The coronavirus (COVID-19) pandemic is having a profound impact on the hospitality industry, as travel restrictions, limits on large gatherings, the closure of restaurants and bars and, perhaps most influential, fear of the virus, have brought travel—and most other aspects of hospitality—to a virtual halt. According to Chip Rogers, president and CEO of the American Hotel and Lodging Association (AHLA), “The impact to our industry is already more severe than anything we’ve seen before, including September 11th and the Great Recession of 2008 combined.” With some hotels reporting occupancy levels of below 20%, the industry is facing massive layoffs and the potential closure of many lodging facilities.

On March 17, 2020, hotel industry executives met with representatives of the federal government to discuss the need for the federal government to provide relief and financial support to the industry. Executives cited the extensive layoffs that have already occurred, as well as the potential for and probability of even greater layoffs as more hotels close their doors.

Financial support of the hospitality industry makes enormous sense given the importance of the sector to the U.S. economy. According to the U.S. Travel Association, the economic impact of the U.S. travel industry was $2.6 trillion in 2019, and the industry supported a total of 15.8 million jobs. The hotel industry represents a significant part of this impact. An economic impact analysis prepared by Oxford Economics for the AHLA concluded that the hotel industry generated $1.2 trillion in business sales and supported 8.3 million jobs (direct and indirect) in 2018, accounting for $395 billion in wages, salaries, and other compensation. This equates to about 4.2% of total employment in the United States. Direct employment represents 4.7 million jobs and $97.2 billion in payroll. The downturn has a direct impact on all of these metrics and threatens hundreds of thousands of jobs and revenues, including tax revenue.

