WASHINGTON (April 5, 2016)—Growth in the travel sector of the U.S. economy remains positive despite a continuing decline in business travel, thanks to a consistently strong domestic leisure travel market, according to the U.S. Travel Association's Travel Trends Index (TTI).

Domestic business travel declined again in February, as businesses struggle to recover confidence amid volatility in international markets. The business Current Travel Index (CTI) for the month was 48.7—a number below 50 indicates decline—falling even below the 6-month average of 49.3.

The predictive 6-month Leading Travel Index (LTI) stands slightly higher at 49.7, but still forecasts a continued contraction in the business travel segment.

"Even though domestic business travel declined and flagging advance airline bookings from abroad brought the LTI down slightly, these number should be measured against the healthy growth seen in previous months," said U.S. Travel Association Senior Vice President for Research David Huether. "Domestic leisure travel is likely to buoy summer travel expenditures, and keep overall travel growth in positive territory for the next six months."

Meanwhile, international inbound travel trailed the domestic market for the eighth straight month in February, due to the strong dollar's suppressive effect on foreign buying power. The weight of the dollar will likely cause international inbound travel growth to hover around 1% into the second quarter of 2016.

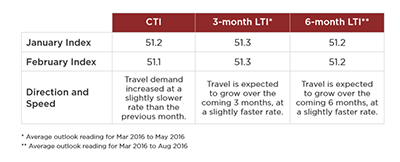

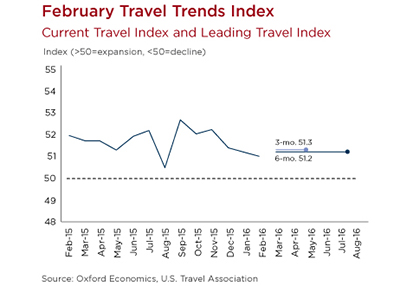

The TTI consists of the Current Travel Index (CTI), which measures the number of person trips involving hotel stays and/or flights each month, and the Leading Travel Index (LTI), which measures the likely average pace and direction of business and leisure travel, both domestic and international inbound. It assigns a numeric score to every travel segment it examines—domestic and international, leisure and business—in current, 3-month predictive and 6-month predictive indicators. As with many indices similarly measuring industry performance, a score above 50 indicates growth, and a score below 50 indicates contraction.

The February CTI registered 51.1, down slightly from 52.2 in January, showing that travel demand still grew in February, albeit at a slightly slower rate than the previous month. Still, the CTI has been above 50—indicating growth—for 74 straight months.

In the full Travel Trends Index report, the 3-month and 6-month predictive Leading Travel Indices (which predict future industry performance) indicate a growth rate of around two percent, on average, through August 2016, with readings of 51.3 and 51.2, respectively.

The U.S. Travel Association developed the TTI in partnership with Oxford Economics, and draws from multiple data sources to develop these monthly readings. In order to compile both the CTI and LTI readings, the organization's research team utilizes multiple unique, non-personally identifiable data sets, including:

- Advance search and bookings data from ADARA and nSight;

- Passenger enplanement data from Airlines for America (A4A);

- Airline bookings data from the Airlines Reporting Corporation (ARC); and

- Hotel room demand data from STR.

Learn more about the Travel Trends Index.

Click here to read the full report.