By Anthony Davis

HVS analysis found that while venues with districts do have more amenities, the difference is not statistically significant. When broken out by sport, MLB and NFL venues with districts had more entertainment amenities, however the differences were still not significant. Demand for these districts, estimated by tracking what attendees do before and after events, shows that the percentage of attendees who use entertainment amenities is not significantly different between venues with districts and without. Instead, these districts import existing demand from other locations in the city and concentrates them around the venue.

Giannis Antetokounmpo taking flight towards the hoop, over hapless defenders, was a common sight in the 2021 NBA Playoffs as Antetokounmpo led the Milwaukee Bucks to their first title since 1971. Another common scene on national broadcasts was the “Deer District”, an entertainment district outside the new Fiserv Forum, jammed full of fans watching games broadcast on large screens outside the arena. The crowd outside the Bucks arena for Game 1 of the NBA Finals, played in Phoenix, was estimated at 20,000 people. By Game 5, also in Phoenix, the crowd was estimated at 35,000.

The first stadium-anchored entertainment district is recognized as the area around Nationwide Arena in Columbus, Ohio that opened in 2000, followed shortly by a proposed “ballpark village” at Busch Stadium in St. Louis. Today, stadium districts come in many different compositions and can be created organically or as planned developments, but generally offer some form of entertainment to event attendees before and after events at the venue. This includes bars, restaurants, music venues, retail shopping, entertainment, and hotels for out-of-town attendees. Venues can be developed in existing districts, like Petco Park in the Gas Lamp Quarter in San Diego and Little Caesars Arena in the District Detroit, or districts can be built around stadiums, like Titletown in Green Bay, Wisconsin and Patriot Place in Foxboro, Massachusetts.

Stadium districts are beneficial from the team, attendee, and fiscal perspectives. Teams like the Golden State Warriors and Atlanta Braves that own the real estate surrounding their venue or that have been granted development rights within their stadium districts, capture income streams generated by the district. Event attendees enjoy the entertainment that the districts offer, the concentrated grouping of fans, and an extended event experience that exceeds the actual length of the event. Teams that do not own districts, like the Seahawks and Padres, still enjoy an improved event experience for attendees. Cities can capture tax revenue generated by the stadium districts, which have been used to pay the construction cost of the district or venue but can also be used for other purposes.

This article analyzes NBA, NFL, and MLB venues with and without entertainment districts, including the supply of entertainment amenities within a 10-minute walk of the venue, and the demand for these amenities before and after games. Do entertainment districts around professional sports venues encourage the development of more entertainment amenities, and do event attendees use the entertainment amenities more when a district exists than when it doesn’t?

Supply

Stadium entertainment districts are oriented primarily toward entertainment for attendees, before and after events and games. They should have more of these options surrounding the venue, like restaurants, bars, retail, entertainment, and hotels, than other venues that are not in districts. That is what the district is encouraging: the development of entertainment options for event attendees. Using data from ESRI for the number of entertainment options and University of Michigan research on stadium districts, HVS tested this hypothesis.

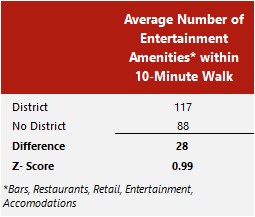

HVS compared the number of bars, restaurants, retail, entertainment, and hotels within a 10-minute walk of every NBA, NFL, and MLB venue in a stadium district in the U.S. to those venues not in stadium districts[1]. Z-scores must be greater or less than 1.96 to indicate that the difference does not occur by chance within a 95% confidence level. See the figure below.

Supply of Entertainment Amenities within a 10-Minute Walk, All Sports

Source: ESRI, University of Michigan

Stadium districts do average 28 more bars, restaurants, retail, entertainment, and accommodations than venues that do not have a stadium district. However, a difference of means test shows that this difference is not statistically significant and could have happened by chance[2]. This leads us to reject the hypothesis that venues in stadium districts have more entertainment options than venues not in formal districts. But an interesting pattern is revealed when the analysis is broken out by league. See the figure below.

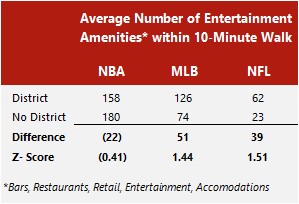

Supply of Entertainment Amenities within a 10-Minute Walk, By League

Source: ESRI, University of Michigan

NBA arenas with a stadium district have 22 fewer entertainment options than arenas with formal districts, while MLB and NFL stadiums with districts have 51 and 39 more entertainment options than stadiums without districts, respectively. These differences are larger than across the entire sample, but as shown by the Z-scores, this difference is not statistically significant. However, it is a curious pattern of difference by sport.

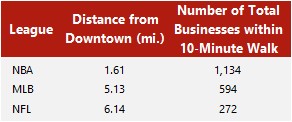

This pattern is partially explained by the location of these venues and their proximity to dense, central downtown areas that already support entertainment options, without additional demand from stadium events. NBA arenas are, on average, closer to downtown areas, and surrounded by more businesses. See the figure below.

Venue Proximity to Downtown and Density Surrounding Venue

NBA Arenas are closer to downtown areas than MLB or NFL stadiums, and they are surrounded by more businesses. This may be because MLB and NFL stadiums are larger in both land area and seating capacity, which means more parking and transportation must be provided surrounding the already larger venue site. This makes assembling a site in a downtown or already dense area harder and leads to these venues being developed further from existing entertainment options, and to require the development of stadium districts to offer a similar experience to attendees.

