By Kyu Baek Kim and Hok Yean CHEE

The Republic of Singapore is a metropolitan city-state and island country in Southeast Asia with a total land area of 714.3 square kilometres. It is situated at the southern tip of the Malayan Peninsula, between Malaysia and Indonesia. With an economy supported by its growing population of approximately 5.6 million, Singapore rose as an economy in the latter half of the 20th century and today serves as a global commerce, finance, and transportation hub.

According to the World Travel & Tourism Council (WTTC), the direct and total contribution of Travel & Tourism to Singapore’s Gross Domestic Product (GDP) was 4.1% and 10.2%, respectively of the total GDP in 2017, making tourism one of the key supporting industries for the economy.

In 2017, Singapore’s economy outperformed expectations at 3.5%, boosted by robust growth in the manufacturing sector. Bolstered by the uplift in arrivals from Mainland China, Singapore’s tourism sector also finished the year on a strong note, up 6.2% year-on-year (y-o-y) in international visitor arrivals (IVA). Singapore’s transportation hub, Changi Airport, hit two milestones this year, opening its first high-tech, automated Terminal 4 and welcoming its 60 millionth annual passenger.

Having witnessed a solid tourism performance recovery in 2017, the Singapore Tourism Board (STB) built on its Hotel Industry Transformation Map (ITM) launched in 2016. Among the new initiatives is a roadmap for hotels to evolve into “Smart Hotels” through the “Smart Hotel Technology Roadmap”. This will serve as a framework for hotel operators and owners to enhance their hotels by adopting technology.

Economic Outlook

Following a weak economic performance in 2016, the global economy performed stronger than initially expected in 2017. According to the World Bank, global economic growth is estimated to have closed at 3.0%, 0.3 percentage points higher than its June projections, led by the upturn in global investment.

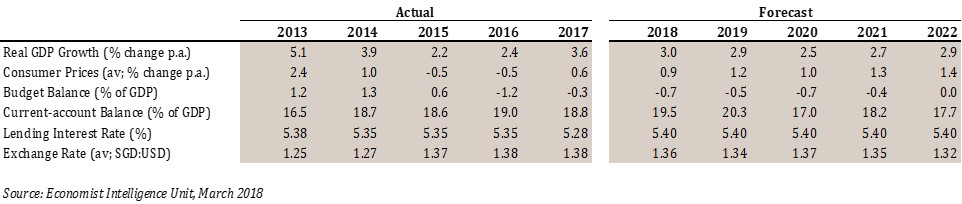

Economic Performance & Outlook

Singapore’s economy ended 2017 stronger than expected, recording a 3.5% real GDP growth for the year. The economic uplift was greater than the Ministry of Trade and Industry’s (MTI) initial forecast of 1.5%. The growth was supported by the manufacturing sector, historically the main pillar of Singapore’s economy, and strong output expansion in electronics. Going forward, taking into account a brighter outlook for the Chinese economy, the Economist Intelligence Unit (EIU) forecasts Singapore’s economy to see a slower, but resilient growth at 3.0% in 2018.

Currency Exchange Outlook

Since the Trump administration took office in 2017, the United States (US) has depreciated the greenback to reinvigorate the country’s manufacturing and exports. The US Dollar Index (USDX) subsequently went on to decline by 11.2% in 2017. As the US Dollar (USD) retreated, the Singapore Dollar (SGD) gained an uptrend against the US Dollar, boosted by a remarkable recovery of its economy in 2017, finishing the year 8.2% stronger. It is forecasted by EIU that the SGD will continue to stay strong in 2018 as the Monetary Authority of Singapore (MAS) tightens its policy, gradually appreciating the nominal effective exchange rate (NEER).

Inflation

Singapore’s inflation rate remained moderate at 0.6% in 2017, up from two consecutive years of negative inflation. EIU expects, with the increase in global energy prices, inflation to accelerate to an annual average of 1.2% in the next five years.

