By Marco Tagliatti

Hotels are always looking for new ways to drive demand – and packages have been a solid vehicle to do just that. Packages, or combined hotel, airfare and/or car bookings, offer valuable benefits to hotels, as well as consumers, but there’s a lack of industry information around how hotels can strategically manage this demand. Between 2014 and 2015 alone, there was a four percent increase in the number of U.S. travelers booking packages, and with the largest U.S. traveler pool since the pre-recession peak of 20081, that demand is likely to continue growing in the years ahead.

Historically the traditional package booker was often a travel deal seeker. Today, budget and luxury travelers alike find package booking not only cost efficient, but time efficient as well. According to Phocuswright’s 2016 report, Destination Unknown: How U.S. & European Travelers Decide Where to Go, travelers who book complex trips like packages tend to take more trips and/or spend more than those who buy just a flight, hotel or other single component – and these complex purchases are on the rise in the U.S. With the continued growth of this category, hoteliers can leverage travel data and partnerships to enhance their offering and make package bookings a key component of their success.

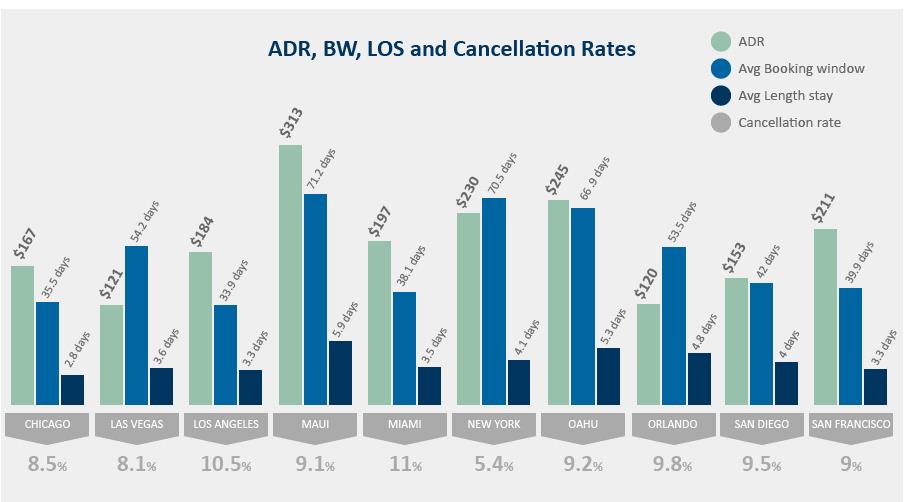

To provide hotels with more actionable insights, Expedia took a deep dive into 12 months of its first-party data (Full year 2016), comparing package bookings to standalone hotel bookings from global points of sale inbound to U.S. properties. The findings? A wealth of information and opportunity that should be music to hoteliers’ ears. Packages are a great way to maximize revenue, secure longer booking windows, and minimize cancellations.

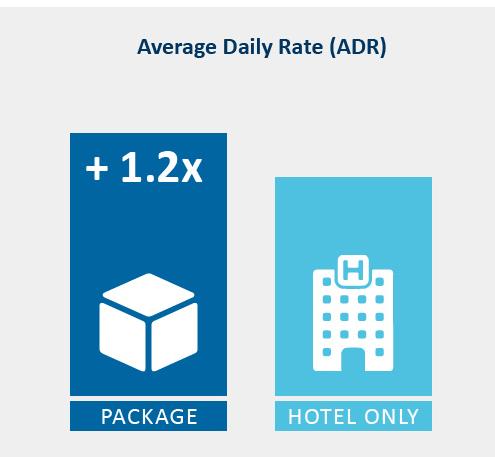

Packages Drive Increased Revenue Overall, in full year 2016, Average Daily Rates (ADRs) – a common performance metric for hotels – for package stays were higher versus standalone stays by an average of 20 percent (see Figure 1). This shows a substantial rate boost for hotels – and an incentive to include their hotels in package offerings.

