By Maxime Gauthier

With a population of more than 930,000 , the capital city of Amsterdam lies on the coast of the province of North Holland. The city – known for its historic canals, the famous Van Gogh Museum, the Rijksmuseum, and the coffee shops of the Red Light District – is also a significant financial and business centre in Europe. There were more than 3,500 international companies in the Amsterdam Metropolitan Area (AMA) in 2023, representing more than 30% of the private-sector jobs. The city is highly accessible via local, national and international transport links. Amsterdam has excellent domestic and international connections via Amsterdam Schiphol Airport, the European high-speed rail network and the North Sea Canal.

Source: HVS Research

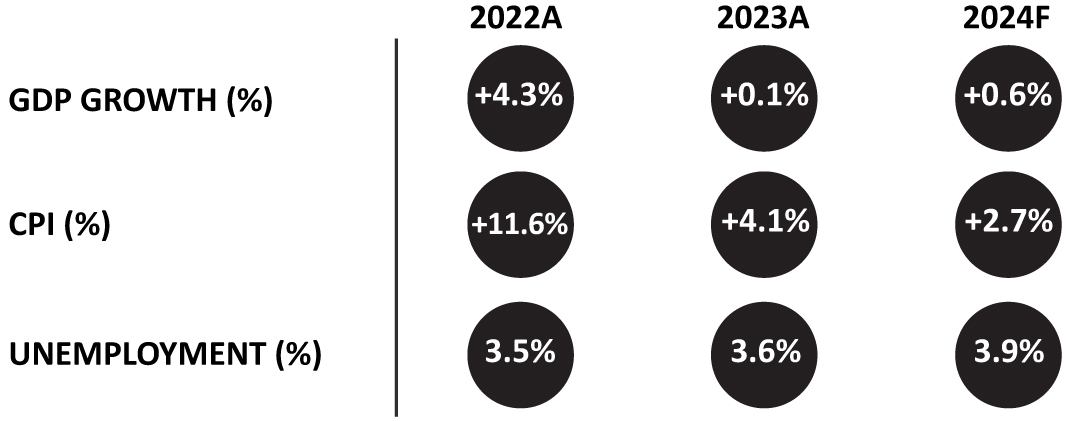

Economic Indicators – The Netherlands

Source: IMF

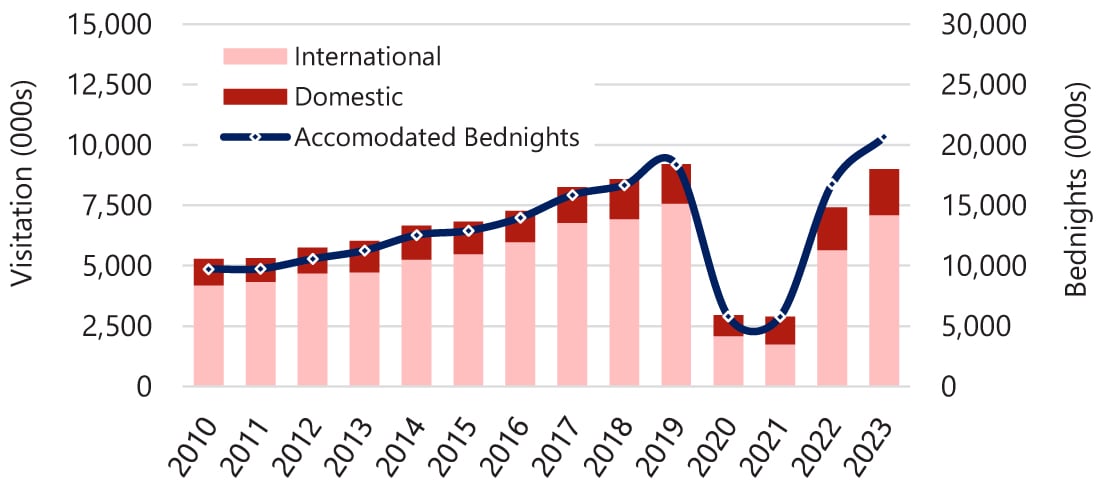

Tourism Demand

Amsterdam has historically been one of the main tourism destinations in Europe. Between 2010 and 2023, the city’s visitation grew by 4% each year, on average, with more than 75% of the visitors being international. In 2023, the primary international feeder markets remained identical to the pre-pandemic years, with the UK (13%), the USA (11%), Germany (10 %) and France (5%) being responsible for nearly 40% of inbound traffic. The domestic market accounted for 21% of total visitation, reaching 117% of the pre-pandemic levels of 2019. After a severe drop in visitation in 2020 owing to the pandemic, visitation picked up slightly in 2021 but truly started to recover in 2022, following the lift of the travel restrictions in March.