Interest Rates

In 2017, the 3-month Singapore Interbank Offered Rate (SIBOR) rose by 0.53 percentage points in parallel with the US Federal Reserve’s (Fed) interest rate hikes. The Fed raised interest rates three times in 2017 on the back of solid economic expansion in the US. It is likely that the Fed will continue to raise interest rates further in 2018. Thus, short-term interest rates, such as the 1-month and 3-month SIBOR, are expected to hike in 2018.

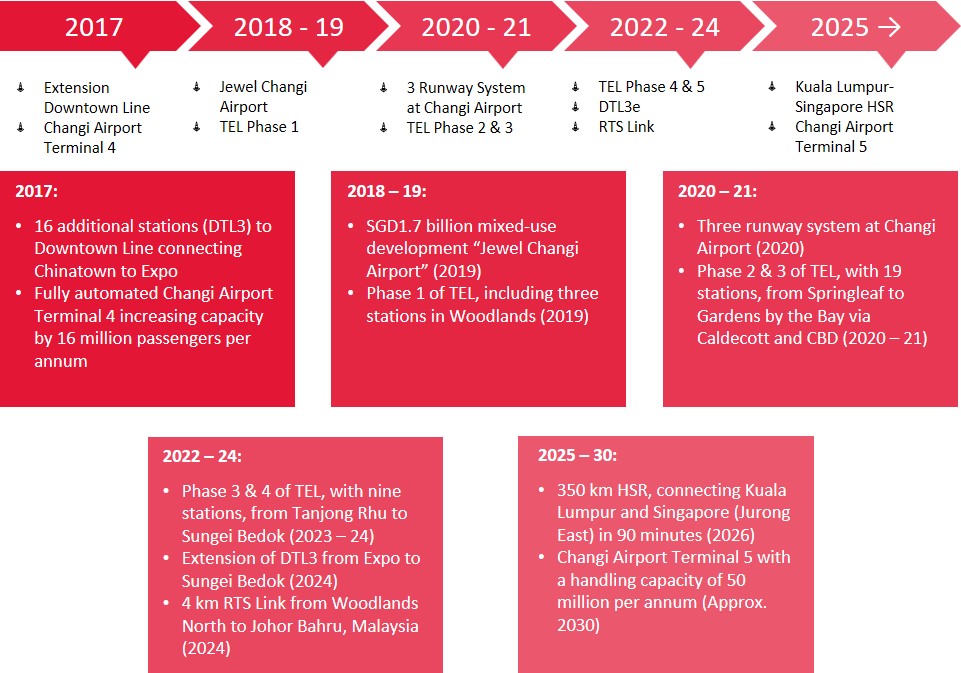

Infrastructure

FIGURE 1: INFRASTRUCTURE DEVELOPMENTS

Singapore Tourism Landscape

Singapore’s tourism arrivals have increased for the third consecutive year to reach historical highs in 2017. International visitor arrivals (IVA) increased by 6.2%, mainly due to the recovery of the global economy and continued growth of the tourism sector in the Asia Pacific region.

STB reached out to its main source markets, namely China and India, and broadened its efforts to Tier 2 cities in these regions. The endeavour led to a 12.7% and 15.9% y-o-y growth in the respective markets.

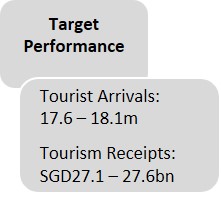

FIGURE 2: TOURISM FORECAST 2018

International Visitor Arrivals & Tourism Receipts

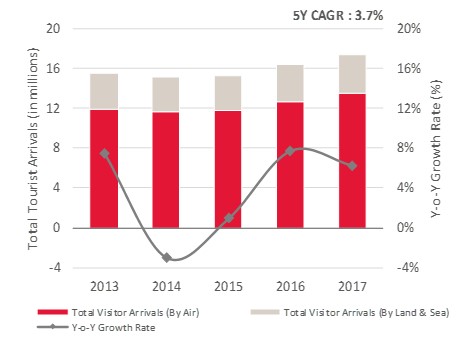

FIGURE 3: INTERNATIONAL VISTOR ARRIVALS

Since the contraction of IVA in 2014 due to a decline of Chinese visitor arrivals, IVA in Singapore has recovered, ending 2017 on a positive note. The healthy growth in arrivals from 2015 to 2017 has translated to a compounded annual growth rate (CAGR) of 3.7% in the last five years.