One potential reason for package bookings delivering a higher ADR? Hotels offering deeper room discounts in package bookings may successfully upsell consumers on room type, due to the overall perceived value. For example, in Hawaii – where package demand is high – a package consumer typically books a higher room view type; an ocean view room versus say, a courtyard view room. While the ADR for an ocean view room may be more expensive than a courtyard view room, if the ocean view room is more deeply discounted as part of the package, consumers may be more apt to re-invest their package savings into a higher category room.

“From extensive review, there is a comprehensive difference between a hotel-only consumer and a package consumer. We have found that package bookings showcase stronger consumer spend while on property along with a longer length of stay, and incremental upsell opportunities due to these guests booking further out and paying off their vacation in advance due the savings received. Because of this, Expedia’s ability for us to garner extensive package bookings, specifically domestically, is a huge value to us!”

– Erin Naeve, Director of Leisure Sales, The Cosmopolitan of Las Vegas

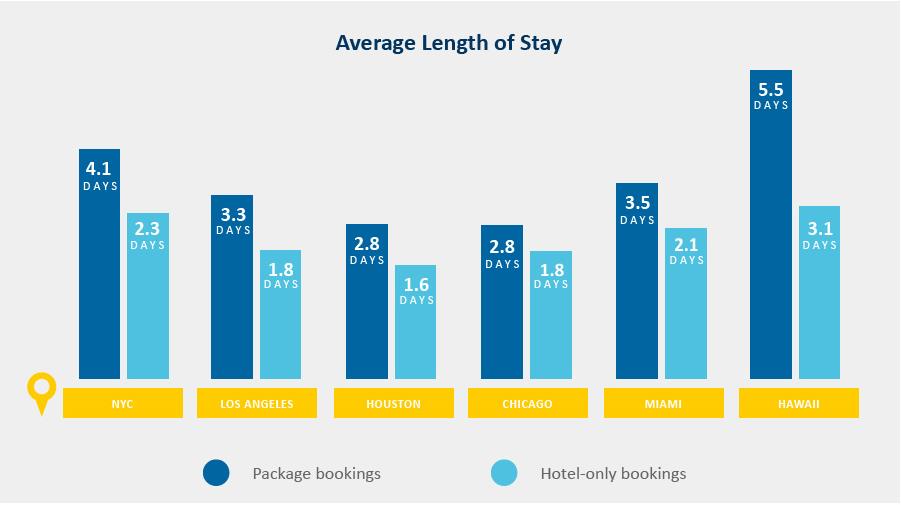

Packages Equate to Longer Stays, and Booking Windows Package bookings typically have twice the length of stay than a standalone hotel booking, making them an attractive source of incremental demand for hotel partners. Interestingly, the length of stay for standalone hotel bookings is similar across markets, but broader variances occur when looking at package bookings.

As illustrated by Figure 2, major U.S. markets and resort destinations have a noticeably longer length of stay for package bookings compared to standalone hotel bookings. For additional U.S. markets and details, see Figure 7 in the Appendix.

Package bookings also typically have a two times longer booking window than standalone hotel bookings, providing more opportunities for hoteliers to upsell consumers – both prior to check-in and on-property. Looking at data for all of 2016, a broad view of the 30-60-90-day package booking windows reveals that the average booking window for packages is just under 50 days. As a leading resort destination, Hawaii has one of the longest booking window for packages (67 days out), just short of New York City at more than 68 days prior to travel.

Fewer Cancellations In package bookings, since the hotel stay is commonly linked to a non-refundable flight, packages have half the cancellation rate of a hotel-only booking (see Figure 3). This is especially important for hoteliers, particularly during a time when consumers are paying for trip protection [travel insurance] or potentially booking refundable, standalone hotel stays in a separate booking to get the most competitive rate.

Notably, some inbound markets with lowest cancellation rates for packages include Summit County, CO at less than seven percent, and Bryan- College Station, TX at less than eight percent. In comparison, a major metro market like Los Angeles has a package cancellation rate of over 10 percent. While this is a substantial delta when compared to the lowest cancellation rates, the Los Angeles package cancellation rate is consistent with the 2016 average, and has a nearly 35 percent lower cancellation rate than comparable standalone hotel bookings.

