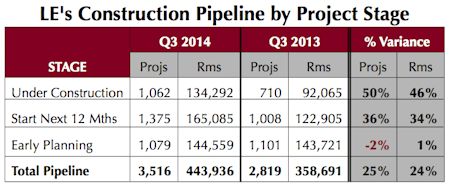

The Hotel Construction Pipeline surged forward to a five-year high in Q3 with 3,516 Projects/443,936 Rooms. The Pipeline has posted double-digit Year-Over-Year (YOY) increases for four consecutive quarters in both Projects and Rooms. In 3Q14, YOY increases are up 25% and 24% respectively, signaling a breakout into the expansion phase of the current real estate cycle which is likely to continue another two-to-three years.

Projects Under Construction, 1,062 Projects/134,292 Rooms, are up a booming 50% by Projects and 46% by Rooms YOY. Projects Scheduled to Start in the Next 12 Months are also strong, up 36% and 34%, at 1,375 Projects/165,085 Rooms.

All Lights Are Green For Hotel Development

Developers are extremely positive with development conditions being near perfect. In 3Q the economy grew at a better than expected annualized rate of 3.5%.

Industry operating statistics are very strong. Importantly, 2014 will be the fifth consecutive year when guestroom demand growth has exceeded supply growth and the fourth year in a row when supply growth has been 1.3% or less. At year-end 2014, occupancy will have reached a 17-year high. Both Average Daily Rate and Revenue Per Available Room will finish at record highs.

Because of the industry’s favorable metrics, lenders are increasingly more attracted to hotel investment making funds easier to access by developers. Interest rates are near record lows and are expected to remain so at least through mid-2015. Selling prices are rising rapidly as Upscale and Upper Midscale branded hotels remain investor favorites.

Favorable economic conditions, record-setting operating metrics, and the positive outlook for the next few years have combined to make it a most opportune time for hotel developers.

Top Markets & Franchise Companies

Guestroom demand in the top 25 markets is explosive as 23 of the top 25 markets are running above the nation’s Average Occupancy Rate of 65.9%. Development too, is thriving in these markets, which account for 40% of all guestrooms in the Pipeline.

New York, with 176 Projects/29,775 Rooms, has the largest Pipeline in the country, and when built-out would result in a hefty 28% increase to the City’s current supply. Houston, a booming, sprawling city spurred by the oil industry, has 133 Projects/14,982 Rooms. Washington with 87 Projects/14,701 Rooms and Los Angles with 65 Projects/13,365 Rooms follow. Miami, a growing vacation and second-home destination for the Latin American business and tourist class, is next having 63 Projects/12,037 Rooms.

Leading the Pipeline is Marriott International with 667 Projects/82,502 Rooms, Hilton Worldwide 683 Projects/79,966 Rooms, and Intercontinental Hotels Group (IHG) 578 Projects/59,778 Rooms. The Pipeline for these three franchise leaders is up significantly YOY. Among developers who have already made a branding decision for their project, 55% of them have selected a flag affiliated with one of these three companies.

Key Upscale and Upper Midscale brands are the industry pacesetters in the early years of the development cycle’s expansion phase. For Marriott their leading brands are Courtyard, Residence Inn, Spring Hill Suites, Fairfield Inn and Townplace Suites. For Hilton it is Hilton Garden Inn, Homewood Suites, Home2 Suites and Hampton Inn & Suites. IHG’s leading brands are Holiday Inn Express, Holiday Inn, Indigo, Staybridge Suites and Candlewood Suites. Other Upscale and Upper Midscale lifestyle brands favored by developers include Aloft and Element by Starwood and Hyatt Place.