Construction is booming in Nashville, Tennessee, particularly in the hospitality industry. This latest wave of hotel construction commenced with the opening of the Music City Center in May 2013.

Currently, there are 153 hotels totaling 23,400 hotel rooms in the city of Nashville. In 2015 and through May 2016, five hotels have opened increasing rooms supply by 3%. These properties ranged from 93 to 214 rooms ranging from economy priced hotels to upper-tier extended stay brands (i.e., Residence Inn Vanderbilt/West End).

Currently, STR and Pinnacle Advisory Group have identified 46 potential hotel development projects in various stages of development in the city of Nashville, totaling over 11,800 rooms. Because of rising real estate and construction costs Luxury and Upper Upscale priced hotels have become more appealing to developers.

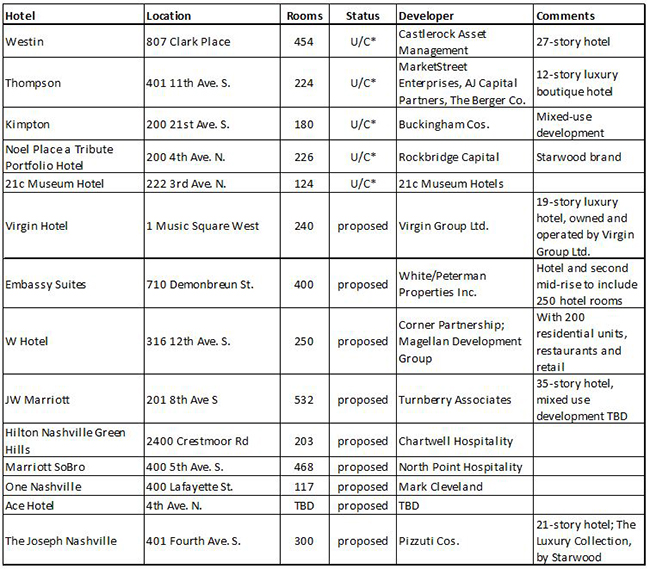

Today there are only three luxury tier hotels in Nashville: the 122-room Hermitage Hotel (opened in 1910), the 340-room Loews Vanderbilt Plaza hotel (opened in 1984), and the 247-room Hutton Hotel (opened in 2009). These hotels represent 3% of total existing luxury tier rooms in Nashville. The Upper Upscale tier of hotels, represented by brands such as Hilton, Marriott, and Omni, currently comprise 32% of the Nashville’s hotel room inventory. However, there are numerous luxury and upper upscale tier hotel projects in various stages of development in the City of Nashville as noted in the following table:

* U/C – Under Construction

Source: STR, Pinnacle Advisory Group

Should all of these projects come to fruition, 3,700 new luxury and upper upscale tier hotel rooms would be developed in Nashville. Although financing constraints will likely hinder some of these projects to open, it is daunting to consider that Nashville could face a potentially 45% increase in luxury and upper upscale tiered hotel room inventory.

Although there are numerous residential development projects under construction and proposed in Nashville, office development provides a better indicator of the potential hotel demand growth. Per CBRE, there is currently over 34.8 million SF of office space in the greater Nashville office market. In downtown Nashville, the overall vacancy rate was reported at 12.6% with the majority of its inventory is identified as Class B or C space. Currently, there are 1.8 million SF of office space under construction in downtown Nashville.

Current office projects under construction or under consideration in Nashville include:

- 1201 Demonbreun – Currently under construction, this $97 million project will be a 275,000-square-foot building, with retail. This project is being developed by Eakin Partners

- Bridgestone – A 30-story tower to house Bridgestone's U.S. headquarters. 506,000 SF of office, with ground-floor retail is currently under construction. Located at 200 Fourth Avenue South and Developed by Highwoods Properties, is estimated to be a $200 million project.

- Music Row – 96,000-SF building under construction at 35 Music Square East. This $31 million project is being developed by Panattoni Development Company. SESAC will relocate headquarters there, to occupy half of the building.

- 4000 Hillsboro – Under construction in Green Hills, this mixed use development will include 67,000 SF of office space, apartments and retail. This $125 million project is being developed by Southern Land Co.

- HCA – Under construction on Charlotte Avenue, the 500,000 SF office building will house 2,000 employees of HCA’s subsidiaries.

- OneC1TY – The $400 million mixed-use facility located on Charlotte Avenue is under construction. It will include 1 million SF of office space, apartments/condos, retail and hotel. This project is being developed by Cambridge Holdings.

- 2400 Crestmoor – 30,000 SF of office space is under construction along with a Hilton hotel and Residence Inn hotel in Green Hills. This $100 million project is being developed by Green and Little LP.

- Midtown Medical Expansion – The 70,000-SF expansion of medical office building is currently under construction at 2011 Church Street. This $51.8 million project is being developed by Healthcare Realty Trust.

- 5th and Broadway – Multi-use facility with 425,000 SF of office space, apartments, retail and entertainment, located at 500 Broadway. This $400 million project is being developed by Oliver McMillan, Spectrum/Emery Inc.

- Music Row Roundabout – Located at 112 16th Avenue South, this proposed mixed-use project is planning buildings up to 22 stories, a grocery store, up to 590 residential units, 640 hotel rooms, 103,000 square feet of retail space, and 420,000 SF of office space.

- Vanderbilt Place – A 12-story, 200,000-SF office building has been proposed at 125 30th Avenue South, to be developed by Eakin Partners.

- SoBro Office Building – A 25-story office and retail building is proposed at 222 Second Avenue South. This project is expected to house 350,000 SF of office space.

- SoBro Office Building – An 8-story, 125,000-SF office building, is proposed at 615 Third Avenue South.

- Music Row Office Building – Panattoni Development Company is in its preliminary development stages of a 120,000-SF office building at 1 Music Circle South.

- 400 First Avenue South – Was originally slated as the site for the new Lifeway Headquarters, MDHA, its developer, is now in the process of taking developer bids.

- West End Summit – Located at 1600 West End Avenue, this 3.93-acre development site is in its preliminary development stage.

The above projects account for 2.2 million SF Downtown, 733 thousand SF in Music Row/Green Hills, and 1.3 million SF in West End/Belle Meade. As of first quarter 2016, the overall market reported a 6.5% office vacancy rate with Class A office space in the market reported a 4.2% vacancy rate.

Although developers have read the signs of potential office demand growth, it is uncertain how many of the above proposed projects will obtain the required financing.

According to STR, the overall Nashville market reported an 81.4% hotel occupancy, for the 28 days ending May 28, 2016. This was slightly above the occupancy for the same period in 2015.

With such healthy overall market demand, it is clear to see why Nashville has been attractive to potential hotel developers, but how much new supply can be absorbed by demand growth?