focal point of an estimated $2.2-billion stadium district, revitalizing a notably underutilized piece of prime riverfront real estate. Furthermore, Mayor Cooper recently announced approximately $769 million in additional capital improvements along the East Bank in an effort to address Nashville’s strained infrastructure amid the unprecedented growth. These improvements will focus on transportation, affordable housing, and utilities, including development of the boulevard envisioned as the primary corridor of the East Bank. As an illustration of the growth trends, the following chart shows the value of building permits issued in Nashville since 2010, broken down by total figures and commercial permits only.

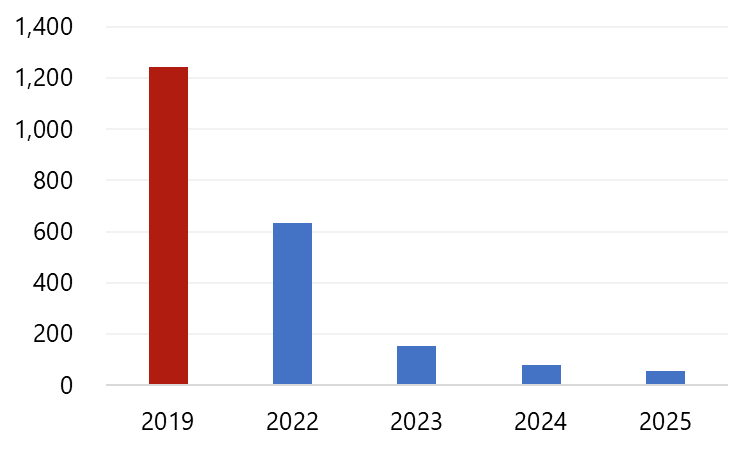

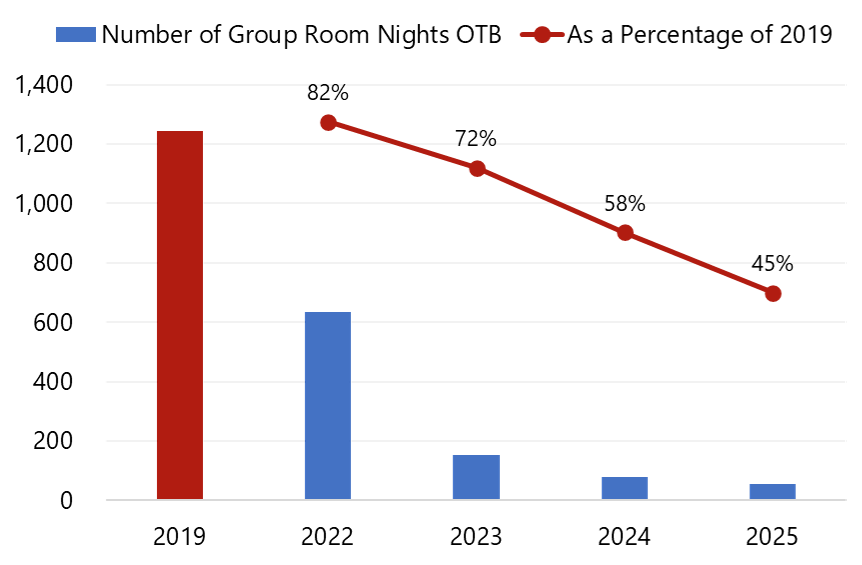

- Meeting and group demand became a primary component of the Nashville lodging market in the decade prior to 2020 and was a major catalyst for the development of multiple convention center hotels downtown. Meeting demand still lagged notably in 2021, with a limited number of smaller events being held. However, since successful vaccines have been introduced, citywide meeting and group demand has increased substantially in 2022, according to data from Visit Music City. Meeting demand is expected to continue to grow over the next few years, likely outpacing the 2019 level by 2024 or 2025, given the influx of new hotels that have opened in the market over the past several years, allowing the accommodation of larger groups and events. The following charts illustrate the numbers of events and group room nights booked in Nashville through 2025 as of mid-year 2022.

