Hotel Franchising in Europe is an update of our previous report published in 2014. The report aims to assist owners in increasing their understanding and awareness of the franchise business model and current market trends. The fees outlined in this report apply solely to hotels operating in Europe.

By Stephen Collins, Sophie Perret

Introduction

The slew of acquisitions and mergers in the hotel industry over the past few years has rapidly changed the landscape. The ‘big’ brands are larger than ever and must continue to drive growth, lest they fall behind their peers. Their coverage, loyalty programmes and distribution channels are accordingly stronger than ever as well, but so is their bargaining power. Technology continues to evolve. The OTA versus direct channel debate rages on. Third-party operators have continued to grow and prove themselves as viable options. These are but a few of the factors that make a hotel owner’s choice of operating model essential for unlocking a property’s full potential and maximising their return. In order to help with this decision, this report will focus primarily on franchising and provide greater clarity on what terms can be expected.

Although franchising continues to be less prevalent in Europe compared to the USA, there is both anecdotal and quantitative evidence that it is gaining in popularity, both as a preferred means of expansion by the brands as well as an attractive model that allows owners to maintain greater degrees of control. Franchising is also important for brands entering new markets, as it allows them to increase their footprint rapidly and rely on the owner or a local operator to manage the hotel, who often already have a strong network of connections with their business community, local travel agents and tour companies, and so forth.

Hotel brands are arguably more important than ever, as they have a reach that independent hoteliers cannot match. For example, large operators have the resources to keep up with rapidly moving technology, whereas this might be more challenging for smaller independent hotels. Operators also have the depth of knowledge and the ability to send their ‘specialists’ (be they in marketing, IT, operations, finance or other areas) across the regions to assist their properties as needed.

When considering franchising, brand affiliation is important. The importance of selecting the appropriate brand for a hotel resides in the impact it will have on the positioning of the hotel within the market, its capacity to maximise occupancy and achieve room rate premiums, and the potential benefits of the chain’s distribution channels and know-how. All of these factors will ultimately be reflected in the bottom line, and therefore both owners and lenders will be interested in properly understanding and considering the overall benefits that a brand will bring to the hotel when assessing if the additional franchise cost is worth it.

Franchising in Europe

Franchising in Europe is not as transparent as it is in the USA, where because the Federal Trade Commission regulates the sale of franchises, information regarding each franchise fee structure is readily available. While discounts on the standard fees are often still offered, at least in the opening years, all parties know what the starting point is when they come to the table to negotiate. This report is focused on Europe and therefore limited to the information franchisors and franchisees we interviewed were willing to share and what was publicly available in their annual reports.

Because Europe is a collection of independent countries, as opposed to the USA, hotel operators must understand and adhere to the different regulatory requirements and disclosure obligations across the continent, which has resulted in a slower uptake of franchise agreements in the region. Some countries such as Belgium, France and Italy have specific franchise laws that clearly dictate what is required for contract summaries and commercial disclosure, while in others there are no specific obligations outside of the civil codes and what is considered good practice.

However, it is fair to say that there is an increasing recognition of the strength of a hotel brand and brand affiliation, and this is expanding. Despite this, challenges remain. For example, brands instantly recognisable and successful in one European country may have a more difficult time gaining recognition in other European markets. This is part of the reason for many of the mergers and acquisitions in recent years; if a big international chain is able to acquire a local brand, they instantaneously gain significant coverage in that country and, as it is now under the umbrella of a larger chain with greater brand awareness, can more easily roll it out in other markets. For example, IHG has done this with the USA’s Kimpton, and Marriott recently launched the first European Delta Hotel, the Canadian chain it acquired in 2015. Most recently and on a larger scale, the acquisition of NH Hotels by Thailand’s Minor International provides an excellent example of how two chains with excellent regional coverage in separate parts of the world can combine to become a truly global hotel company virtually overnight.

