In early Q3 2023, STR completed the third edition of the Hospitality Industry Sentiment (HIS) survey, a quarterly survey of travel industry professionals. Between the first and second waves of this survey, we saw some subtle shifts in experts’ expectations for industry performance. Leisure demand was tapering off, but group demand and major events were on the rise. Now with the third wave of the survey on the books, some patterns have become further established, and some new trends emerge as well.

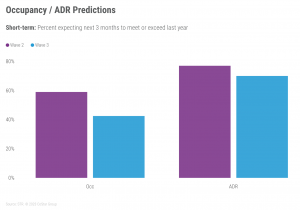

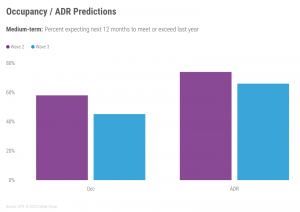

Average daily rate (ADR) expectations across the globe remain positive, while optimism for occupancy growth has slipped into the minority. This is true whether looking ahead to the short-term (three months into the future) or in medium-term predictions (12 months into the future).

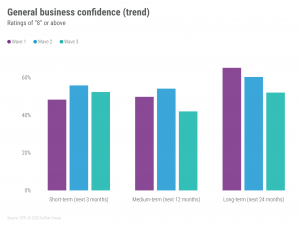

Looking further ahead to the long-term outlook (two years into the future), general business confidence is steadily on the decline. The percentage of optimistic experts (those rating their confidence as an “8” or higher on a 10-point scale) has shrunk in each quarter of this survey so far. This is not just a trend for the extreme ends of the ratings scale; the overall average ratings for business confidence also mirror this decline for the long-term outlook.

Because this is a global survey, we’re able to break out the results by different regions of the world. Across demand segments, all regions reported the greatest improvement expected in group demand, followed by business transient and leisure transient demand. Optimism for all segments is declining, however. Professionals in Europe show the greatest optimism for group demand growth while U.S. is the least optimistic for leisure.

Labor costs and supply challenges remain the top concern for hotel industry professionals, but recession-related concerns are close behind. Nearly 50% of respondents expressed that “concerns regarding a potential recession” is one of their top five greatest challenges currently, barely trailing labor-related issues. Europe shows the greatest concern for “labor cost challenges,” while the U.S. is the area most affected by “limited business travel demand.” In total, close to 60% of experts say that they are either “moderately concerned” or “very concerned” by “reduced leisure travel due to economic uncertainty.”

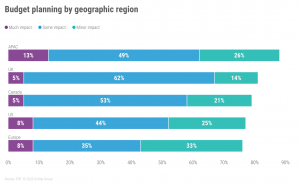

These experiences and expectations that our global panel of professionals have described above can be summarized by one final question: “How much impact, if any, has a potential recession had on your 2024 budget planning?”

Overall, more than half of those surveyed indicated that recession fears have had at least “some impact” on their budget planning for next year. In the U.K., it’s closer to two-thirds of industry professionals, and experts in APAC were the most likely to say that a potential recession has had “much impact” on budget planning.

But it’s not all bad news. About a third of respondents indicated that blended business-leisure travel is still a major strength for their business. “Bleisure” travel took the top spot, with leisure demand and major events rounding out the top three strengths. Unfortunately, from quarter to quarter, fewer respondents have indicated that factors such as “strong leisure demand” and “increased guest spending” are a strength for their business.

Whether these trends will continue on their current trajectory remains to be seen. The next wave of the HIS survey will launch the week of 25 September. If you are not yet a part of the HIS community of travel and hospitality professionals, we would greatly value your input and participation. Register to become a member of the HIS community, and we’ll send you a summary report of the results when you complete the survey.