Tourism receipts also registered a robust growth in 2017, also at historical highs. STB estimates, based on the first three quarters of 2017, that tourism receipts rose by 3.9% to SGD26.8 billion. However, as the uplift of IVA was greater than that of tourism receipts, average capita per spending decreased from 2016 to 2017.

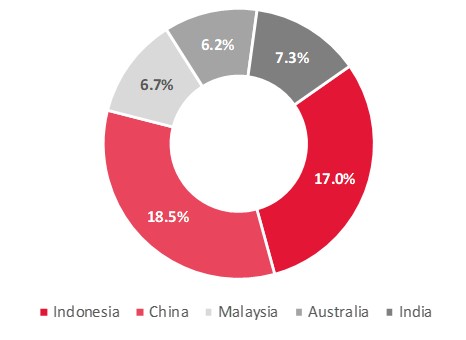

International Source Market & Average Length of Stay (ALOS)

Singapore’s top five international source markets in 2017 remained similar to 2016. The top five source markets made up 55.7% of all IVA in 2017, with China (18.5%) as the largest in-bound market, followed by Indonesia (17.0%), India (7.3%), Malaysia (6.7%), and Australia (6.2%). Continuing from 2015 and 2016, China and India showcased robust growth of 12.7% and 15.9%, respectively, in 2017. As a result, tourist arrivals from the top five source markets increased by 7.4% y-o-y.

In 2017, the average length of stay (ALOS) of travellers to Singapore was 3.4 days, a decrease of 1.5% from 2016.

FIGURE 4: TOP 5 SOURCE MARKETS

Singapore Hotel Market

Singapore’s hotel market had a dynamic year in 2017. HVS has tracked that 10 hotels, branded and unbranded, with a total room count of 2,800 hotel rooms, opened in 2017. This increased the total available room nights (ARN) by 5.5% from 2016.

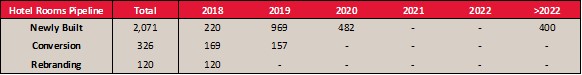

According to HVS Research, a total of 389 branded hotel rooms are expected open in 2018. Between 2019 and 2023, an additional 2,008 branded rooms are expected to be added to Singapore’s hotel supply.

HVS has tracked four major branded hotel projects, slated to open in 2018, with the majority of properties in the luxury segment:

- Q2 2018 Six Senses Duxton, 49 keys

- Q3 2018 Six Senses Maxwell, 120 keys Raffles Singapore, 12 keys *

- Q4 2018 Dusit Thani Laguna Singapore, 208 keys

* Raffles Singapore is undergoing a renovation which will add 12 additional suites

Figure 5: Singapore Hotel Room Pipeline (2018-2022)

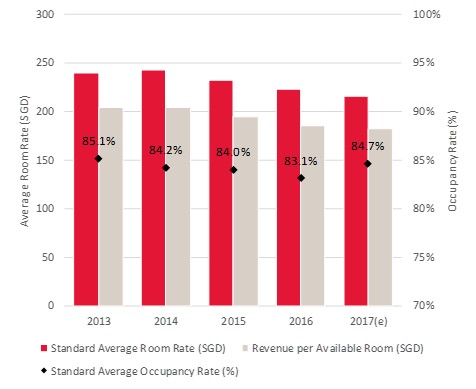

Singapore Hotel Market Performance

Despite a large influx of hotel rooms, the market showed resilient performance in terms of occupied room nights, as occupancy in hotels increased by 1.5 points to reach 84.7% in 2017. The average room rate was SGD215.6, a decrease of 3.3% compared to 2016, resulting in a RevPAR 1.5% lower than in 2016 and marking the fifth consecutive year of decline in marketwide RevPAR.