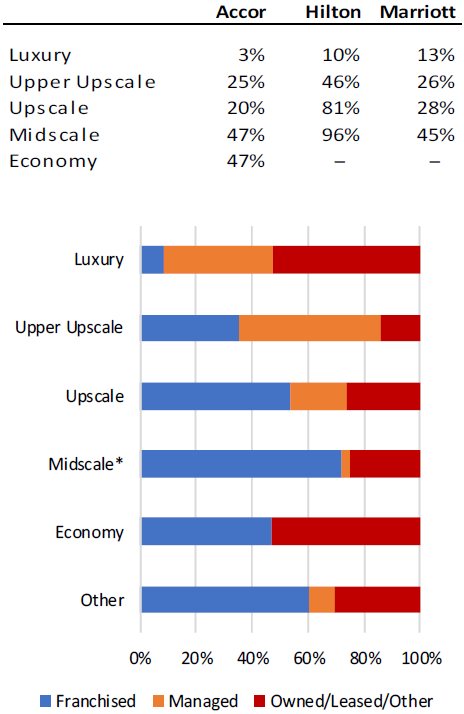

TABLE 1: PROPORTION OF FRANCHISED PROPERTIES IN EACH MARKET SEGMENT (2018)

While hotels in Europe are still largely unbranded, there is clear evidence that this is changing. Brand affiliation in Europe is currently estimated at over 40%, when a decade ago it was closer to a third. Despite this growth in affiliation, independent properties are still the majority. Where franchising is concerned, this issue currently presents more opportunities than threats. In the USA, an estimated 70% of hotels are branded, which remains unchanged from five years ago. This clearly means that the opportunities for brand growth in Europe, including franchises, are significant.

Whilst hotel chains are still reluctant to relinquish the control offered by management contracts for their more luxury brands, particularly in flagship locations, franchising is becoming a strong, often preferred means of expansion for midmarket properties. This is clearly illustrated in Table 1 which looks at a few of the big brands as an example where the operating model of each brand was disclosed in company SEC filings.

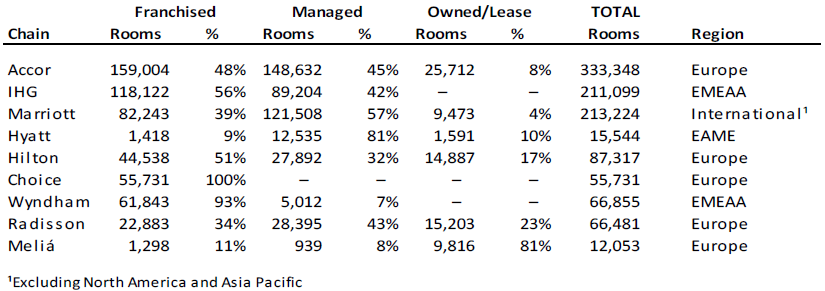

TABLE 2: FRANCHISED PROPERTIES IN EUROPE AS OF 31 DECEMBER 2017

Source: Annual Reports 2018, Brand Development Representatives

Franchisors in Europe

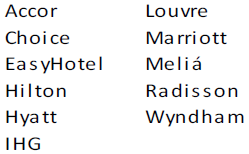

Our research included surveying a sample of hotel companies in Europe and reviewing annual reports and SEC filings for publicly traded chains operating in Europe. The sample spans the full spectrum from large international players to smaller European operators. Brands included in the sample range from limited-service to luxury full-service hotels. All companies sampled currently franchise some or all of their brands in Europe or are planning to do so in the near future. Table 3 provides a list of the companies either surveyed or researched via their annual reports and other publicly available information. Table 2 shows the breakdown by operating model for a number of major hotel chains.

TABLE 3: CHAINS INCLUDED IN RESEARCH

Source: HVS Research

Focusing on the biggest four chains in Europe, franchising clearly represents a significant portion of their European portfolios, with the franchised rooms accounting for approximately a third of Marriott’s portfolio (although for disclosure complications they report Europe, MEA and South America as an aggregate, meaning the portion of franchised rooms specifically in Europe may differ), approximately half of Accor’s and Hilton’s European portfolio, and the majority of IHG’s European portfolio.

