Compelling economic and industry fundamentals suggest continued momentum for 2018

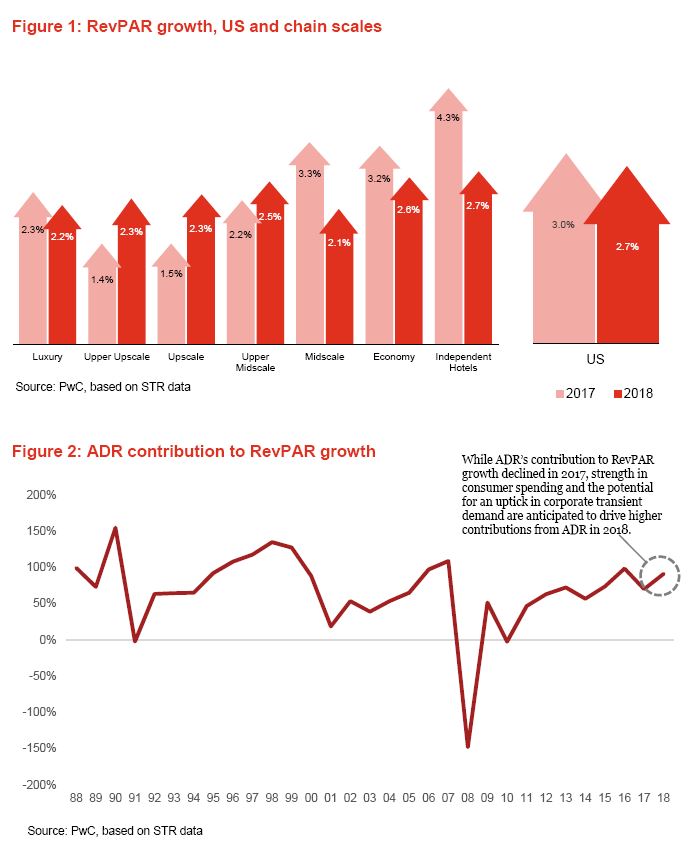

Less than a month into 2018, the eight-year growth cycle in the lodging industry lumbers on. While RevPAR performance in the third quarter of 2017 appeared to take a breather, the combined impacts of improving economic fundamentals and the regional increase in performance associated with the aftermath of Hurricanes Harvey and Irma resulted in a stronger fourth quarter, driving home a solid finish for the year. Going forward, the Tax Cuts and Jobs Act is reportedly providing a boost in business and consumer sentiment, and is expected to contribute to GDP growth in 2018.

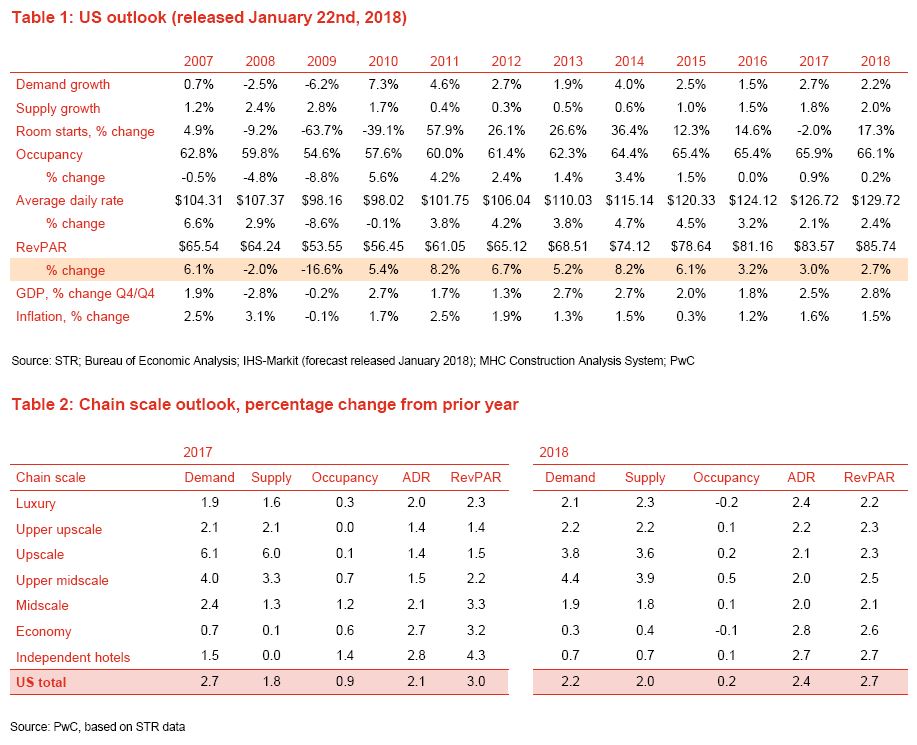

Growth in lodging demand continues to be a tale of two travelers. The leisure transient segment, which provided a meaningful tailwind for demand this cycle, continues to drive room-night demand. These travelers, however, tend to be relatively price sensitive and are more likely to shop around for a compelling price. Inbound international travel, an important source of leisure demand, declined in the first and second quarter of 2017, though the weakening US Dollar may help to offset that decline going forward. Conversely, the corporate transient segment (and its counterpart, group travel), largely considered the bread and butter business for many hotels, continues to exhibit anemic growth. The sluggishness of these two demand segments has been cited as contributing to the slower growth in ADR in the late stages of the current recovery, even as occupancy levels exceed 35-year records.

Increase in supply, long considered the Achilles heel for industry growth cycles, has been relatively tame during this recovery. While occupancies in 2017 continued to reach record levels, this can be attributed in part to restraint in supply growth.

Looking ahead to 2018, underlying macroeconomic and industry fundamentals are expected to remain strong. Supply growth is expected to reach the long-term average, while demand growth is anticipated to continue to support record occupancy levels. Strength in consumer spending and the potential for an uptick in corporate transient demand are anticipated to drive a slight uptick in ADR growth compared to last year, ultimately resulting in the ninth straight year of RevPAR growth, approaching the record for the longest consecutive quarterly growth cycle in over 30 years.

The Tax Cuts and Jobs Act is a significant political win for the Trump administration; the short, medium, and long-term impacts of the new tax code structure on the lodging industry are less easy to measure. However, economists at IHS-Markit anticipate a 10 basis point incremental increase in GDP in 2018 as a result of the Act.

Consumer fundamentals have been on solid footing for several quarters, encouraged by rising home prices, real wages, and stock prices, in addition to a decreasing unemployment rate. While our lodging commentary notes the tepidness with which corporate transient demand has grown this cycle, business activity in the broader economy has remained strong, with spending on equipment and construction both ending the year on positive notes. Non-residential fixed investment, a key indicator of business investment spending, is anticipated to grow 4.8 and 5.5 percent, respectively, in 2017 and 2018.

Overall, economists at IHS-Markit anticipate GDP in 2017 will grow at a 2.5 percent rate, measured on a fourth-quarter-over-fourth-quarter basis, driven by strong consumer fundamentals, exports, and equipment spending. In 2018, the Tax Cuts and Jobs Act is expected to positively contribute approximately 10 basis points to GDP, resulting in a 2.8 percent growth rate, measured on a fourth-quarter-over-fourth-quarter basis.