Source: Visit Music City

Number of Group Room Nights on the Books

Source: Visit Music City

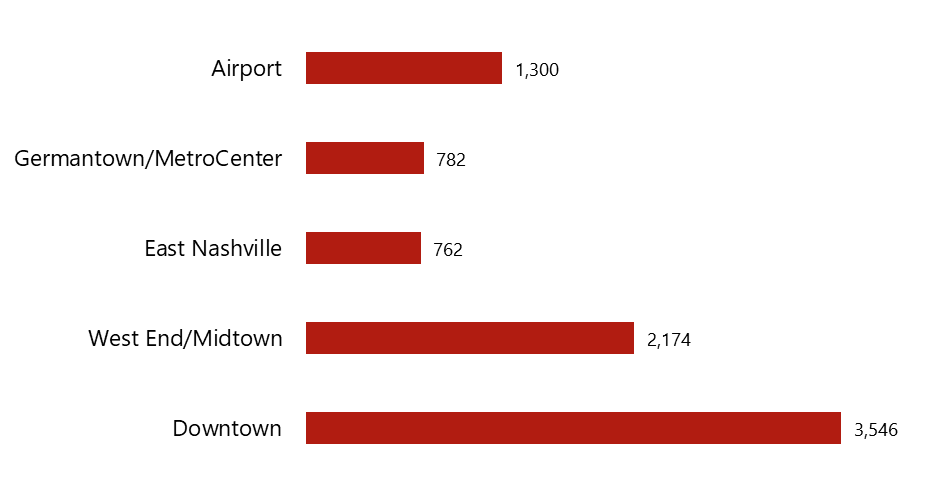

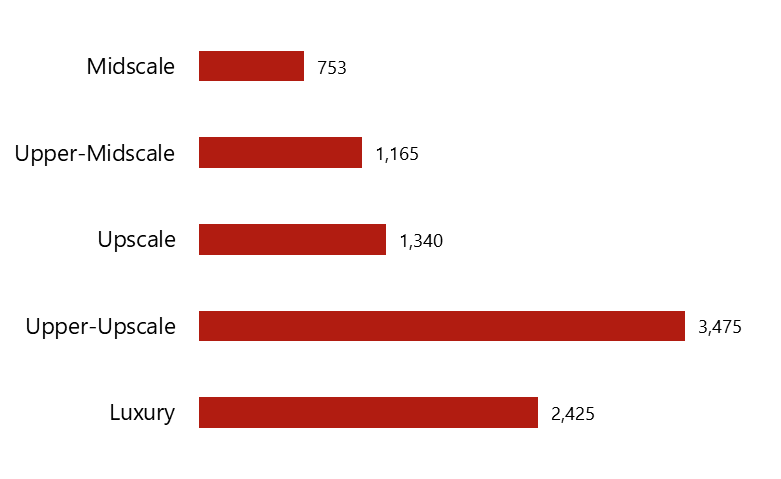

- New hotel development has continued, seemingly unhindered by the pandemic or rising construction costs. The majority of downtown developments are centered on the luxury and upper-upscale segments given the increasing market ADR over the last several years, which evidently supports the development of hotels of this caliber. Notable hotel projects under construction within this segment include the Four Seasons Hotel and Private Residences, Conrad Hotel, 1 Hotel, and Hotel Fraye, Curio Collection by Hilton. Multiple other projects are in the final planning stages, including an EDITION hotel and a Ritz-Carlton & Private Residences property. All of these luxury hotels are expected to raise the market rate ceiling and will likely stimulate further luxury development.

Source: HVS and Visit Music City

Number of Proposed Hotel Rooms by Product Tier

Source: HVS and Visit Music City

We are confident that the Metro Nashville market will continue on this upward path to recovery. Incoming luxury hotels and other developments should continue to elevate rates in the market and spur the development of new districts attractive to a variety of visitors. However, the ongoing rise in inflation and interest rates is a potential threat to Nashville’s growth. We continue to watch the factors affecting Nashville lodging, and our many consulting engagements throughout the metropolitan area allow us to keep our finger on the pulse of the market.

For more detailed forecasts or to inquire about a specific hotel project, contact Marc Greeley.