At the beginning of 2020, the future of Boise’s hospitality industry looked bright given the anticipated arrival of Amazon to the Treasure Valley and a robust 2020/21 convention and event schedule on the books at the Boise Centre. The return of the renowned Jaialdi Basque festival in August 2020 also positioned Boise for a strong summer season. Although new hotel supply was under construction, Boise’s hoteliers were optimistic that local occupancy levels would hold steady and that the market would register minor average rate (ADR) increases. The onset of the COVID-19 pandemic in March then changed this outlook, as demand dropped and events were postponed or canceled, including Jaialdi (now scheduled for July 2022). Nevertheless, despite the significant declines, the downturn also revealed evidence of this market’s resilience.

The key factors that affected Boise’s lodging market performance in 2020 are listed below.

- Ada County vs. Canyon County: During our conversations with local hoteliers and economic development officials throughout the Treasure Valley, it became evident that the difference in city, county, and federal regulations regarding group meetings and conventions impacted how well local hotels were able to capture demand and weather the pandemic. Most notably, the Ford Idaho Center in Canyon County benefited from less-strict gathering regulations and hosted multiple events, such as basketball tournaments, equestrian trade shows with 100 to 800 horses in attendance per event, and agricultural trade shows at the attached horse park from April through October 2020. These events provided a significant boost to nearby hotels. It is important to note that while the Hampton Inn next to the Ford Idaho Center closed temporarily during the early weeks of the pandemic, operations and guests were shifted to its adjoining sister property, the Home2 Suites by Hilton, under the same ownership. Due to the limited hotel room inventory surrounding the Ford Idaho Center, occupancy registered at higher levels than at comparable hotels in Ada County, according to local hoteliers.

- Boise Centre: In Ada County, the downtown Boise Centre was on pace to set attendance and revenue records in 2020, but events and conventions, which typically cause compression in the market, grinded to a halt mid-March, leaving hotels with mass group and meeting cancellations. According to local news sources, in April 2020, the Greater Boise Auditorium District (GBAD) only collected $125,000 in lodging taxes, compared to $703,000 the year before (a decline of 82%), with some hotels bottoming out at 6% occupancy at the height of the pandemic. Subsequently, in May 2020, the GBAD voted to transfer $1.5 million of reserve funds to help offset the significant decline in revenue caused by the lack of lodging tax collections from convention-related business at downtown hotels.[1] Based on market interviews, hoteliers were forced to heavily discount prices in an attempt to attract travelers who were opting to stay in Canyon County, where gatherings were less regulated. Representatives of select hotels throughout the area reported a 35% to 40% decline in revenues in the market at the end of 2020, attributed to occupancy declines between 25 and 30 points and a roughly $40 drop in ADR.

- Demand Shifts: Historically heavily reliant on the business-traveler segment, Boise hotels were typically filled during peak midweek nights, from Tuesday through Thursday. The significant corporate travel decline in Boise hit key hotels in early 2020, when Hewlett-Packard (HP) announced the cancellation of TechU, an annual Boise anchor event that typically attracts hundreds of international attendees for two weeks and boosts regional occupancy levels. Since then, demand has undergone a significant shift, and business-focused hotels have had to pivot their marketing and operational approach to cater to leisure travelers. Hoteliers also noted that this demand segment of overnight guests resulted in higher housekeeping costs. Rooms occupied by leisure travelers were reportedly more work-intensive due to a higher person-per-room occupancy ratio. Traveling families also contributed to this aspect in comparison to corporate travelers, who usually only occupy rooms for a brief period of time. In addition, general managers reported that heightened safety protocols resulted in an increase in operational expenses, which created a challenge for keeping costs down to remedy the loss of business. On the flip side, hotels typically geared toward accommodating leisure demand associated with Boise State University (BSU) events and airport passengers felt the brunt of the decline. All sporting events at BSU were shifted to a virtual setting during the 2020 tournament season, and Boise Airport passenger levels dropped to a historical low. Local hoteliers reported that hotels along Interstate 84 benefited from increased leisure travel during the summer months, mainly accommodating overnight guests on their way to Glacier and Yellowstone National Parks. Guests would stay in Boise as a stopover destination on their way to Montana from nearby states under stricter lockdowns, such as Oregon, Washington, and California.