Amongst Singapore’s hotel categories, the upscale and mid-tier segments recorded a stable RevPAR in 2017, in line with overall market performance, while the luxury segment’s RevPAR decreased by 2.8% following declines in occupancy and average rate. The economy segment improved its RevPAR performance by 8.4% due to an increase in both occupancy and average rate.

FIGURE 6: SINGAPORE OVERALL HOTEL PERFORMANCE (2013-2017e)

Singapore Branded Serviced Apartment Market

Given the city-state’s status as an international financial centre, Singapore is home to numerous serviced apartments. Traditionally strong sectors in Singapore, such as financial services, manufacturing, and information technology, drive the demand for serviced apartments as international companies need to accommodate overseas staff for several months. Serviced apartments provide mid to long-term accommodation, as opposed to hotels that cater primarily to short-term guests.

Following the Urban Redevelopment Authority’s (URA) reduction of the minimum rental period of apartments, from six months to three months, serviced apartments need to diversify their target market to remain competitive. Thus, creating more flexibility in room bookings to provide short-stays, contingent on a valid hotel licence, can make the serviced apartment sector more profitable.

Currently, HVS has tracked Singapore’s branded serviced apartment supply to be 32 properties with a total count of approximately 4,650 units as of 31 December 2017. We also note that one branded serviced apartment, Winsland Serviced Residences by Lanson Place, is expected to complete its renovation by April 2018.

Going forward, HVS Research shows six major serviced apartment projects currently under development and to be completed by 2021. Upcoming branded serviced apartments in Singapore, mainly to be positioned in the upper-midscale segment, include:

2019

- Capri by Fraser China Place, 306 units

- Citadines Rochor, 320 units

2020

- lyf Funan, 279 units

2021

- Citadines Balestier, 166 units

- Citadines Raffles Place, 299 units

- lyf Farrer Park, 240 units

Luxury & Upper Upscale Brands in Singapore

Lifestyle Brands in Singapore

Brands present in Southeast Asia & Australasia, but not yet in Singapore

- Adina

- Cassia

- Kantary Collection

- Marriott Executive Apartments

- Mantra

- Medina

- Modena

- Oaks

- Quest

- Shama

- The Sebel

* Please note that all brands have been listed in alphabetical order

"Smart" Hotels of the Future: Trends in Hotel Technology

Singapore is a global pioneer when it comes to technology innovation and digitalisation. Hence, it is no coincidence that the city-state is a frontrunner in the development of new applications, innovative tools, and improved programs to support hotels on their way to technology transformation. Millennials travelling around the world are requesting for digital convenience that goes far beyond offering free-wifi, leading to a race for technology innovation among the hotel operators.

The Internet of Things (IoT) and the transformation of guestrooms

International and regional hotel operators are currently working in their innovation labs to test Artificial Intelligence (AI) applications and take the Internet of Things (IoT) concept to the guestroom. The ultimate goal is to personalise the room to guests’ needs and provide a more memorable experience supported by digital innovation.

IoT projects expected to be inaugurated in the short future to transform the future hotel room:

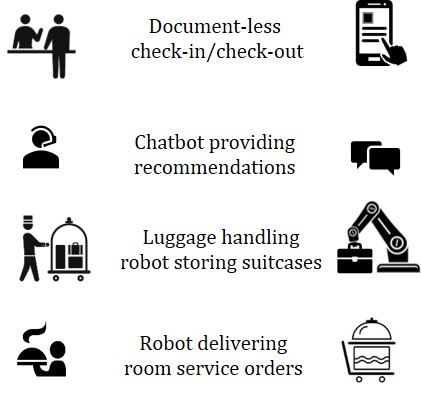

Robotics & Digital Innovation

Since 2016, hotels in Singapore have deployed robots in hotel lobbies and back-of-house areas. As of today, HVS Research identified three key benefits of having a robot in the hotel:

- Curiosity Guests are keen to explore hotel robots and its services

- Online Marketing Curious guests’ videos of hotel robots increases hotel’s visibility on social media.

