By Manav Thadani

Twenty years is a long time to understand a hotel market, which is about the same time when the first HVS Asian office was set up in New Delhi. Yes, what is happening in the leisure space for hotel accommodation in India today is indeed a revelation that needs to be recognized.

One of the key benefits of HVS data and knowledge base for the Indian hotel market is that we are able to slice and dice information and extract trends that deserve timely attention by the industry's stakeholders. This year we challenge an industry paradigm that has since long held us back in exploring new avenues for revenue growth – leisure lacks the ability to make money!

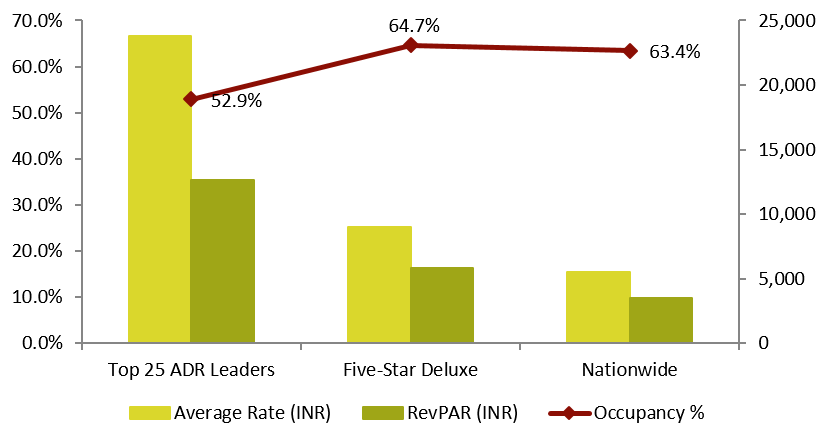

Fact is that a healthy market for leisure hotels exists in India, and here is why – we took a look at the top 25 ADR leaders in the country, and remarkably, 23 of these operate in leisure markets. With an average inventory of 68 keys, this sub-set secured a RevPAR of about INR12,600 last year, which is 3.6 times the national average and 2.2 times that achieved by five-star deluxe hotels. Playing the devil's advocate, some of you may suggest that leisure hotels' ADRs are mostly inclusive of breakfast and a few other charges bundled with the room rate. Even so, we are confident that the gap between this sub-set's performance and the rest would remain wide enough to call attention.

FIGURE 1: ROOMS PERFORMANCE COMPARISON (2015/16 )

Source: HVS Research

Now, although ADR is the primary driver of RevPAR in these 25 hotels, the occupancy of 53% in 2015/16 offers strong evidence of a steady demand for such hotels in India. Previously, domestic leisure locations were associated with only high-weekend demand, but this appears to be altering with meetings and conferences, weddings and social functions, corporate off-sites and group travel contributing to room bookings all through the week. The traditional adage that summer and monsoon months are poor is also being challenged with the reduction of gap between peak and non-peak season occupancies across several leisure markets. Another aspect working in favor of leisure demand is that these hotels do not rely on RFPs per se. Business hotels in India are too dependent on the RFP process to sell their room inventory. This, coupled with inexperienced sales professionals negotiating with the procurement managers of large corporations has systematically brought down ADRs across our hotel markets over the past few years, making it challenging to push the rate back up. Conversely, leisure hotels focus on FIT business that is more discerning in seeking an experience and not just a room at a discount. Increasing purchasing power of the Indian middle class, fuelling their propensity to take more vacations further bodes well for hotels operating in this segment.

Besides, it is not news to many that India in comparison to other Asian countries is a less expensive destination for foreign travelers, particularly for those arriving from the US and Europe. Even as the Indian media paints a picture of exorbitant hotel pricing, our research reveals that a very small percentage of the occupied rooms in India command an ADR that is commensurate to similar hotel markets globally, making the country extremely competitive for inbound leisure travel. However, the abnormally high taxes on room tariffs somewhat changes this for the end user. Thus, we hope that the state and central governments will take steps to rationalize tax policies, encouraging more visitors to the country.

Yet another takeaway is that over three-fourths of the top 25 ADR leaders discussed above are represented by the pre-eminent domestic Indian brands that have traditionally had a stronghold in this segment. We commend their foresight and commitment in defining Indian hospitality. The Taj Group was instrumental in establishing Goa as the leisure destination of choice almost three decades ago, by opening two seminal properties in Sinquerim. In recent years, their partnerships with hotel developers who have developed Taj properties in Coorg, Bekal and Damdama, displays their continued efforts for the creation and growth of leisure locations. The Oberoi group has repeatedly been recognised for establishing global and unparalleled hospitality standards with their Vilas properties. Also worthy of applause are hotels such as JW Marriott Walnut Grove and Alila Diwa Goa, both of which prove the inherent business sense in building hotels and operating in leisure markets. Their success also challenges the deep-rooted assumption held by many that budget and mid market hotels are the only safe investment bet in India. Instead, numbers prove that experience-led leisure hotels can also qualify as a prudent investment strategy.

In conclusion, it is clear that high ADRs do not mean low occupancies. We are more than convinced that the leisure segment in India holds tremendous potential with diverse destinations waiting to be explored. A paradigm shift is necessary, and the time has come.

Note: This article is part of HVS South Asia’s latest annual publication titled ‘2016 Hotels in India – Trends & Opportunities' report.