By Amy Schmidt, Brian Arevalo

Despite the COVID-19 pandemic, readers of Condé Nast Traveler magazine have voted Chicago as the best big city in the U.S. for the last six years. Chicago’s numerous attractions include unique dining experiences, modern hotels, diverse neighborhoods, and an abundance of arts and entertainment venues. The market also benefits from its proximity to other major markets and its popularity as a meeting and group destination.

Data for the Downtown Chicago market is outlined below, illustrating a strongly rebounding economy as of year-end 2022.

Data for Chicago as of December 2022

Sources: Choose Chicago, Crain’s Chicago Business, BLS.gov, flychicago.com

New Supply

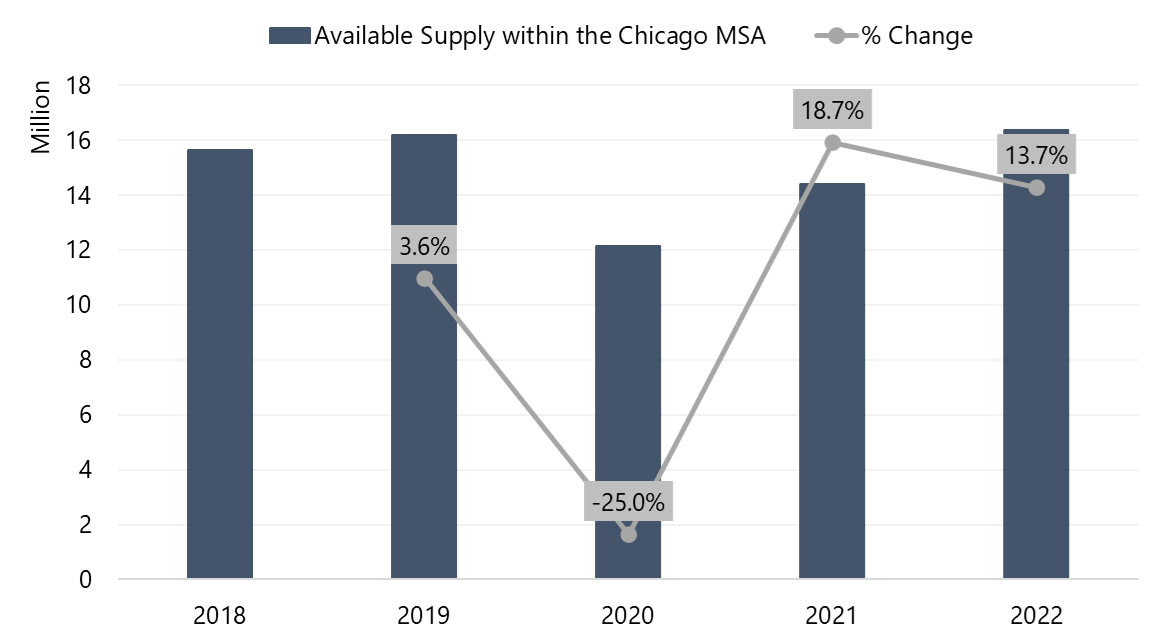

Although new supply growth in Chicago slowed in 2022, the city continues to attract major corporations and hotel development, supported by its available global transportation infrastructure and well-educated workforce.

Chicago MSA Supply

Source: STR Inc. and Choose Chicago

Some notable hotel redevelopments and conversions in the last year have included the conversion of the Holiday Inn Mart Plaza to Chicago’s first dual-branded voco and Holiday Inn; the opening of The LaSalle Chicago, Autograph Collection in June 2022; and the opening of the citizenM Chicago Downtown hotel in September 2022. Furthermore, there are approximately 1,500 rooms currently in the construction pipeline within Downtown Chicago.

COVID-19 and Recovery

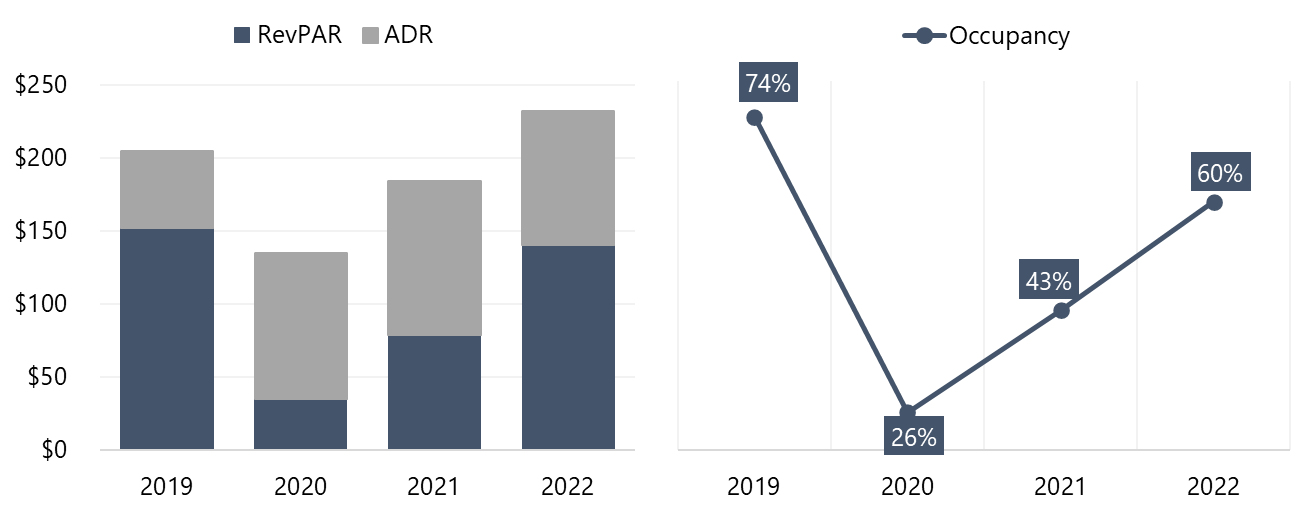

Chicago MSA Hotel Metrics

Source: STR Inc. and Choose Chicago

In 2019, the harsh weather during the first quarter and the soft convention year contributed to a weakening trend; however, there were still more room nights sold in 2019 than the prior year. The first two months of 2020 registered a substantial improvement in both occupancy and ADR compared to the prior year, and Downtown Chicago hotels were expecting a very strong year and convention calendar. However, in March 2020, the COVID-19 pandemic began to affect the local market, resulting in decreased business activity and convention cancellations through the end of 2020. Furthermore, statewide restrictions nearly eliminated group and commercial travel in the market from March 2020 through early 2021. As such, occupancy and ADR declined notably in 2020, with RevPAR falling to $35.22.

Both occupancy and ADR increased in 2021 given the wide distribution of vaccines and strengthening economic conditions, resulting in higher demand levels, particularly from leisure travelers. However, occupancy remained well below 2019 levels. Notably, although ADR was also below 2019 levels, the difference between 2019 and 2021 levels diminished significantly over the course of the year. Data for 2022 illustrate a significant improvement in both occupancy and ADR, with ADR levels surpassing 2019 levels, primarily driven by heightened leisure demand. This is attributed to the accelerating level of group activity and the increasing return to offices.

Looking Forward

While the pandemic may continue to affect business to some degree in the near term, the overall outlook is optimistic. Over the long term, the strong leisure and commercial demand generators and the rebounding convention and group demand bode well for the market, as over 50 large events are on the books for 2023.

For more information or to inquire about a specific hotel project, contact Amy Schmidt or Brian Arevalo with our Chicago team.