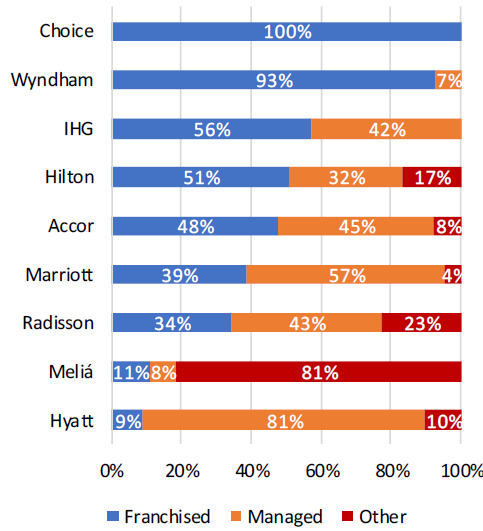

To highlight the increasing importance of this operating model, since the time of our 2014 report the portion of franchised properties has increased from 37% to 48% for Accor and a substantial increase from 32% to 51% for Hilton. Even companies such as Hyatt, which historically had no franchise presence in Europe, now have several franchised properties in Europe and will be relying on this model for the expansion of their limited service and extended stay brands. The following table provides an overview of the proportion of franchised hotels in Europe by chain.

TABLE 4: PROPORTION OF FRANCHISED HOTELS IN HOTEL CHAINS

Source: Annual Reports 2018, Brand Representatives

Basic Conditions

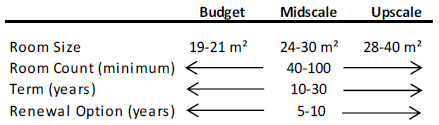

Table 5 sets out the general conditions required for building purposes and the terms for franchise agreements in Europe, by segment.

TABLE 5: BASIC CONDITIONS AND TERM

Source: HVS Research

While there is no set formula which defines what franchisors look for in a project. Typically, whether a property is an existing or new-build hotel is not an issue as long as the brand is a good fit for the type of product and the positioning of the hotel. Conversions are just as capable of achieving a profitable return as new builds. As with franchise fees, room count, term and renewal options are all open to negotiation. More desirable locations in strongly performing or strategic markets are likely to be offered more favourable terms, while the chains are likely to take into account what is considered the norm in the market when determining how strictly to adhere to required room sizes and other brand standards.

Lower-end hotel categories tend to offer more flexible terms while more upscale properties see larger minimum room counts and sizes and lengthier terms. A term of 20 years seems to be the sweet spot that most companies prefer, although many offer terms of 10 to 15 years, sometimes even less.

Franchise Fees

Perhaps the most important part of evaluating the potential of a hotel franchise is the structure and amount of the franchise fees.

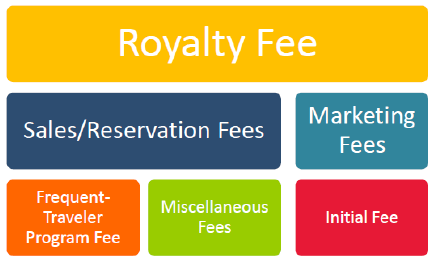

A one-size-fits-all approach to franchising does not work in Europe, owing to reasons discussed previously. Our findings are based on an average of ‘typical’ fee structures, which generally include the following:

Initial Fees

The initial fee typically takes the form of an amount based on the hotel’s room count. Research shows a wide range in initial fees, with average minimum fees of about €400 a room (the lowest fee at €150) and the average maximum of about €1,000 a room. Therefore, for a hypothetical 150-room hotel, this initial amount could range from as low as €22,500 up to €150,000, whereas for a smaller 75-room hotel this amount would range between €11,250 and €75,000. In addition, some agreements call for a fixed or minimum initial fee to be paid as a lump sum upon submission of the franchise application; this is often the case for hotels with a lower room count.

The initial fee is typically paid (either partly or in full) upon submission of the franchise application and covers the franchisor’s cost of processing the application, reviewing the site, assessing market potential, evaluating the plans or existing layout, inspecting the property during construction, and providing services during the preopening or conversion phases. In the case of reflagging an existing property, the fee is often reduced and occasionally waived, as preopening advice and inspections are no longer required. Depending on the agreement, some franchisors will return the initial fee if the application is not approved, whereas others will keep a share in order to cover their administrative costs. If the fee was only partly paid on application, it is typically retained by the franchisor.

With that said, existing hotels will still be required to comply with brand standards of the new franchise, which may require the purchase of soft goods, signage and even minor to possibly major refurbishment.

