Benefiting From Strong Economics

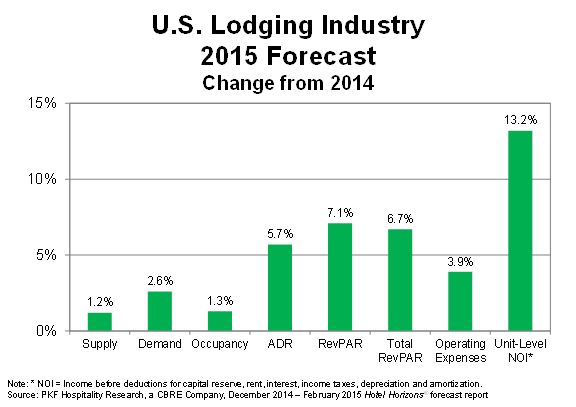

December 5, 2014, Atlanta, Ga. – All segments of the U.S. lodging industry will enjoy strong performance for the foreseeable future according to the recently released December 2014 edition of PKF Hospitality Research’s (PKF-HR) Hotel Horizons® (PKF-HR is a CBRE company). Rising levels of employment, combined with increased geographic expansion of the national economic recovery, will result in revenue per available room (RevPAR) growth in excess of long-run averages for all hotel chain-scales, most location categories and the vast majority of markets from 2014 through 2017.

“No matter what hotel performance indicator you look at for any type of hotel, we foresee extremely favorable movements the next few years,” said R. Mark Woodworth, president of PKF-HR. “Our firm is projecting demand growth to outpace changes in supply in the U.S. through 2016. That will result in industry wide occupancy levels at, or above, all-time record levels through 2017.

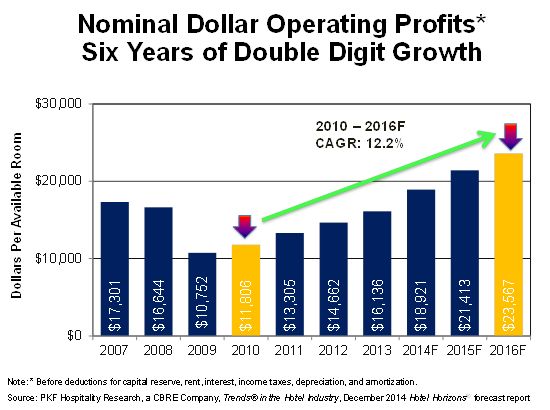

“With scarcity now a reality for consumers in many markets for a growing number of property types, hotel operators will have the leverage they need to drive room rates well above the pace of inflation,” Woodworth added. “Real average daily room rate (ADR) growth driving RevPAR will contribute to a six year period of double-digit increases in hotel profits; something we have not seen in the 78 years PKF has been tracking the U.S. lodging industry.”

The December 2014 Hotel Horizons® report forecasts ADR to increase by an annual average of 5.4 percent from 2014 through 2017. In turn, PKF-HR is forecasting unit-level net operating income to increase at an average annual rate of 11.8 percent during this same period.

It’s the Economy

“Moody’s Analytics, our economic forecasting agent, projects that the U.S. is on track to reach full employment by 2016,” said John B. (Jack) Corgel, Ph.D., the Robert C. Baker professor of real estate at the Cornell University School of Hotel Administration and senior advisor to PKF-HR. Moody’s forecasts show that by year-end 2014 the national unemployment rate will drop down to 5.9 percent from a great recession high of 10.0 percent in 2009.

“What impresses me most is the profile of the populations that recently have seen the greatest declines in unemployment,” said Corgel. “Individuals at the lower end of the income spectrum, and those with the lowest levels of education, lately have enjoyed the greatest gains in employment. This is completely opposite of the employment patterns we observed in 2009 and 2010.”

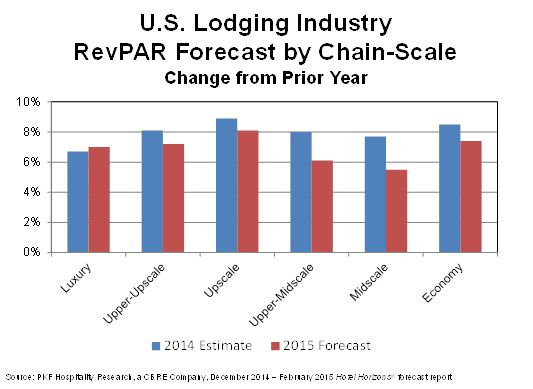

Previous research conducted by PKF-HR found that changes in employment have the greatest impact on the performance of hotels in the lower-priced chain-scales, while changes in income influence the demand for upper-priced lodging facilities. “Employment gains now have reached all segments of the population, which translates into strong RevPAR forecasts for all segments of the U.S. lodging industry,” Woodworth surmised.

The favorable impact of employment gains is evident in the forecast performance of individual lodging markets across the U.S. “Half of the 20 Hotel Horizons® markets forecast to enjoy the greatest increases in employment, also are projected to benefit from the greatest increases in lodging demand,” Corgel noted. “Further, according to Moody’s, close to 90 percent of the local economies in the U.S. currently are classified as being in either a recovery or expansion phase. Accordingly, we will see 15 of our 55 Horizons® markets achieve all-time record high occupancy levels in 2015.”

Peak Persistence Over Oil

“The current favorable economic outlook is not only deep, but long as well,” Woodworth concluded. “That will result in an extended period of peak performance for all participants in the U.S. lodging industry. As if that were not ample good news, the world oil market dynamics are generating prices for transportation fuel that work to the benefit of travelers. If low energy prices are sustained, 2015 hotel performance will be better than expected.

To purchase a December 2014 Hotel Horizons® report, please visit store.pkfc.com. Reports are available for each of 55 major metropolitan areas in the U.S., and contain five year projections of supply, demand, occupancy, ADR, and RevPAR.