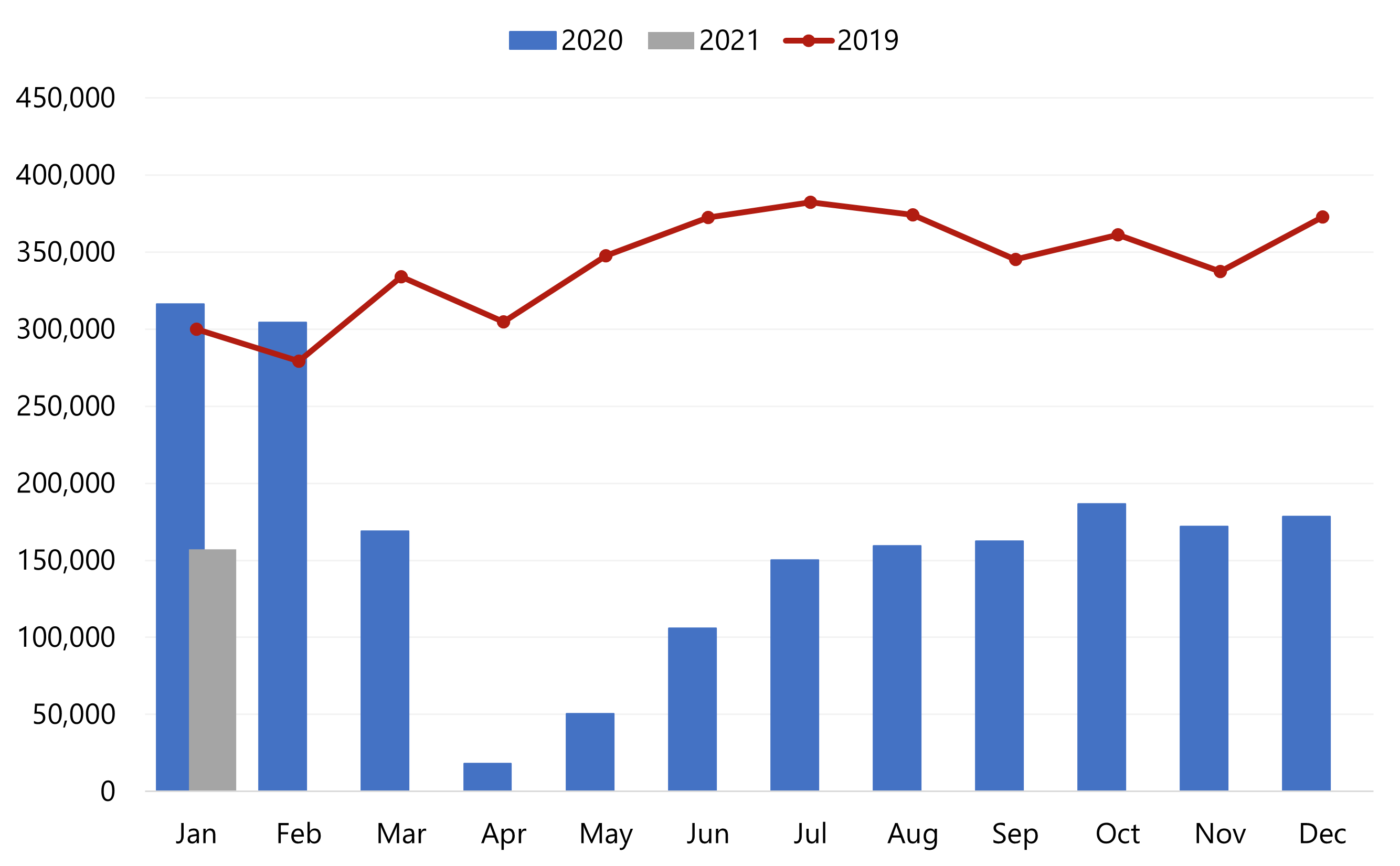

- Boise Airport: Due to a significant decline in passenger traffic, as illustrated in the chart below, the City of Boise halted its funding of a $16-million employee parking-garage project in April 2020. The garage was the first phase of a garage addition and concourse expansion. Instead, the airport relied on a $18.9-million boost from the U.S. Department of Transportation under the CARES Act to continue operations. For local hotels, this meant that construction work crews no longer contributed to occupancy near the airport during the summer of 2020. In October 2020, it was announced that plans would continue; however, a passenger garage would be prioritized moving forward.[2]