Having reported an increase in issues linked to overtourism in recent years, Amsterdam raised the city tax to 12.5% in January 2024, aiming to reduce the number of cruise ship arrivals and change the profile of visitors coming to the city. This strategy is becoming increasingly popular in European cities facing the same problem, such as Barcelona and Venice.

Visitation and Accommodated Bednights

Source: Centraal Bureau voor der Statistiek

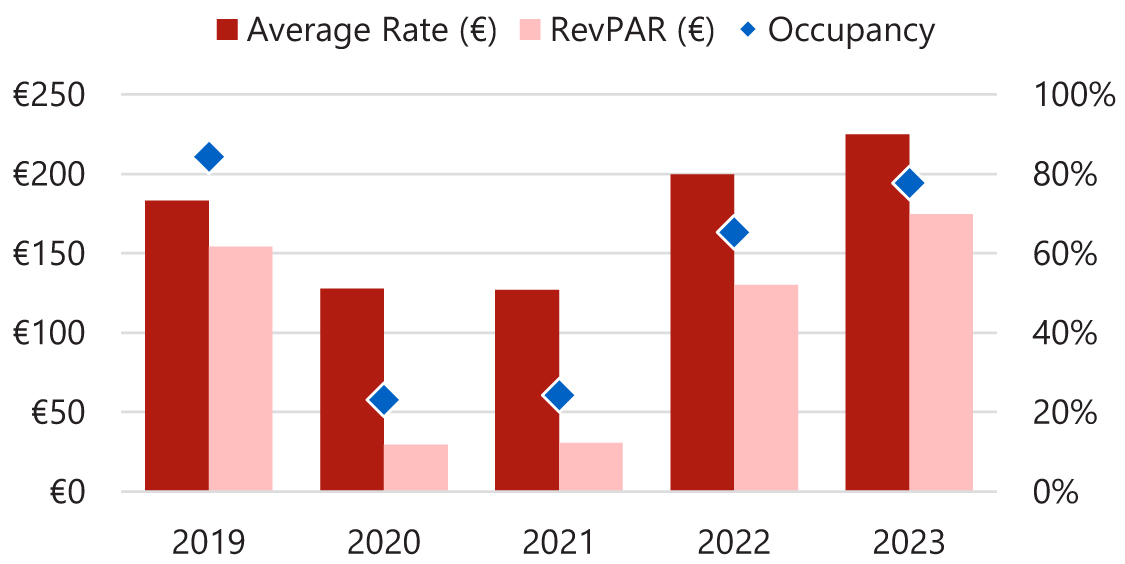

Hotel Performance

In 2018 and 2019, the Amsterdam market saw healthy growth in both occupancy and average rate, achieving record RevPAR levels, before plummeting by approximately 80% during COVID.

Despite a slow start to 2022, the market experienced a rapid recovery following the lifting of restrictions in March. Owing to a drastic increase in occupancy (+40 percentage points) and an equally impressive growth in average rate (+55%), the market’s RevPAR quadrupled year-on-year. Maintaining this momentum in 2023, RevPAR increased by 35%. Despite reaching pre-pandemic levels in nominal values for the first time, last year’s RevPAR was still a couple of percentage points behind 2019 in real terms. We highlight that our data sample leans more strongly towards the upper end of the market, as reflected in the higher-than-average room rates.