Demand

This article has focused on the supply of entertainment options around stadiums and arenas, but what about demand for entertainment options in districts? Does the presence of a district induce people to go to public venues, hotels, bars and restaurants, shops, and attractions before or after events? Or is it a substitution effect occurring where the entertainment amenity users seek those things out, regardless of their proximity to the arena and the presence of an entertainment district?

Is a person in a bar in the Deer District at that bar because the Deer District is entertaining and a fun place to be before or after a game or event? Or would they be in a bar somewhere else in Milwaukee before or after a game or event anyway? If stadium entertainment districts work as intended and do induce new demand instead of import existing demand, data would show that more people come from or go to entertainment district amenities at venues with districts than those without districts.

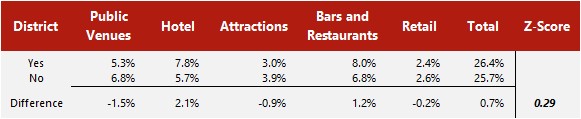

HVS tested this hypothesis using data from Placer.ai. Placer.ai offers tracking data through phone apps and tracks what venue attendees do before and after events. HVS gathered data for the last calendar year on what attendees of events at every NBA, NFL, and MLB venue do before and after games and sorted them into categories. The categories include public venues (like other stadiums, arenas, music venues, and convention centers), hotels, attractions (like tourist attractions and destinations), bars and restaurants, and retail. HVS combined this data with data from the University of Michigan on stadium districts to estimate the difference between venues with districts and those without districts. See the figure below.

Demand for Entertainment Amenities

Data from Placer.ai indicates that there is not a significant difference between venues with entertainment districts and those without entertainment districts, in terms of what attendees do before and after games. Regardless of whether there is an entertainment district or not, between 26.4% and 25.7% of attendees come from or go to a public venue, a hotel, an attraction, a bar and restaurant, or a retail store. The other 75% of attendees come from or go to work, school, home and other locations. The largest increase that entertainment districts create is hotel use, which increases by 2.1% in venues with districts.

This indicates that districts do not create more demand for entertainment amenities, but instead take demand for these things from existing sources and moves it closer to the venue. Demand is shifted and concentrated instead of induced. However, breaking the venues out by leagues again reveals an interesting pattern. See the figure below.

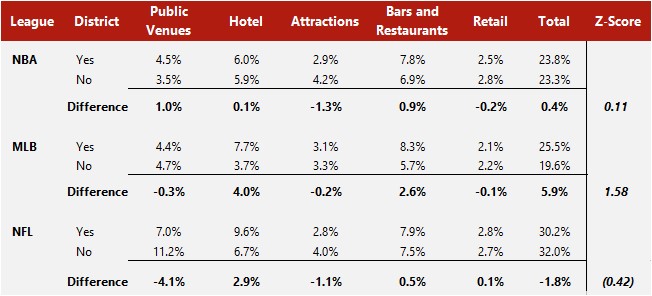

Demand for Entertainment Amenities, By League

Source: Placer.ai, University of Michigan

Fans in each league behave differently before and after games; however, none of the differences are statistically significant and could have happened by chance[3]. NBA fans are most similar to the combined sample, with a small difference between venues with districts and those without districts. MLB fans are the most impacted by entertainment districts, where amenity usage is 5.9% higher in venues with entertainment districts than those without districts. This difference comes entirely from hotels and bars and restaurants: 4% more attendees use hotels, and 2.6% more attendees went to a bar or restaurant before or after a game. NFL fans actually used entertainment amenities before and after games more at venues without districts than those with districts. However, the majority of that difference comes from a 4.2% difference in fans using public venues like other stadiums, venues, and convention centers before or after an event. NFL fans in venues with districts do use hotels 2.9% more before and after games than those without districts, but the differences in other categories are not significant.

It does not appear that stadium districts significantly impact the demand for entertainment amenities before and after events. There is a not a significant difference in what attendees do before and after events between venues with districts and those without districts in NFL and NBA venues, and while there is a difference in MLB venues, it is not statistically significant. Instead of creating demand for entertainment amenities, they offer another option for entertainment for event attendees, and compete with existing amenities throughout the city. The person who is in the bar in the Deer District before the NBA Finals would have been in a bar somewhere in Milwaukee, regardless of whether the Deer District existed. A Padre fan, however, is more likely to end up in the Gas Lamp District before a game, when without the Gas Lamp District, they would stay home until game time.

Conclusion

Across all sports, the creation of stadium districts surrounding major sporting venues does not have a statistically significant impact on the number of bars, restaurants, retail, entertainment, and hotel within 10-minutes of the venue. Nor do they increase the percentage of event attendees that use these entertainment amenities before or after events.

However, when supply and demand for these entertainment amenities are broken out by sport, there are larger but still not statistically significant differences. In the supply of amenities, the differences can be partially explained by the location of the venues, with the smaller NBA arenas located closer to downtown areas and in denser areas than MLB or NFL stadiums. For demand, the MLB is the only league that sees a difference in demand based on the presence of a district or not, and even then, the majority of the difference comes from hotels and bars and restaurants. Instead, the majority of stadium districts appear to take demand from other locations throughout a city and concentrates them in one area, which enhances the fan experience, but the data does not support the notion that districts induce new demand into the market.

1]HVS excluded Madison Square Garden in New York City as an outlier in the dataset.

[2]Z-scores must be greater or less than 1.96 to indicate that the difference does not occur by chance within a 95% confidence level.

[3]Z-scores must be greater or less than 1.96 to indicate that the difference does not occur by chance within a 95% confidence level.