Boise Airport – Monthly Passenger Statistics

Source: Boise Airport[3]

- Hotel Transactions and New Supply: Since the pandemic, the greater Boise hotel transaction market has been essentially nonexistent, with only one closed transaction (the Motel 6 Boise Airport) since March 2020. Aside from reductions in demand, market-wide occupancy levels were affected by the opening of several hotels in the Boise market in 2020. Hotel openings included the 135-room Home2 Suites by Hilton Boise Downtown and the 96-room Homewood Suites by Hilton Eagle. Boise’s supply increase continues with the 106-room Fairfield Inn & Suites by Marriott Boise West at 7881 West Emerald Street, which is expected to open by July 2022.

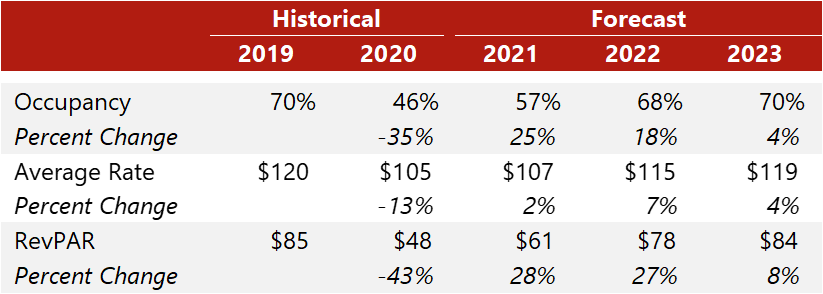

- According to STR, during the Great Recession, Metro Boise’s occupancy fell roughly 5 points from 57% in 2008 to 52% in 2009, while ADR declined roughly 9% from $90 in 2008 to $81 in 2009, resulting in an approximate RevPAR decrease of 17%; considering the COVID-19 pandemic and the above-mentioned factors that have influenced this market, STR reports indicate that local hotel occupancy in the upscale and upper-upscale segment declined from the benchmark of roughly 70% occupancy in 2019 to 46% in 2020, reflecting a 24-point correction, while ADR declined roughly 14% ($120 to $105). As a result, RevPAR suffered a 46% decline in 2020, a heavy hit for local hotels.

Boise’s Historical Performance & 2021–2023 Forecast

Source: STR (Historical Years) and HVS (Forecast)

Major factors contributing to our forecast are summarized as follows:

- Boise Centre: Representatives of the Boise Centre reported that, as of late February 2021, bookings for the third and fourth quarters of 2021 were pointing to a strong return of both conventions and local events on a regional scale. During a typical year, about 275 to 330 events would occur; however, given the effects of the pandemic, 12 definite events are scheduled for 2021 and 76 events are projected for 2022, illustrating an increase in the number of leads and overall interest in the facility. As Boise Centre is the only convention center and event facility in Idaho to have earned the GBAC STAR™ accreditation, Boise Centre representatives are optimistic that comfort levels will return for events supported by stringent safety protocols. Furthermore, two hotels in Downtown Boise, the Hyatt Place Boise Downtown and the Hyatt Place Boise Towne Square, also earned this accreditation, which should further strengthen the perceived safety of the area for future travelers. With Boise’s central location among drive-to markets in the Northwest, the convention center is expected to benefit from pent-up demand related to smaller and regional group and meeting events in late 2021 and early 2022.

