Analysis by M. Brian Riley

The hotel industry knows concerts “all too well,” as they have long been one of the top catalysts for high occupancy nights and premium room rates. That dynamic has been center stage over the last three months, as Taylor Swift’s “The Eras Tour” added $98.2 million in room revenue to the U.S. hotel industry. Remaining tour dates over the rest of the summer are also leading to spikes in bookings.

Methodology

The U.S. leg of the tour began in mid-March and will conclude in August. To measure the impact at the tour’s halfway point, STR analyzed hotel performance for the nights of the first 28 shows held in 10 different cities. Most of those cities hosted three shows from Friday through Sunday. Phoenix, Tampa and Las Vegas were the exceptions with no Sunday show—Tampa hosted three shows Thursday through Saturday.

The analysis used matched days in shouldering weeks as a performance baseline.

Room rates even more impressive than occupancy

For context, the $98 million additional revenue figure is almost equal to an entire week of room revenue in Los Angeles—one of the largest markets in the country. Another way of looking at it, the Swift tour room revenue surplus matched what the five largest U.S. markets combined to sell in a single day (2023 average).

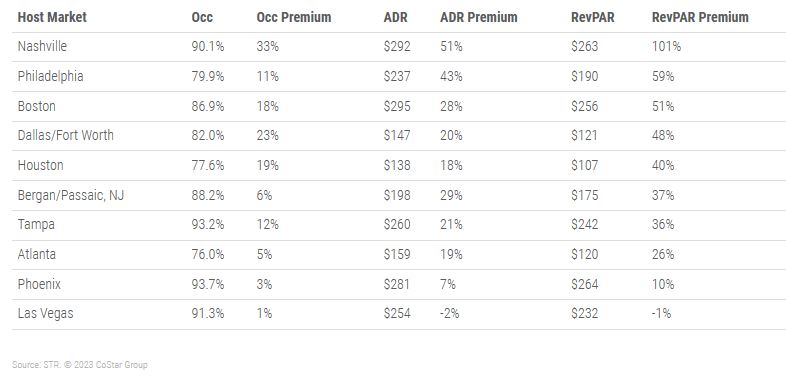

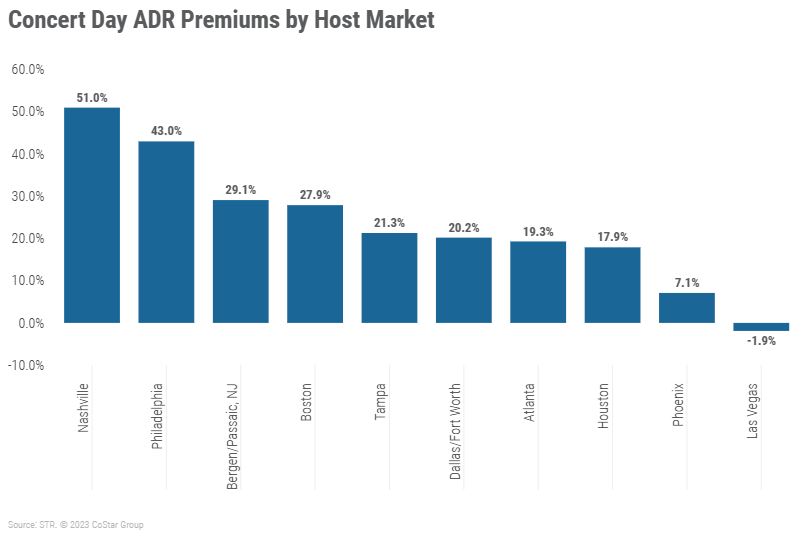

While high occupancy levels were seen for most of the host markets, the bigger driver of top-line gains was higher average daily rate (ADR).

Even in tour markets that saw more moderate occupancy, such as Philadelphia, Boston and Dallas/Fort Worth, there was a widespread lift in ADR despite there not being an extreme shortage of available rooms.

Excluding the one occurrence of a Thursday show in Tampa, Sunday night concerts have had the greatest impact on occupancy thus far, rising from a low baseline of 54.0% to an average of 68.9% during Swift’s concert nights. Saturday concerts produced the highest actualized occupancy of 90.9%, up from a baseline of 81.0%.

Which markets stood out?

Nashville (5-7 May) saw the highest performance premiums across the top-line metrics. Occupancy was up 33% to 90.1%, ADR jumped 51% (or $99) to $292, and revenue per available room (RevPAR) was up 101% to $263. As noted in an early May edition of STR Weekly Insights, downtown Nashville saw substantial occupancy (97.3%) and ADR ($571) levels for Friday and Saturday night shows at Nissan stadium.

Boston, with shows in Foxborough from 19-21 May, posted the highest actual ADR ($295) for concert nights, which represented a 28% or $64 premium. That level also received a boost from Boston University’s commencement ceremony.

