WASHINGTON (August 2, 2016)—Despite a small uptick in June, the U.S. Travel Association's Travel Trends Index (TTI) predicts muted international inbound travel growth for the remainder of 2016, due in part to the fallout from Britain's decision to leave the European Union.

International inbound travel had been stagnant for months, with variables such as the strong U.S. dollar weighing on travel from previously robust markets like Canada. International inbound travel growth in June somewhat defied expectations as the summer travel season began in earnest, outpacing domestic travel for the first time in 13 months.

However, according to the TTI's Leading Travel Index (LTI), a variety of factors point to renewed sluggishness in international travel growth throughout the remainder of 2016—among them the global market's unfolding reaction to the Brexit vote and the problems already presented by the continued strength of the dollar.

A similar pattern was found in domestic business travel. After a decline in May, domestic business travel grew somewhat in June. However, the LTI predicts that domestic business travel growth will be anemic through the end of this year, as companies' travel budgets remain stagnant in response to an uncertain global financial environment.

Domestic leisure travel continued to prop up the U.S. travel market overall, albeit growing at a slower pace than prior months.

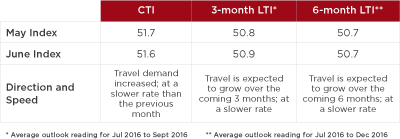

The June Current Travel Index (CTI) registered at 51.6, on par with the 6-month moving average of 51.6 (numbers above 50 indicate growth, and scores below 50 show contraction). The travel industry at large remains in expansion mode, as the CTI has registered above the 50 mark for 78 straight months.

In the full TTI report, the 3- and 6-month LTI readings of 50.9 and 50.7, respectively, indicate that U.S. travel overall is expected to grow at a rate of around 1.6 percent through December 2016.

"International inbound travel's rebound in June is a welcome sign for the U.S. travel industry," said U.S. Travel Association Senior Vice President for Research David Huether. "The June Travel Trends Index also shows that domestic leisure travel is, and will continue to be, a primary source of growth for the travel industry moving forward.

"This strength will be necessary to prop up U.S. Travel growth, given the near-term outlook indicating deceleration in international inbound travel during the second half of this year."

The TTI consists of the Current Travel Index (CTI), which measures the number of person-trips involving hotel stays and/or flights each month, and the Leading Travel Index (LTI), which measures the likely average pace and direction of business and leisure travel, both domestic and international inbound. It assigns a numeric score to every travel segment it examines—domestic and international, leisure and business—in current, 3-month and 6-month predictive indicators. As with many indices similarly measuring industry performance, a score above 50 indicates growth, and a score below 50 indicates contraction.

The U.S. Travel Association developed the TTI in partnership with Oxford Economics, and draws from multiple data sources to develop these monthly readings. In order to compile both the CTI and LTI readings, the organization's research team utilizes multiple unique non-personally identifiable data sets, including:

- Advance search and bookings data from ADARA and nSight;

- Passenger enplanement data from Airlines for America (A4A);

- Airline bookings data from the Airlines Reporting Corporation (ARC); and

- Hotel room demand data from STR.

Learn more about the Travel Trends Index.

Click here to read the full report.