Key Metrics

Sources: HVS Research

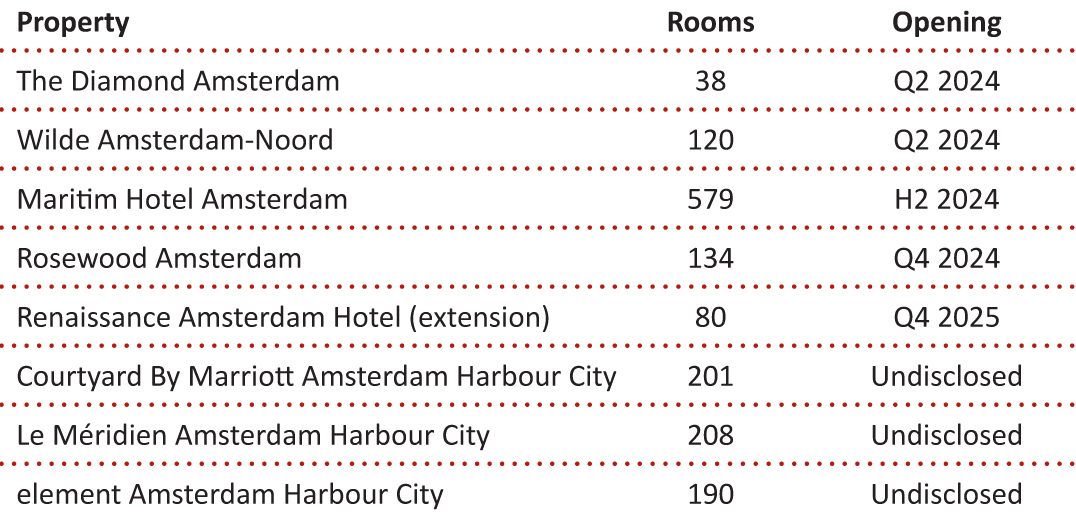

Hotel Supply

Hotel room supply increased at a compound annual rate of 5% from 2014 to 2023, with approximately 3,200 new rooms since pre-pandemic times. Total hotel supply currently stands at around 42,000 rooms and is mostly concentrated in the mid- and upscale segments (approximately 75%). The upscale segment witnessed the greatest compound annual growth rate between 2014 and 2023, at around 8%.

The initial ban imposed on new hotel developments in the Canal District in 2015 led to planned projects relocating to peripheral areas. However, to further improve tourism flow and limit overtourism in the city, the city of Amsterdam implemented further restrictions on new hotel construction at the end of 2016. These restrictions essentially prohibit the development of hotels within the city centre; certain projects, mostly across the IJ river, can however still be accepted. This understandably had a drastic effect on the market’s pipeline.