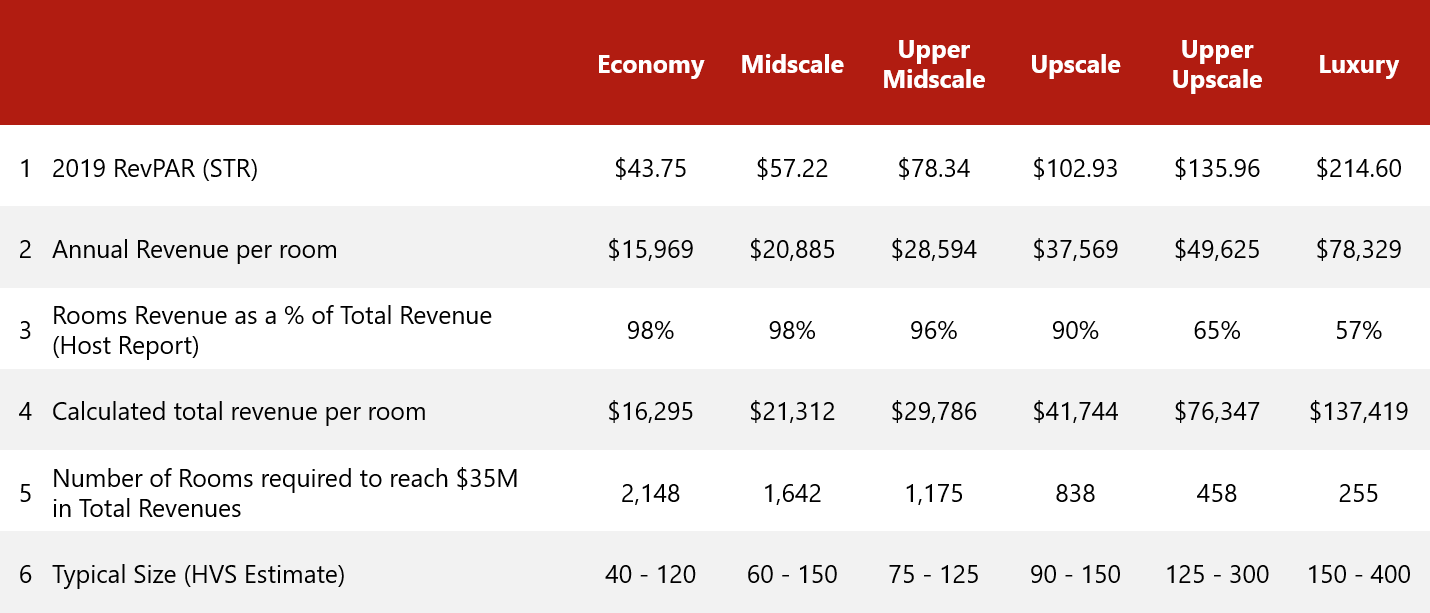

One of the primary sources of relief under consideration is disaster loans through the Small Business Administration (SBA). As currently proposed, eligible hotel businesses would be able to borrow up to $2.0 million to cover payroll, debt service, and other expenses. For the hotel industry, SBA loans are available to businesses with average revenues of up to $35 million over the preceding three years. To better understand how this threshold aligns with typical hotels, we have reviewed the revenue metrics of the six hotel classes, as defined by STR. Our calculations are presented in the following table.

Source: HVS, STR

- Line 1 represents the 2019 revenue per available room (RevPAR) for each of the indicated lodging classes, as reported by STR.

- Multiplying that RevPAR by 365 yields the indicated annual rooms revenue per room.

- In addition to rooms revenue, hotels also derive revenue from food and beverage (F&B) operations and various other sources. STR’s HOST report provides aggregate operating statements for hundreds of hotels in the United States. This report indicates the proportion of revenue, by source, for hotels in each asset class.*

- Dividing the indicated annual revenue per room by the rooms revenue ratio yields the total revenue per room for each classification.

- Dividing the threshold of $35 million of revenue by the average per room annual revenue for each class yields the number of rooms a typical hotel of that class would have to have to exceed the $35-million threshold.

- Looking at the typical size within each class, it appears unlikely that any hotels in the economy, midscale, upper-midscale, and upscale classes would exceed the threshold, while some hotels in the upper-upscale or luxury class could, particularly those that have significant F&B revenues (not considered in the above calculations). Hotels with F&B operations are also likely to have a larger inventory of guestrooms.

*STR’s HOST data are categorized by full- and limited- service hotels. We have used the limited-service data for the economy, midscale, and upper-midscale hotels, as this is consistent with the profile of a majority of the hotels in these classes. We have used the full-service data for the upper-upscale and luxury properties, as is consistent with the profile of a large majority of these hotels. The upscale sector includes both limited- and full-service hotels; therefore, we have used an average of the two.

Based on the above calculations, it appears that a majority of the individual hotels in the economy, midscale, and upper-midscale sectors qualify for disaster loans under the SBA loan program. Most individual upscale and upper-upscale hotels are likely to qualify, as well. The hotels in the luxury sector could near this threshold and might not qualify for the proposed loans.

Turning again to the Oxford study, this study estimated the economic and employment impact of a typical, individual hotel, as follows:

“A representative hotel with 100 occupied rooms supports 241 total jobs, including 137 direct jobs and 104 indirect and induced jobs. This impact includes 66 direct jobs at the hotel, with $2.8 million of wages, salaries, and other labor income. This representative property supports $5.4 million of total tax revenue, including $1.9 million of direct taxes generated at the hotel.”

With 100 rooms, this typical property would meet the SBA criteria and qualify for a loan.

The above analysis looks at hotels on an individual, standalone basis. Many hotel owners own multiple properties, and depending on how the $35-million threshold is applied, their eligibility for these loans could be affected.

The need to support the industry through this crisis is obvious—to protect jobs and preserve the significant capital investment in the over 55,000 hotels in the United States. Less obvious, but equally important, is the role the industry will play in the recovery. Tourism is a critical component of the U.S. economy and, as difficult as it may be to imagine at the moment, people will travel again. Domestically, business travel will resume, as businesses address deferred trips and meetings. Leisure travel will also resume, possibly faster than business travel, as people embrace the opportunity to be anywhere but in their own homes. Meetings and events will return, although it may take a bit longer for this segment to recover given the nature of these events. International travel will come back, as well.

As travel resumes, it is vital that the hotel industry be available to support these travelers. Availability means open and operating, with sufficient employees on hand to support guests and, thus, revenues.