Continuing Fees

Payment of continuing franchise fees starts when the hotel assumes the franchise affiliation, and fees are usually paid monthly over the term of the agreement.

This article considers the following continuing fees:

- Royalty Fee;

- Advertising or Marketing Contribution Fee;

- Reservation Fee;

- Frequent Traveller Programme Fee/Loyalty Fee;

- Miscellaneous Fees;

- Other – ‘All-In Fee’.

Royalty Fee

Almost all franchisors collect a royalty fee which represents compensation for the use of the brand’s trade name, services marks and associated logos, goodwill, and other franchise services. Royalty fees represent a major source of revenue for the franchisor. These fees are characteristically subject to negotiations between both parties, and can vary by brand, but typically range from 3.0% to 5.0% of rooms revenues. In some instances, franchisors require an additional percentage of other revenue streams, most commonly food and beverage revenue. In these cases, the average amount is 1.0% to 2.0% of total food and beverage revenue (or sometimes all non-rooms revenue), and this is payable on top of the room revenue in certain agreements. If included in the contract at all, F&B and non-rooms revenue fees are more often found in upscale and luxury brands than midscale and budget.

Advertising or Marketing Contribution Fee

Brand-wide advertising and marketing consists of national or regional advertising in various types of media, including the Internet, the development and distribution of a brand directory, and marketing geared toward specific groups and segments. In many instances, the advertising or marketing contribution fee goes into a fund that is administered by the franchisor on behalf of all members of the brand. Franchisees ideally want their contribution to impact their region, which may not always be the case. From our discussions with various operators, these fees normally range from 2.0-4.0% of rooms revenue or 1.0-2.0% of total revenue. These fees typically vary by market and in some instances are paired with the reservation fee.

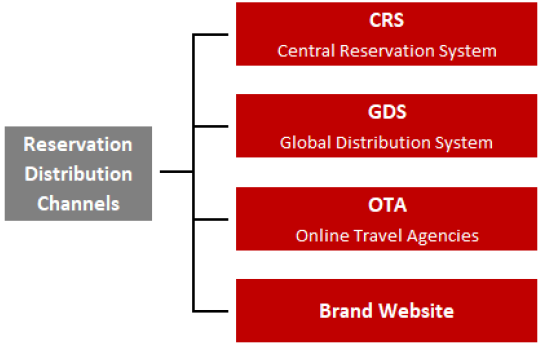

Reservation Fee

The fee and basis of calculation often depends on the source of booking for each reservation. The main sources are:

If the franchise brand has a reservation system, the reservation fee supports the cost of operating the central office, telephones, computers and reservations personnel. The reservation fee contains all distribution-related fees, including fees payable to third parties, such as travel agents and distributors. The calculation of this fee is the one that varies the most across our survey from one operator to another. The reservation fee can be based on a percentage of room revenue – a wide range of 1.0-5.0%, and even higher if based solely on the reservations generated by the brand’s distribution channels. It can also be calculated as an amount per available room per month (ranging from €4.00-€10.00) or a combination of both approaches.

There does seem to be a movement towards the inclusion of the reservations fee in the advertising or marketing contribution fee or bundled into larger programme fees amongst some of the larger brands.

Frequent Traveller Programme Fee/Loyalty Fee

Franchisors often offer incentive programmes that reward guests for frequent stays; these programmes are designed to encourage loyalty to a brand. Many franchisors now require franchisees to bear their fair share of the costs associated with operating a frequent traveller programme. The cost of managing such programmes is financed by frequent traveller assessments. Frequent traveller programme assessments are typically based on a percentage (typically between 1.0% and 5.0%) of either rooms or total revenue generated by a programme member staying at a hotel. In some instances a euro amount fee (say, €8.00) is payable to the franchisor based on the number of loyalty programme points awarded.

Miscellaneous Fees

Miscellaneous fees include fees payable to the franchisor or third-party suppliers for additional system and technical support and fees relating to training programmes and annual conferences. Sometimes franchisors offer additional services to franchisees including but not limited to consulting, purchasing assistance, computer equipment, equipment hire, on-site preopening assistance and marketing campaigns. The fees for these services are not generally quantified in the disclosure document. Our survey considers only mandatory and quantified costs.

