By James Fitzgerald

The Uptrend Is Ending, Now What?

Most people don’t see all the obstacles a hotel owner faces once their hotel revenues start declining; such as if the next travel recession strikes or new hotel competitors enter the market, cash flows fall, and tensions rise.

This is particularly true for overleveraged hotels or those with balloon maturities. So, as this incredible hotel 11 year up-cycle begins to slow, the wise Owner will not solely rely on their management company but will consider all alternatives well in advance of a problem.

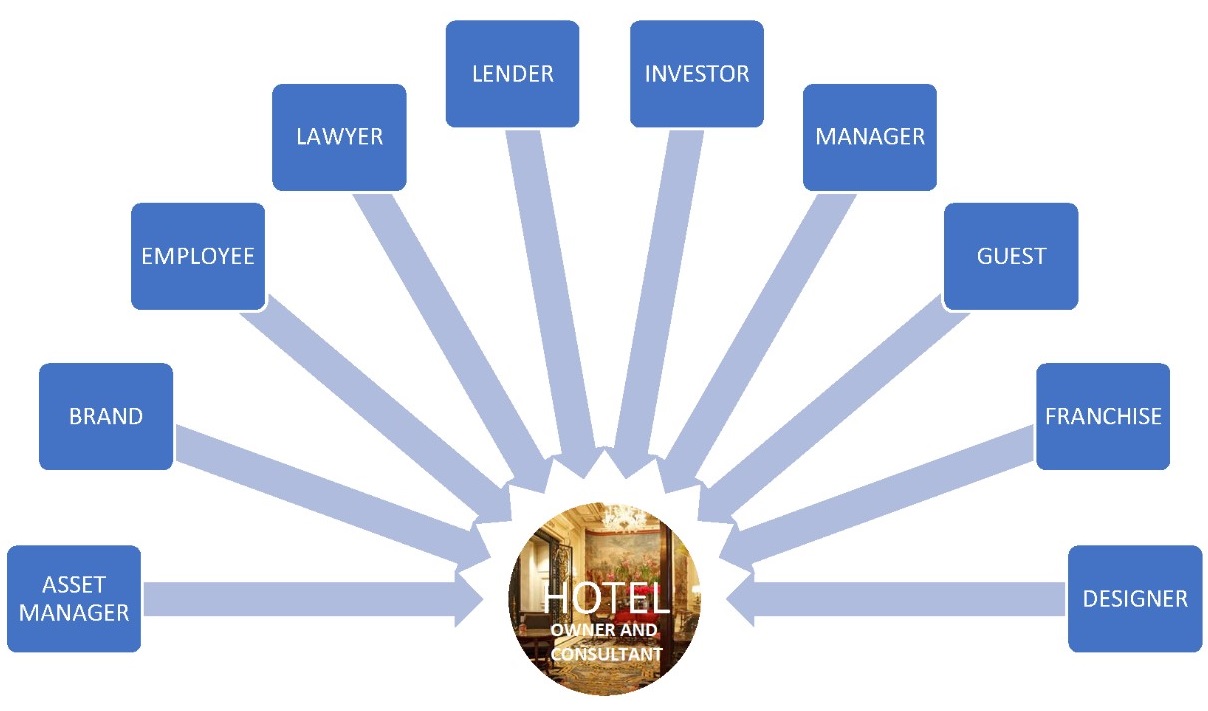

Hotels really are a different animal, some may say, a bird, as the “Peacock” diagram above illustrates.

It’s easy to see just how many facets/constituents the owner has to communicate and interact with, and this is especially true with the lender. Knowing that cash flows will be insufficient relative to hotel debt service or to pay off the loan at maturity is the first step.

The owner must find an alignment between the brand, the lender, and the manager. Let’s dive into some scenarios.

Understanding Conflicting Interests Between Different Parties

Owner vs. Brand

Let’s say your property is struggling to meet debt service. Allowing the Brand to implement a large Property Improvement Plan or “PIP” would be considered conflicting interests, and no one ends up satisfied.

Keep in mind:

One must objectively analyze those PIP items that provide a return on investment and negotiate with the Brand to lessen or delay the scope of capital expenditures.

Owner vs. Lender

What would happen if you lost your hotel to foreclosure? Ownership would go to the lender, and I’m sure that’s the last thing you would want to experience.

The solution:

As the owner, start by seeking advice early in the process to make recommendations on how to improve cash flow and to communicate a plan of action to the Lender which may involve modifying the terms of the hotel loan.

Owner vs. Manager

Yet another conflict that could easily occur would be between the Manager and the Owner. We have all read about luxury hotels that refused to adjust staffing or food and beverage offerings, despite dwindling cash flows.

The solution:

The owner and manager should collaboratively strive to reach an agreement on how to adjust certain operations to avoid financial deficits, without significantly affecting the guest experience.

How to Increase Hotel Profits in the Short run

Still waiting on an increased cash flow? Sit tight, it could take up to 2 years to see improvements even when interactions with the different constituents have been improved.

Solutions in the meantime:

It is imperative that the owner objectively considers the likelihood of future cash flows, from everything between bankruptcy to success:

- The Franchisor may have to lower its royalty fee, while the Management Company lowers its base fee.

- The Lender may amend the loan terms perhaps going interest-only or accruing interest payments.

- Bring in a new equity partner with fresh capital in return for a long- term share of the ownership. This would give the Lender confidence that there is “skin in the game” and the Owner will not be “handing over the keys”

Each situation is different and requires objectivity, wisdom, and negotiating skills.

An objective approach to analyze the market, assess the hotel’s competitive position and recommend the optimal capital structure, among other services. A collaborative solution usually can always be reached.

But this process must begin early on, before debt service payments are missed. Lender despise surprises. So, take action before debt service payments are missed.