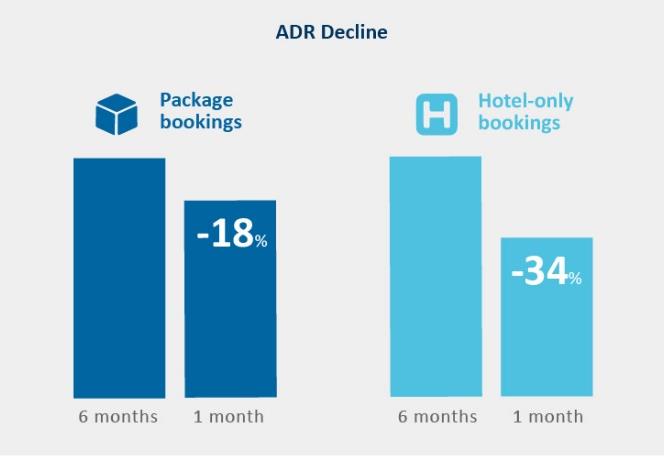

Less Decline in ADR as Booking Window Shrinks Consumers have been bombarded with information pushing last-minute bookings for great deals or discounts, but how can hotels benefit and drive incremental revenue with packages? Expedia’s data for the 12-month period ending 4Q 2016 shows that package bookings can benefit hoteliers – while still delivering a great value to consumers.

As the booking window shrinks – from six months to within 30 days out from stay – the ADR drops for both packages and standalone room nights, but the differential decline is substantial. On average, ADRs for packages dropped 18 percent, while the ADR decline for standalone room nights during the same booking window period is 34 percent double that of packages. (see Figure 4)

SO HOW CAN HOTELS BE EVEN SMARTER ABOUT THEIR PACKAGE OFFERINGS?

Expedia dove deeper into the data to uncover insights and opportunities for hotels to take advantage of.

Understand and embrace the air connection Air prices continued a three-year decline in 2016, per a report from Expedia and Airlines Reporting Corporation (ARC)2, which allows hoteliers to capitalize on more attractive combined savings from air and hotel components. While aggressive airline pricing continues, package offerings should be a strategic consideration for hotels to over-index on their package channel mix, especially vs. the wholesale channel.

In addition, like ADRs, Average Ticket Prices (ATPs) start declining 10 months out, hitting their lowest price one to two months prior to booking on average, with an uptick one-month out from booking. This trend shows that hoteliers should try to load package rates a minimum of three months in advance, to take advantage of the lowest flight prices, offer the best value to consumers, and avoid the discounting that inevitably happens for last-minute hotel deals.

Know how your market fits in Hotels in major metro markets – from Los Angeles to Chicago to Miami – and near airports or convention centers are likely to benefit the most from packages. One exception, however, is New York City, Manhattan proper. In the Big Apple, ADRs for standalone room nights are slightly higher than for package bookings, but the city also has a significantly longer booking window. In New York City, the average booking window for packages is 70 days, while standalone room nights are booked 29 days out, on average.

From a global perspective, during the 12-month period ending 4Q 2016, the top five countries booking packages into the U.S. were Canada, U.K., Germany, Japan, and France. U.S. package bookers who travel abroad are most likely to book a beach destination package in Mexico or the Caribbean, followed by U.K., Ireland, Canada and Italy. In general, resort destinations have higher percentage of package bookings than cities or non-resort areas, with Las Vegas accounting for the highest percentage of package bookings in the US.

In total, the top 10 package destinations (see Figure 5) generate more than half of all package business going into the U.S., while standalone stays are more spread across cities – the top 10 only account for just over one-quarter percent share of business. Las Vegas stands out, with nearly one-quarter of its hotel bookings coming from packages – so Vegas properties more than any other should be including packages in its offerings.