The initial host market, Phoenix (17-18 March), ran extraordinarily strong high weekend occupancies earlier this winter and early spring, so the levels observed during the concerts did not represent as high of a premium. In actual levels, Phoenix ranked first in occupancy (93.7%), second in ADR ($281) and first in RevPAR ($264) for shows in Glendale. Just a few weeks earlier, Phoenix hoteliers scored with the second-highest Super Bowl ADR and RevPAR on record.

The Las Vegas market (24-25 March) did not see a corresponding RevPAR lift on concert nights compared to the surrounding weeks. This was partly due to the market’s massive size (168,000+ rooms), which can readily absorb a stadium’s worth of room demand, as well as seasonal weekend occupancies already hovering around 90%. Either way, Vegas hoteliers shouldn’t have any “bad blood” with Swift.

The lowest absolute occupancy for concert nights was in Atlanta (76.0%) on 28-30 April, which still marked an almost 4-point occupancy gain from surrounding weeks.

Houston reported the cheapest room rates ($138) for concerts on 21-23 April, an 18% surplus above the average of shoulder weeks.

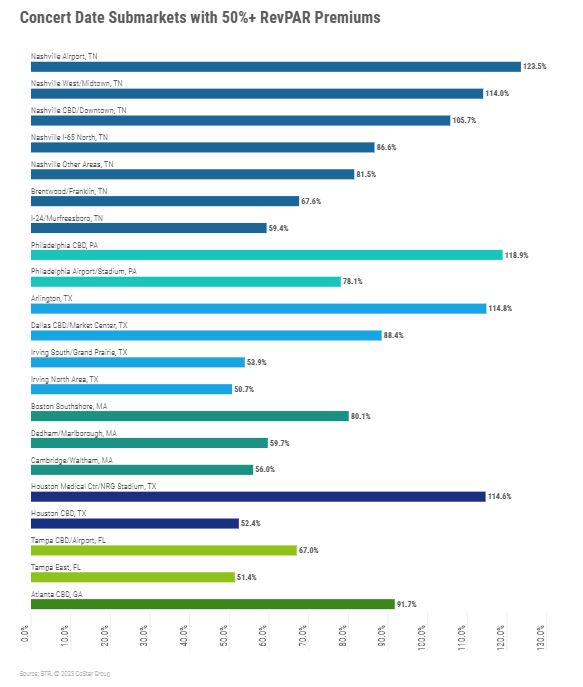

Impacts felt beyond downtown areas

Overall, seven of 10 concert stops included submarkets that more than doubled their RevPAR performance, with the top RevPAR percentage gains occurring around the Nashville Airport and the Philadelphia CBD. All Nashville submarkets posted a 50% or better RevPAR premium.

Looking ahead

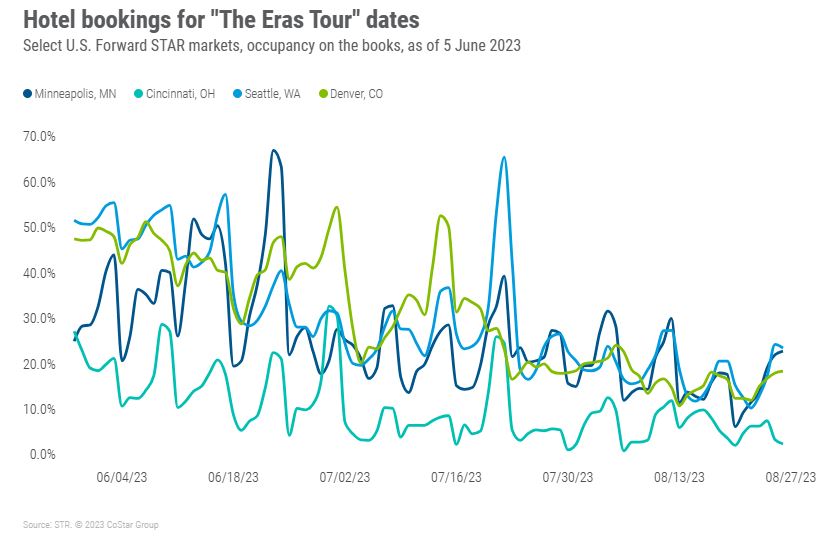

Among select U.S. Forward STAR markets, Minneapolis, Cincinnati and Seattle are each showing Swift concert dates to their highest occupancy on the books for the next 90 days.

In Minneapolis, the Friday night show (23 June) currently shows occupancy on the books that is 29.1% higher than the next closest level. Both 23 and 24 June are the only two days that show forward bookings above 60% in the market.

Similarly, throughout the 90-day period., Cincinnati (above 30%) and Seattle (above 60%) bookings are only at those respective levels on Swift concert nights.

In Denver, Swift’s opening night (14 July) is producing the second-highest booking level for the aforementioned time.

Next update

STR will analyze the second half of The Eras tour later this summer to update the overall impact and look at performance in upcoming host markets. That analysis will include Chicago (2-4 June) and Detroit (9-10 June), the two host markets that fell in between the tour’s halfway point and the time of this initial analysis being produced.