- Staff Support Front-of-house staff can focus on enhancing the guest experience rather than making deliveries to guestrooms.

The presence of robots is not the only technological addition in Singapore’s hotels. In 2017, the Tourism Innovation Challenge, organised by STB, presented 18 exciting tech-solutions to help hotels get on board the Smart Hotel Technology Roadmap.

Fast and convenient communication between staff and guests is high priority in hotels. Already introduced on booking websites, hotels have inaugurated direct messaging or automated chatbots to better answer hotel guest’s queries. Research has shown that it takes about 3-6 months to get a hotel chatbot customised to a hotel and fully functioning. Due to high similarity amongst the questions asked, approximately 60-80% of guest queries can be answered by the chatbot via an application.

Inauguration milestones of robots in Singapore’s hotels

The future arrival experience

While self check-in kiosks are starting to be implemented in hotels, technology companies are gearing up for the next revolution. Document-less check-in with facial recognition and fingerprint verification is bringing the hotel check-in to a new realm. The introduction of biometric verification is expected to not only bring a faster check-in process, but also more security.

Applications that feature document-less check-in, keyless entry, in-room controls as well as direct messaging or chatbot functions allow hotels to optimise space in the lobby by reducing the need for physical check-in areas as well as reduce headcount.

Installation Costs and Cyber-security

Although hotels in Singapore are embracing technology innovation, the cost of its development and acquisition is relatively expensive.

Independent hotels and regional hotel operators might not have their own technology labs, but the trend towards digitalisation and the goal to embark on the Road to Technology is largely supported by STB with the Business Improvement Fund. This allows hotels in Singapore to have access to innovative tools at a more affordable price. Third-party white label applications also allow independent hoteliers and regional groups without an extensive technology budget to join the road to embracing the IoT.

To limit implementation costs, technology companies are looking into ways to add a TV box or a Bluetooth-enabled IoT sensor to the guestrooms, from which all required features could be regulated. This eliminates the need to re-wire all the rooms, which is an advantage especially for recently opened or renovated hotels.

Despite the anticipation towards technological innovation in the hotel space, cyber-security and the protection of guests’ data are the main concerns for both hotel owners and operators. Despite the fact that sharing information is already commonplace, operating systems containing passport copies and credit card details will need additional security features.

Are Food & Beverage (F&B) outlets next in line for the technology revolution?

As the majority of hotel revenue is derived from room sales, technology innovation in hotels is currently concentrated on the arrival experience and guest rooms. Going forward, we expect the tech-optimisation of the Food & Beverage (F&B) outlets to be next in line. Kicked-off by Millennium Hotels & Resorts’ inauguration of the world’s first egg-cooking robot, we would expect tray-returning robots and smart technology apps to be adopted by hotels’ F&B facilities soon.

Co-working of technology and staff

The co-operation between technology and staff is expected to boost productivity in hotels. Industry experts see an opportunity to “outsource” repetitive tasks to robots and AI, while staff can focus on guests’ interaction to create a special experience.

In the Rooms Division and F&B department, possible staff reduction is expected in the following areas:

