By John Burke

With almost 1,500 18-hole equivalent golf course closures over the last 10 years and six million fewer golfers according to the National Golf Foundation (NGF), is it realistic to consider that the highest and best use of a Texas golf range that only managed $310,000 in gross revenue and 25,000 annual customer visits is still a driving range – albeit not your grandfather’s driving range?

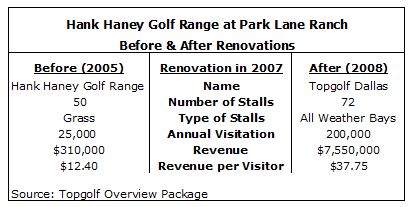

Topgolf developers thought so, and in 2007 transformed the 50-stall Hank Haney Golf Range at Park Lane Ranch in Dallas into Topgolf Dallas, a 72-bay golf entertainment complex that bridges the gap between the traditional driving range and a favorite neighborhood hangout.

In three years, the renovations and expansion increased visitation by a factor of eight, revenue by a factor of 24, and tripled the revenue per visitor. While more analysis would be needed to determine whether a next-generation driving range is truly the highest and best use, it passes the test of financial feasibility with flying colors.

What is a Golf Entertainment Complex?

The concept for a golf entertainment complex was created in England by two brothers who wanted to improve their golf game. They designed and patented technology that allowed microchips to be implanted into the golf ball for sensors to track and provide real-time feedback. After deploying the technology, they found an overwhelmingly majority of non-golfers and families started to come and treat it like a game.

They tweaked the concept to address the demand, and Topgolf was born. Players aim for green-sized, dartboard-like targets that are scattered throughout the 240-yard field and are awarded points depending on where the ball lands. Essentially, golf meets darts. Players choose from a variety of games that concentrate on different skills such as distance, accuracy, or the short game. Unlike a traditional driving range where players buy a bucket of balls, driving range bays are rented by the hour at a cost of $20 to $45 depending on the time of day and day of week.

A New Spin on the Golf Experience

According to a 2015 NGF survey, negative perceptions of golf as a stuffy gentlemen’s game have contributed to its decline in popularity among younger generations. However, turning a driving range into a social event has proven to be the right combination. Golf entertainment complexes are being built near business parks or office space to capture corporate demand and in shopping and entertainment districts to attract parties and leisure visitors. The concept has proven especially popular with the Millennial generation, which comprise over 50% of visitors.

The newest Topgolf golf entertainment complexes, Generation II, are typically three stories and feature 102 climate-controlled driving range bays each with a capacity of up to six people. Music, a full-service restaurant, multiple bars, stage, rooftop terrace, 200+ HD televisions, 3,000 square feet of private event space, pool tables, shuffleboard, and other activities create a fun and lively atmosphere. Wait staff take orders and serve food and drinks at the driving range bays.

Topgolf has reported that its 24 locations have a combined annual attendance of over eight million. Nine locations are in development with plans to expand to 50 locations by 2017.

Development Costs

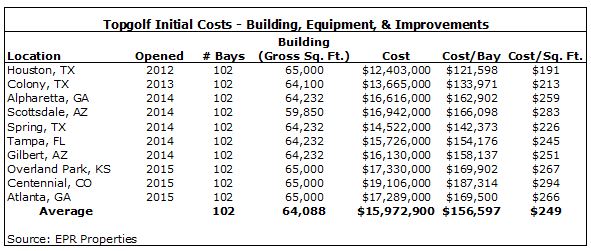

Topgolf’s golf entertainment complexes are approximately 65,000 square feet and require between 12 and 15 acres of land. The first U.S. locations, like the Topgolf Texas, were converted from existing driving ranges and had development costs of $5 million to $7 million. The following table shows EPR Properties’ initial costs, excluding real estate and technological development for 10 Topgolf locations.

Topgolf does not release its financial statements; however, we estimate that golf entertainment complexes are able to generate between $10 million and $25 million in revenue per year with 50% to 60% of revenue generated through food and beverage sales. While Topgolf currently does not plan to expand through franchising, other companies are entering the golf entertainment complex market. Newcastle Investment Corporation and Taylor Made Golf Company announced plans to create Drive Shack, a chain of next-gen golf ranges with locations across the United States and internationally. Origin LLC also has plans to open a golf entertainment complex, Skybox, and is searching for a location.

Looking Toward the Future

In the near-term, the golf entertainment complex is becoming the biggest growth vehicle in the golf industry. As the supply of the 18-hole golf course declines and Baby Boomers age, we foresee the number of golf entertainment complexes increasing as companies add to the experience with amenities such as swimming pools or concert venues.

The golf entertainment complex phenomenon comes at an interesting time for the golf industry as participation continues to decline each year. While golf entertainment complexes are introducing the sport to a new audience, it remains to be seen if those newcomers will try traditional links and grow the sport over the long-term.

Hotels may also benefit from growth in the golf entertainment complex market as hoteliers look to package rooms with interesting local amenities. By partnering with golf entertainment complexes, hotels, especially those with limited meeting space, have an opportunity to attract additional demand from groups seeking less traditional venues for their events.