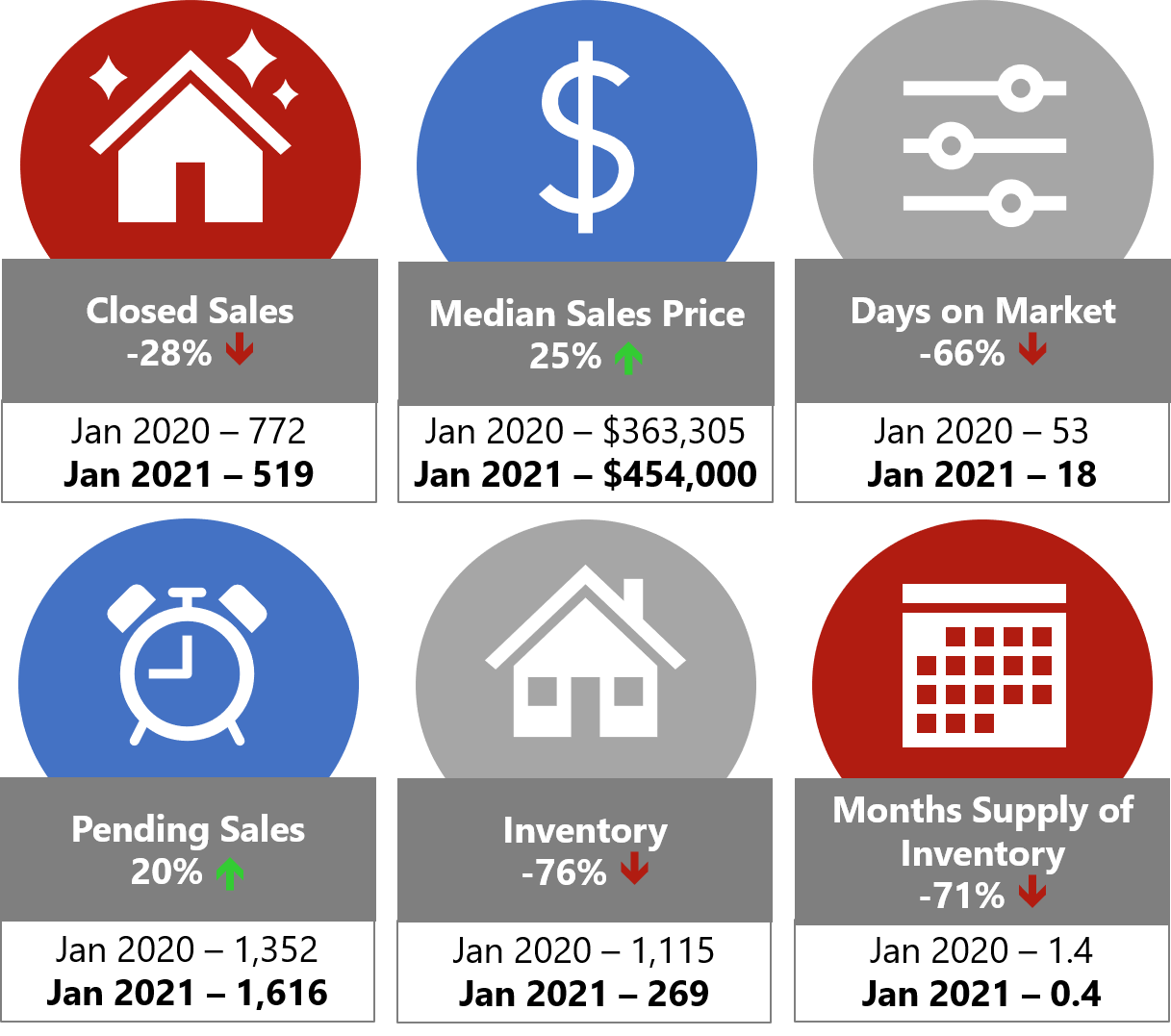

- Housing Shortage: The city’s budget/economy and extended-stay hotels have outperformed the market during the pandemic, attributed largely to the housing shortage in Boise. Data provided by the Boise Regional REALTORS illustrate the fast-paced Boise relocations.[4] In January 2021, existing homes were on the market for an average of 18 days, 66% shorter than the same month in 2020. Hoteliers reported that a housing shortage has resulted in an increased demand for temporary housing options, which helped contribute to the success of extended-stay hotels in 2020. The following table also illustrates that there was much less available housing inventory in the market in January 2021. We expect this foundation to stay in place, with extended-stay and lower-priced demand representing the majority of room nights to be generated in the spring of 2021, in particular.