“Our package consumer books further out, spends more on property and stays longer, which helps us layer on business further out.We also see a lot fewer cancellations with packages, which is important in Las Vegas because the market in general tends to have high cancellation rates. In general, we treat packages as its own channel and get great value from our packages offerings.”

– Stephanie Cloud, Director Leisure Sales, MGM Resorts International

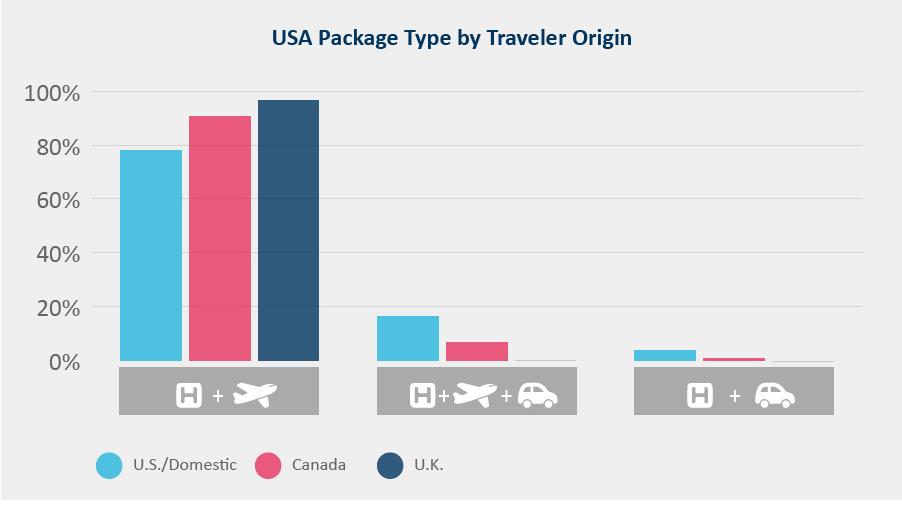

Know what packages consumers are booking More than half of consumers who search for both a flight and hotel within a 90-day period start their search with a flight. By far, during the 12-month period ending 4Q 2016, the most popular package combination is lodging plus air, accounting for over 80 percent of package bookings. Adding a car accounts for an additional 15 percent, with car plus lodging accounting for only four percent of packages.

A deeper look at the package breakdown by traveler origin reveals that U.S. travelers booking a domestic package are more likely to include a car rental, in comparison to Canada and U.K. inbound travelers.

Differentiate your property With the typical package booking paid for in advance, the consumer likely has more funds available to spend on-property, whether at the restaurant, bar, spa, or on activities. There are numerous ways that hotels can stand out from their competitors and attract more looks and books. Knowing that package consumers are more likely to upgrade and spend more on property, hotels should target guests with special discounts and offers, Value Add Promotions, and complimentary amenities leading up to their arrival.

With Value Add Promotions, hotels can better promote their property and maximize their revenue by offering complimentary amenities that enhance a traveler’s stay, including free Wi-Fi, parking, breakfast, and more. These prominently displayed and unique travel offers allow travelers to clearly differentiate hotel offerings and select the hotel and promotion that best meets their needs. Enticing spa and food & beverage credits can also stimulate additional spend in both outlets, which further drives non-room revenue.

Lean on the pros Expedia has an army of Market Managers that know the intricacies of their market – from seasonal trends and events, to what works and when for their hotel partners. Smart hoteliers can input package options that deliver a compelling offering that meets the specific market needs of their travelers.

Additionally, Expedia’s self-service website, Expedia® PartnerCentral, offers several tools and insights to help hotel partners stay informed and competitive in the marketplace. Hoteliers can access real-time insights about the market, read and respond instantly to feedback from guests, and stay up-to-date with reservations, arrivals and cancellations. It can also help increase visibility by creating targeted promotions.

Interested in packaging up a great deal for your consumers? Contact your local market manager or learn more about working with Expedia here.

© 2017 Expedia, Inc. All rights reserved.

1 U.S. Consumer Travel Report Eighth Edition, Phocuswright, July 2016 2 New Heights for Air Travel, Expedia and Airlines Reporting Corporation, December 2016