Hotel Pipeline

Sources: HVS Research

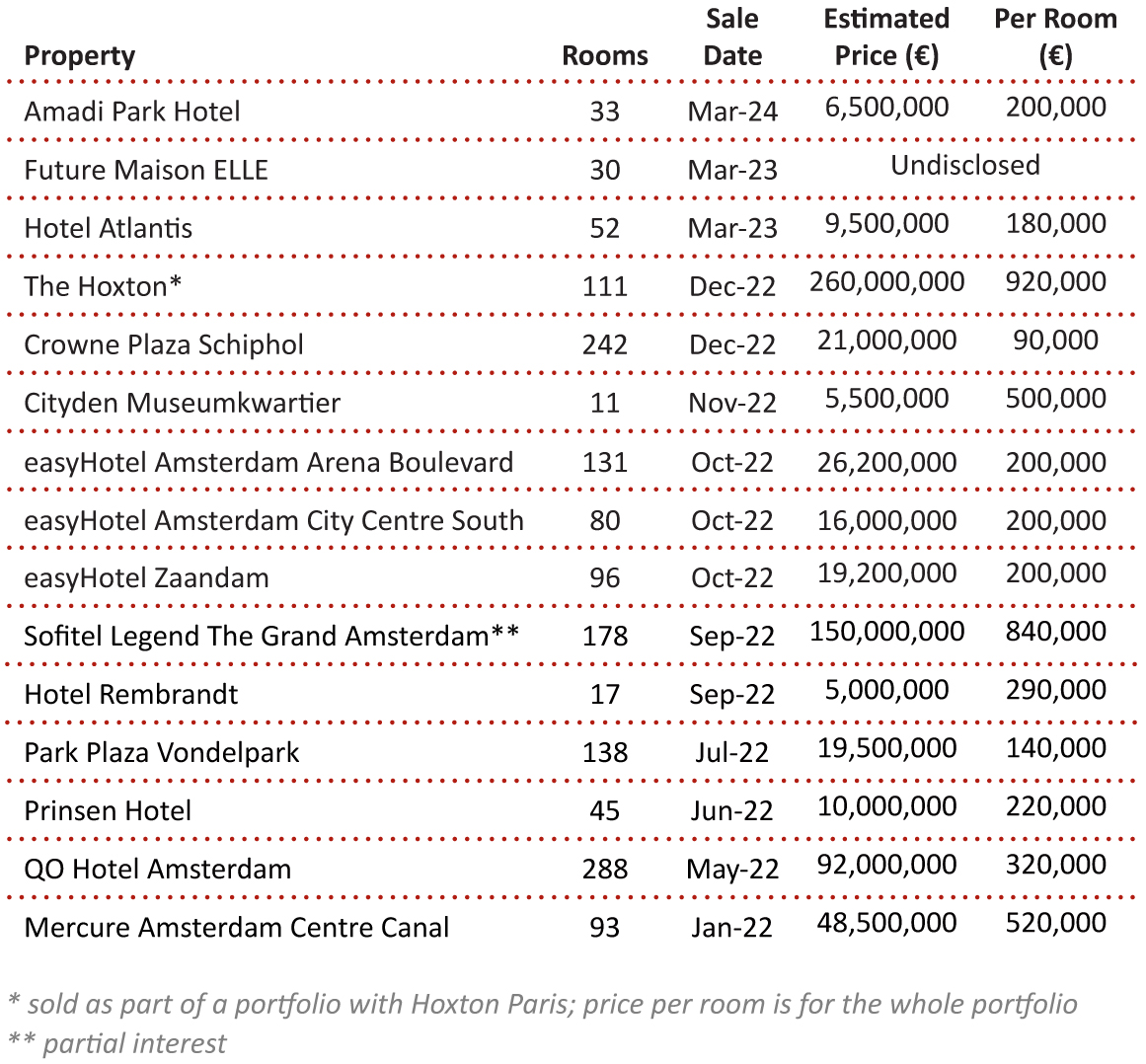

Investment Market

Amsterdam’s hotel investment market has always been one of the most attractive markets in Europe, with a substantial number of transactions taking place in recent years. Notable transactions from 2022 onwards include the sale of the 93-room Mercure Amsterdam Centre Canal in January 2022 (€520,000 per key) by AccorInvest to Ascott Ltd; the 288-room QO Hotel Amsterdam, sold by CBRE IM and Invesco UK to Tristan Capital Partners for €92 million in May 2022; the purchase of Accor’s stake in the 178-room Sofitel Legend The Grand by Schroders (€840,000 per room); and the 111-room Hoxton hotel, acquired by Schroders in December 2022 from Ennismore Capital for more than €540,000 per room. Two transactions occurred in March 2023. The 52-room Hotel Atlantis was bought by Dutch owner-operator Highland Group for around €9.5 million (€180,000 per room). The future Maison ELLE was purchased by Extendam for an undisclosed amount. For the latest value trends, please refer to our annual European Hotel Valuation Index, which showcases the year-on-year value growth of hotel assets in key markets, including Amsterdam.

Hotel Transactions

Sources: HVS Research

Outlook

The Amsterdam market was greatly impacted by the pandemic and the subsequent strict government restrictions. Following the weak performance during 2020 and 2021, a modest recovery started in Q2 2022, building momentum for the drastic improvement showcased in 2023. Although last year’s RevPAR was still marginally below pre-pandemic levels in real terms, the city’s attractiveness – coupled with well-diversified demand sources and a limited supply – indicate a promising 2024 and, potentially, the market’s full recovery. The city’s approach to regulate over-tourism remains important to monitor, its effect on the high season is still to be analysed. Nonetheless, Amsterdam remains one of Europe’s most coveted hotel markets, standing behind only Paris, London and Zürich in our European Hotel Valuation Index.

Value Trends

Sources: HVS Research