Boise Housing Market Statistics

Source: Cassie Zimmerman, Director of Communications, Boise Regional REALTORS

- Government Travel: According to local hoteliers, expected benefits of the significant 2019 per-diem rate increase were never realized in 2020 due to a discontinuation of government travel to Boise in 2020. However, some downtown hotels were able to maintain higher ADRs due to business from select necessary government entities, such as the Idaho Air National Guard. The strength of Boise’s corporate and government segments should return after restrictions related to meetings, group gatherings, and social-distancing requirements are eased. Downtown Boise’s multiple state agencies, courtrooms, and corporate headquarters are anticipated to resume normal operations and travel beginning in the late spring of 2021 once the COVID-19 vaccines are more widely distributed.

- Boise Airport’s New Destinations: In November 2020, Delta Air Lines began to offer a new daily flight between Boise, Idaho, and Atlanta, Georgia. This decision signaled a reversal from Delta’s initial call to suspend the new route in 2020 due to the pandemic. This positive trend is expected to continue with Alaska Airlines’ new seasonal connection to Palms Springs International Airport in California and the addition of connections to Austin, Texas, and Chicago, Illinois, starting on June 17, 2021; JetBlue’s announcement to add a seasonal flight between Boise and New York City’s John F. Kennedy Airport starting in the summer of 2021; the addition of a new, twice-weekly flight on Allegiant to/from Santa Ana, California, in February 2021; and Allegiant’s anticipated new flight service between Boise and Nashville, Tennessee, beginning in May 2021. These routes are anticipated to connect Boise to a greater number of tourism feeder markets, including the East Coast, which should support passenger volume recovery.

- Amazon: Local news sources reported that a new application is under review by the City of Boise for a sizable “sortation” facility on 2155 East Freight Street, rumored to be associated with Amazon.[5] While a potential Boise addition is still speculative, representatives of the City of Nampa confirmed that more facilities are in the works for Amazon; however, a timeline is unclear.

- Summer Visitation: A stronger market is expected for the summer of 2021, relative to 2020, as the nation is anticipated to emerge from pandemic restrictions and the distribution of the vaccine should be well underway. Boise realized occupancies in the low 60s by the end of the summer of 2020; we expect summer occupancy to reach the high 70s across the Boise metropolitan market. In a normal year, Greater Boise experiences occupancy in the low 80s during the summer. The market is forecast to reach this level again by 2022.

As Boise enters phased reopening, we are confident that the greater market will rebound upon the continued release and widespread distribution of COVID-19 vaccine, the end of group meeting restrictions, a return to regular operations at the Boise Centre, and the resumption of corporate and government travel. We continue to watch the factors affecting Boise’s lodging industry, and our consulting engagements throughout the metropolitan area allow us to keep our finger on the pulse of the market.

For more information, contact anyone on our Portland team: Kasia Russell, MAI, Breanna Smith, Lauren Reynolds, and Eileen Bosworth.

COVID-19 Resource Highlights (Boise is currently in Stage Three of the Reopening Process)

- City of Boise and Ada County:

- As of February 19, 2021, a mask mandate continues within the city limits of Boise (see the full City of Boise guidance here), whereas Ada County lifted the mandate and issued a mask advisory that functions as a strong recommendation (see the Ada County public health advisory here).

- Boise on the Block/Pilot Seating Modification of Downtown Restaurants and Businesses

- Ada County COVID-19 Case Tracker

- Development Project Tracker

- State of Idaho:

- Bars, restaurants, and nightclubs can operate with seating unless local ordinance dictates otherwise. Find the full bar protocols here.

- Restaurants must adhere to limiting occupancy as necessary to maintain a six-foot physical distance and must space tables appropriately apart from one another. Find the full restaurant protocols here.

- Only gatherings of 50 or fewer people are permitted, excluding political and religious expression, educational activities, and healthcare-related events; however, large events (trade shows and weddings) in excess of 50 attendees may receive an exemption based upon confirmation by the public health district that the event will be conforming to social distancing and hygiene protocols, as outlined by safe operations plans. Based on the new public health order issued by Boise Mayor Lauren McLean, a health and safety plan must be submitted to Central District Health (CDH) in order to be approved for large events. Additionally, restrictions are not applicable to youth sporting events if organizers comply with spectator plans administered by the Idaho State Board of Education.

- Phased Reopening Information: “Idaho Rebounds: Our Path to Prosperity”

- COVID-19 Enforcement Tracker