Canopy by Hilton Frisco

Canopy by Hilton Frisco

Austin, TX – January 14, 2022 – Summit Hotel Properties, Inc. (NYSE: INN) (the “Company” or “Summit”) today announced that it has completed an initial closing of the previously announced portfolio acquisition through its existing joint venture with GIC from affiliates of NewcrestImage. The initial closing included 26 of the 27 hotels totaling 3,533 guestrooms, two parking structures, and various financial incentives. The remaining hotel to be acquired is the currently under construction 176-guestroom Canopy by Hilton New Orleans which is nearing completion, and the joint venture expects to close on the acquisition of the hotel during the first quarter 2022 (collectively with the initial closing referred to as the “Transaction”).

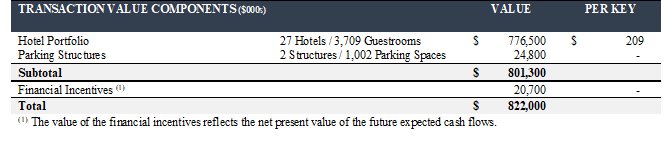

The total consideration for the Transaction is comprised of $776.5 million, or $209,000 per key, for the 27-hotel portfolio, $24.8 million for the two parking structures, and $20.7 million for the various financial incentives. The Transaction is expected to be immediately accretive to adjusted FFO per share, generate a stabilized net operating income yield of 8.0% to 8.5% including future capital investment and excluding any ancillary joint venture fees earned by Summit, and be leverage neutral to the Company’s balance sheet while preserving existing liquidity of nearly $450 million.

Capital Structure and Financing

Upon closing of the Transaction, the Company will fund its 51% equity contribution with a combination of common operating partnership units and preferred operating partnership units. The Company will issue 15.865 million common operating partnership units valued at $160 million to seller affiliates, based on the 10-day trailing VWAP of $10.0853 per unit as of November 2,

The Company will also issue $50 million worth of newly designated 5.25% Series Z Preferred Units. The preferred operating partnership units will be entitled to distributions at a rate of 5.25% per annum, may be redeemed by the holder on the 10th or 11th anniversary of the issuance date and may be called by the Company at any time after the 5th anniversary of the issuance date. GIC’s 49% equity contribution will be in the form of cash.

The Company has secured a $410 million financing commitment from Bank of America and Wells Fargo Bank which will be the primary debt financing for the Transaction. The term loan has a four-year initial term with a one-year extension option, subject to certain conditions. The loan is interest-only and provides for a floating interest rate equal to SOFR + 2.86%.

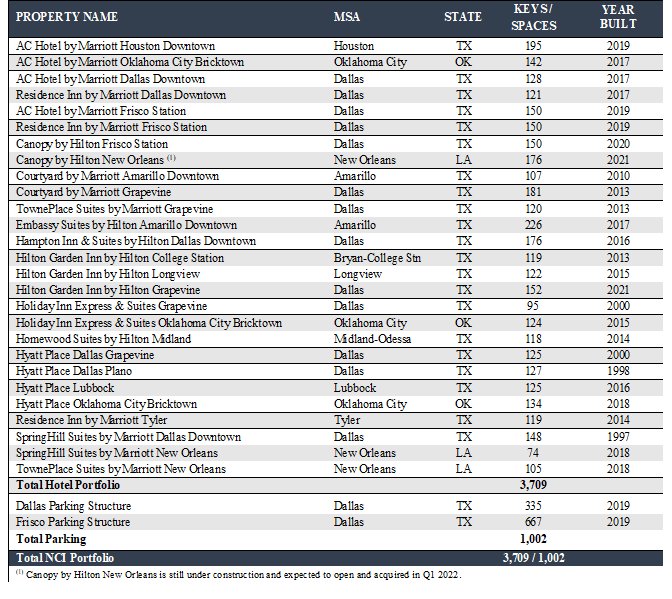

Portfolio Asset Listing:

Board Composition

Effective January 13, 2022, Mehul Patel, Managing Partner and Chief Executive Officer of NewcrestImage, was appointed as a director to the Company’s Board of Directors.

Advisors

BofA Securities, Inc. is acting as financial advisor and Hunton Andrews Kurth is acting as legal counsel to the Company on the Transaction. Goodwin Procter, Munsch Hardt Kopf & Harr, Haynes and Boone, and Colven & Tran are acting as legal counselors to NewcrestImage.