SYDNEY – 30 August 2023 – Australia’s recent hotel performance represents normalization as leisure demand has peaked and given way to strengthening in corporate business, according to CoStar and STR analysis that will be presented this week at NoVacancy Hotel + Accommodation Industry Expo.

CoStar is a leading provider of online real estate marketplaces, information and analytics in the property markets. STR is CoStar’s provider of data benchmarking, analytics, and marketplace insights for the global hospitality industry.

Australia’s occupancy through the first seven months of the year was 68.2%, which was up 9.8% from last year but down 6.0% from 2019. Average daily rate (ADR) of AUD234.46 was 7.4% higher than last year and 22.4% better than 2019. Driven by gains in ADR, revenue per available room (RevPAR) has been indexing at 120 (20 percentage higher) or better than 2019 since April 2022.

“Australia is following many other countries into a period of normalization,” said Matthew Burke, STR’s regional director for the Pacific region, Central South Asia and Japan. “That is happening because the surge in domestic leisure travel peaked in 2022, and while room prices are considerably higher than 2019, we’ve seen minimal-to-no rate growth year over year. That isn’t a loss, but more of a shift, as we’ve seen gains in capital cities and on the days most associated with corporate demand.”

Burke’s NoVacancy presentation, which will cover historical performance, profitability and forward bookings is set for 11:30 a.m. on Friday, 1 September: “Industry Outlooks: Prepare for the challenges and opportunities of the future.”

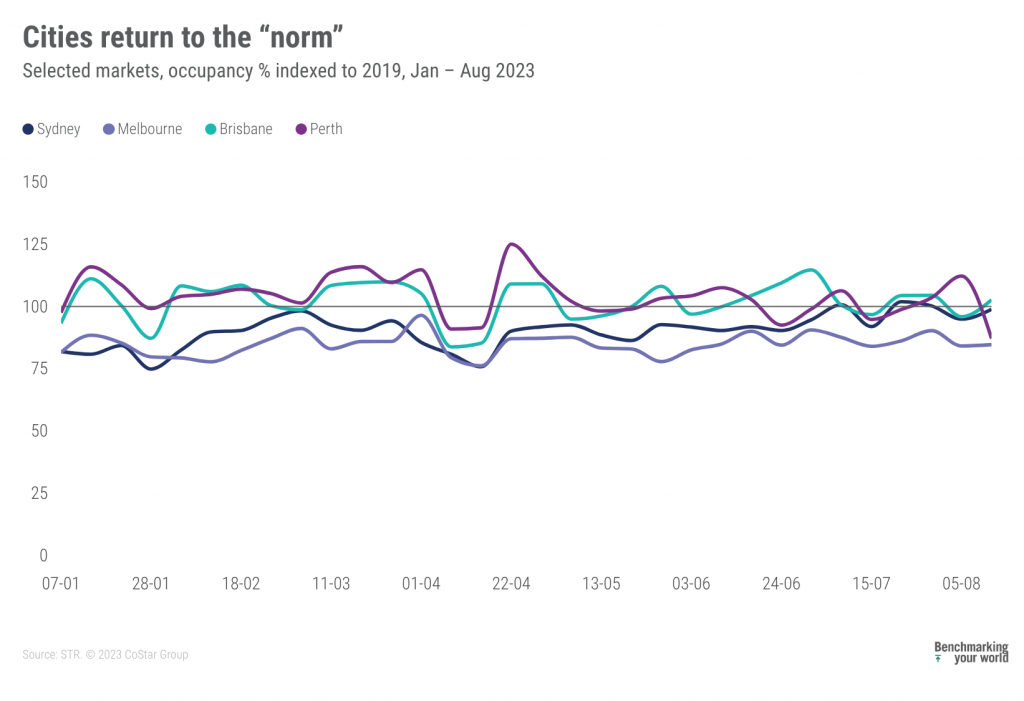

Brisbane shows the highest occupancy index peaks recently, reaching as high as 114 in early July. Perth has remained above 2019 levels for much of the year and peaked as high as 125 in late-April. Sydney trended below 2019 for much of this year but eclipsed that threshold for two straight weeks in late July. Melbourne, whilst absorbing a higher volume of supply, has remained below 2019 comparables all year.

