By Rod Clough

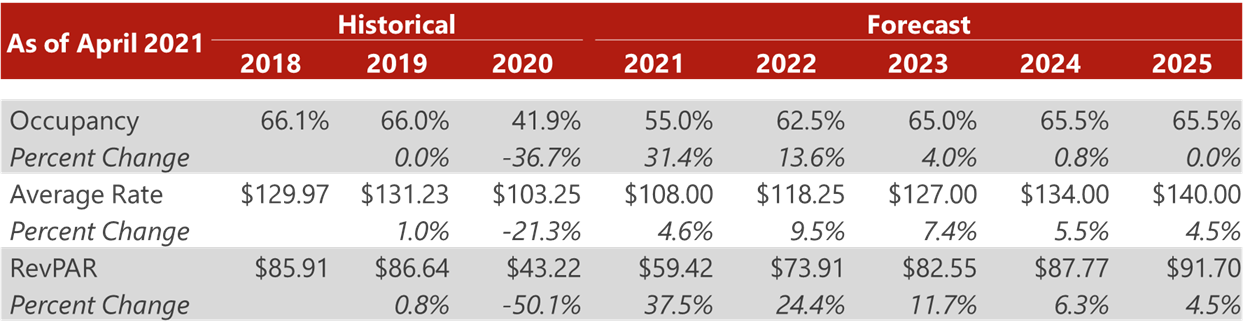

As to be expected, the prevalent theme was that leisure demand continues to drive the initial recovery, with corporate transient and meeting/group demand lagging, but one must wonder if meeting/group demand will bounce back quicker than anticipated given the rather last-minute popularity of this event. Multiple panels reported that small and mid-sized corporate group bookings are picking up, which will be a critical piece of the recovery story in the second half of 2021. Also highlighted was that travel would return to normal more quickly if/when companies quicken their return to the office and once normal in-classroom education resumes. Only time will tell, but if this conference was any indicator, meeting/group business will likely play a more important role in the early recovery of the industry than we might have expected. Forecasts presented by major firms aligned closely to HVS’s current projected trajectory, as illustrated below.

HVS U.S. Forecast Key Performance Indicators

Source: HVS

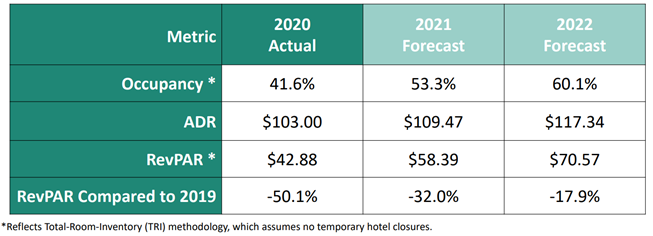

STR U.S. Forecast Key Performance Indicators

Source: STR 2021 © CoStar Realty Information, Inc. from Hunter Hotel Investment Conference

Both the shortage and rising cost of labor were top concerns that were highlighted by several panels and interviewees. These factors will inevitably influence the re-introduction of services, the elimination of services, and increased automation. These challenges are so real that some hotels have modified their reopenings by not opening full inventories and phasing in additional rooms based on management’s ability to rebuild the hotel’s operating team. In many instances, managers are working in line-level roles to “gap fill” where positions remain unfilled, while housekeeping is having to use weekday shifts to catch up from busy weekend nights; however, these realities cannot sustain a recovery. New ideas are starting to emerge, such as paying team members at the end of their shifts, working with new staffing services, and joining forces with local politicians to find solutions.

Mobile technology will remain a priority and, through automation, may reduce the need for some roles, which could lead to enhanced revenues with programmed methodologies for upselling to guests. Mobile technology can also improve communication between hotel staff and guests through texting platforms. We will need to keep a watchful eye on automation, as people and our face-to-face interactions with hotel staff are important drivers of hospitality. Ultimately, owners and management teams will need to drive real ADR increases, innovate to find new revenue sources, negotiate hard to reduce third-party booking fees, and embrace a new reality where associates are paid higher wages.

On the transactions side, the industry has realized a notable shift in interest and activity since the beginning of the second quarter. There are certainly still more buyers than sellers, but favorable assets that are coming to market (those in leisure destinations or that are less dependent on larger-scale group bookings) are receiving multiple offers. Valuations are improving quickly, as the impacts of the pandemic have started to shift into the rearview mirror now that the path to recovery is clearer. While most buyers are still seeking a discount from 2019 pricing to account for the 2021–2023 recovery still ahead, some assets are so highly sought after that they will go under contract with almost no discount at all. Lending is returning as well, with local and regional banks diving back into the market, particularly on deals in markets they understand and with borrowers with whom they have a strong relationship. Banks are still pricing some premiums due to risk in the sector, but interest rates remain favorable even after the added premium. Furthermore, CMBS is back with favorable interest rates, but with higher debt yields that ultimately limit a transaction’s available loan size. We are likely to see a notable upward trajectory to closed hotel transactions in the second half of 2021 and into 2022 as a result.

More than anything else, attendees were simply happy to be traveling again and to be around others, sharing ideas, deals, and predictions for the industry going forward. Smiles and optimism were everywhere to be seen—it was an exciting event. I am looking forward to ALIS in July, and if you have not secured your spot and lodging for that conference, I would suggest you do so quickly.