Other – ‘All-In Fee’

Generally, these various fees are applied individually, but in some cases franchisors combine a number of formulas which amount to an overall fee. These come in the form of an annual fee of a total euro amount which covers everything, or an overall percentage of total revenue.

Independent Management Companies

With the increasing presence of branded hotels across the world and many major chains focusing on franchising as the choice method of expansion, owners and brand companies are left with the challenge of ensuring their mutual interests are in capable hands. While many franchisees are owner-operators and have the management expertise to be successful, there remains a gap between owners that are unable or unwilling to control the daily operations of the hotel and the franchisors that provide the brand. This is where third-party operators (TPOs) have come into prominence.

Independent operators are an obvious choice for unbranded, independent properties, but can also be an excellent and valuable inclusion in franchised hotels. Owners may at first be hesitant to engage one, as it may seem like poor business sense to share the revenue and profit pie amongst three parties when it could be split between just two. When considering that the cost of operating under the brand is additional to these fees in the case of the independent operator, the nominal cost of the third-party operator may indeed be higher. That said, the fees charged often see a lower base fee in favour of a higher incentive fee. The brand gets its fees for bringing in the revenue, while the operator can focus on effective and efficient cost control and operation of the property.

Clearly, implementing a franchise agreement and a management agreement with an independent management company moves the hotel into the double fee scenario; however, we note that independent management fees are typically more competitive than those of the brands. There are several other benefits including the following.

- Owing to their close relationships with franchisors, independent management companies are often able to help owners negotiate more competitive franchise fees;

- Cash flows are typically run at a tighter level with marketing costs (which are covered by the franchise agreement) usually lower;

- The term of the management agreement is characteristically much shorter (starting at a minimum lock-in of five to ten years) and exit options are typically more flexible.

The franchisor can also benefit from this scenario. In certain markets or for brands they prefer to franchise, it is preferable (and sometimes required) that they know and trust the operator, particularly for higher-end brands in their portfolios.

In conclusion, independent management companies open the door for expansion for both the franchisor and the owner.

Trends

In order to be competitive and demonstrate an alignment of interests with the owner, some brands are being creative in their fee structures. Some only charge fees based on room revenues. Soft brands, which arguably are less identifiable to the typical guest as being associated with the larger chain, can go even further and may charge lower fees or use a different basis for calculating them. For example, a franchise agreement could have the royalty fee charged only on room revenue from bookings that have come through direct channels (albeit at a higher percentage than typical royalty fees), similar to the treatment of reservation fees. As soft brands are often suitable for existing hotels that already have a strong name or history behind them, this provides some comfort to the owner that the agreement is fair and that they are not paying franchise fees on bookings they may have received regardless of brand. Another increasingly popular model elsewhere in the world that some say may gain more traction in Europe is ‘manchising‘, a hybrid agreement whereby hotel owners engage a hotel operating company for an initial period, say three to five years, after which the contract transfers to a franchise contract.

Overall, the trend of growing interest in franchising is growing. Owners in regions where franchising has been prevalent for some time have gained considerable experience in the middle and a better understanding of what terms they can and cannot negotiate.

Conclusion

As discussed, a one-size-fits-all approach to franchise agreements is not possible in Europe owing to the independent nature of countries in the region. Different countries impose different regulations and disclosure obligations, and hotel chains must be adept at understanding these as well as the expectations of local owners in order to remain competitive.

Clearly, franchise agreements have become more established in most markets across Europe and are increasing in popularity and acceptance. The consolidation and acquisition of hotel chains has led to a sharp rise in the proportion of franchised properties in the portfolio of the top chains, and as they are now larger than ever, they will need to continue to rely on franchises to achieve the desired growth and remain ahead of their competition.

On the other side of the negotiating table, owners have more brands than ever to choose from. Although this increases the likelihood of finding a brand and chain that is a good fit for any one property, it also means that owners must truly do their research and understand the cost and commitment of their choices.

Taking on a franchise is a complicated investment. Selecting the appropriate franchise for the property entails exhaustive research and investigation. The information presented in this report provides some general insight into franchise fee structures that should only be relied upon as a preliminary resource.