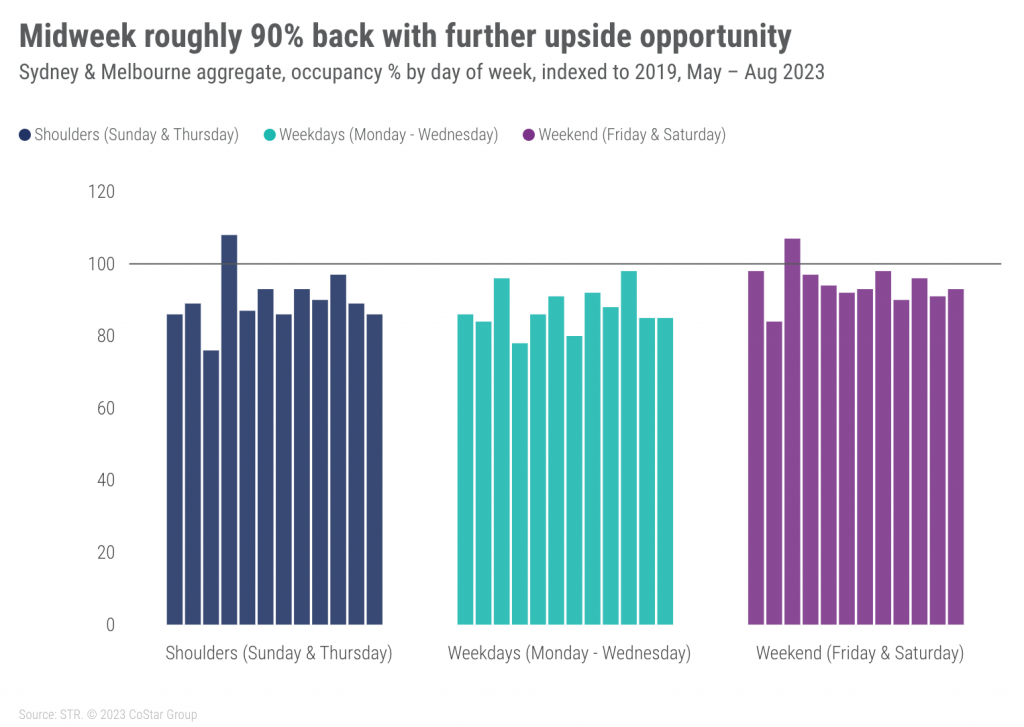

Weekday (Monday-Wednesday) occupancy, which grew the most against last year earlier in 2023, has maintained consistent growth in recent months while shoulder days (Sunday and Thursday) have fluctuated and weekends (Friday-Saturday) have decreased. When compared against 2019, weekends are the furthest recovered whereas weekdays reached 98% of the pre-pandemic comparable in late July.

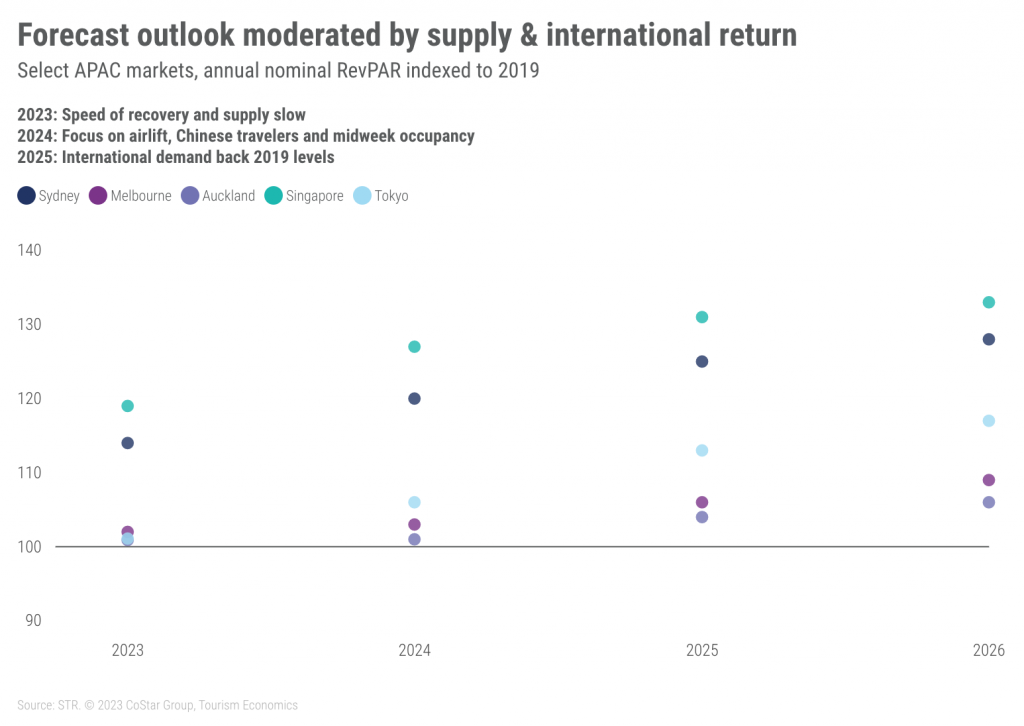

“Weekend occupancy remains high, and that demand has evolved with major events proving major drawcards to future bookings and high ADR,” Burke said. “Midweek shows plenty of upside opportunity as international meetings, large-scale events, corporate and day-agnostic international leisure are still working their way back. There is anecdotal evidence that finance and professional service corporate travelers have been slower to recover than other industries. With all that considered, our forecast is watchfully optimistic on the assumption of further improvement in international and corporate demand.”