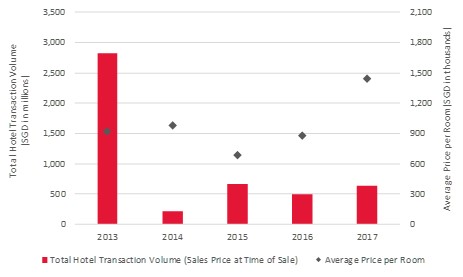

Hotel Transactions & Investment

Domestic investor appetite for Singapore hotel assets is back

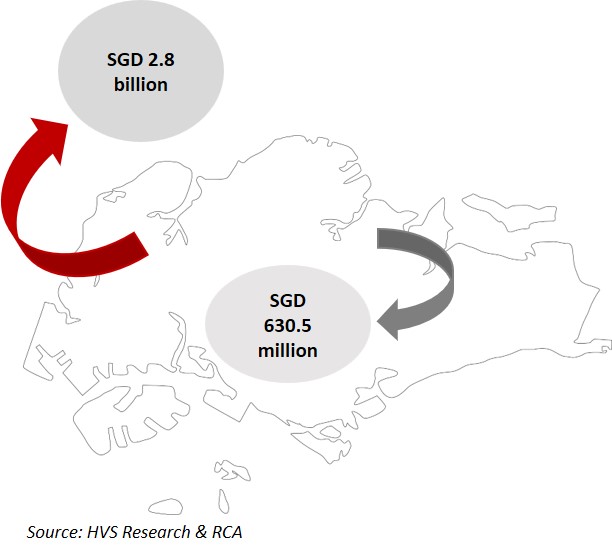

After a slower 2016, approximately SGD631 million in hotel property sales were recorded in 2017. While the total volume of transactions recorded in 2017 is lower than the record amount of 2013 (SGD2.8 billion), Singapore is a seller’s market with limited supply and high demand within the region leading to a significant increase in the average price per room.

The most noteworthy transaction in 2017 was the Ascott Orchard Singapore at SGD1.8 million per key in October, finalised more than three years after the initial announcement.

The sale of the historic 32-room Sloane Court Hotel at SGD2.5 million per key was excluded from our analysis, as the property was sold with plans for redevelopment into a 12-storey condominium.

FIGURE 7: SINGAPORE HOTEL TRANSACTIONS (2013-2017)

Singapore’s outbound hotel investments surges

In 2017, Singapore’s hotel market was dominated by local investors, accounting for all of the transaction volume recorded last year. Moreover, Singapore investors’ interest for hotel real estate went across borders, with acquisitions of SGD2.8 billion outside the country, an increase of 50% from 2016. Hotels, as an individual asset class among retail, residential, industrial and logistics, represented about 7% of total outbound real estate investment in 2017.

Approximately 40% of total outbound hotel investments (or SGD1.1 billion) were made in Europe. Asia was the second most important market with 35% (or SGD996 million), with Japan receiving the most significant sum at roughly SGD676 million. North America and Australasia accounted for 14% and 11% of total outbound hotel investments, respectively.

Outlook

Having achieved unprecedented historical highs in both tourism arrivals and tourism receipts in 2017, it is expected that the solid performance in the tourism sector will continue in 2018.

In parallel to the expected resilient growth of the economy in 2018, STB has forecasted an approximate 1 to 4% and 1 to 3% y-o-y growth in international visitor arrivals and tourism receipts, respectively, for the coming year.

With a healthy growth target set for Singapore’s hotel and travel market, STB will continue to further scale up their marketing initiatives and capabilities with more partners as part of its Phase 2 of the 2016 – 2020 Travel Marketing Strategy in 2018.

In the hospitality sphere, close to 2,500 hotel rooms were introduced into Singapore’s hotel supply in the second half of 2017. Going forward, HVS Research notes that there will be limited hotel openings in 2018.

As the market takes time to absorb the new inventory, we expect occupancy levels to remain stable in 2018. Average room rates, however, with competitive pricing to attract guests, is likely to experience a fourth consecutive year of pressure.

While the short-term perspective remains unfavourable, it’s important to keep perspective on the medium-term outlook. As strong increases in tourism arrivals continue while only limited hotels enter the market, we expect Singapore’s hotel market to elevate in the medium-term with both occupancy and rates likely to experience positive growth.

As STB continues to support technology and digitalisation in the hospitality industry, hotels in Singapore will transform into “smart” hotels, with AI applications, IoT in the guestrooms, robots, and other technological innovations enhancing the hotel rooms and the arrival experience. Going forward, such trends are expected to spread to other hotel departments, such as F&B outlets and back-of-house.

Investors’ appetite for hospitality assets have recovered in 2017. With a thriving tourism market, coupled with the strong SGD, high quality of hotel assets, and security of the Singapore economy, the trend is expected to continue in 2018.