Florida's prime office and industrial markets reported minimal impact from Hurricane Irma—mainly temporary power outages, downed trees and minor leakage.

Except for the Florida Keys and certain parts of Jacksonville, flood and wind damage to Florida retail properties was also minimal. Certain retail segments, such as building supplies, food and fuel, should see a significant uptick in sales in the coming months.

Single-family residential properties bore the brunt of Hurricane Irma's destruction, particularly in the south, central and northeast regions of the state. As a result, demand for multifamily properties is expected to increase in the short term.

Hotel properties in the state's major markets have reopened for business, except for many in the Florida Keys. Demand may increase by an average 15% for the next four months as displaced residents, aid workers and construction workers seek accommodations. Longer term, the stigma of the hurricane could affect the state's tourism industry.

Overview and economic impact

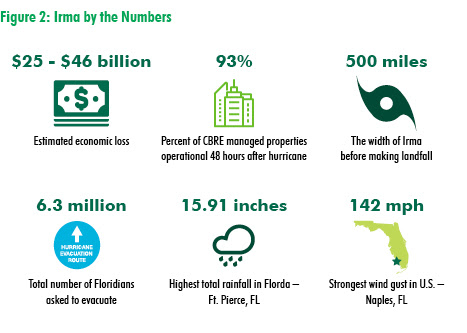

Hurricane Irma made its initial U.S. landfall in the Florida Keys on Sept. 10 as a Category 3 storm, and later that day made a second landfall at Marco Island on Florida's west coast before barreling north through the state. Cities on both coasts experienced flood surges and extremely strong winds.

Both short- and long-term preparation significantly minimized Irma's impact on commercial properties. Evacuation plans, emergency fuel and power supply arrangements, as well as contingency plans, were critical short-term preparedness factors. Long-term preparation consisting of enhanced building codes and infrastructure readiness was critical to the state's ability to both withstand damage and assess how quickly infrastructure and power losses could be restored.

For commercial properties, building-level preparation was key in minimizing damage. Approximately one-third of the 240 office buildings managed by CBRE's Asset Services division were impacted by Irma. Of those affected, the majority experienced only power loss. A smaller portion (less than 5%) sustained water and wind damage.

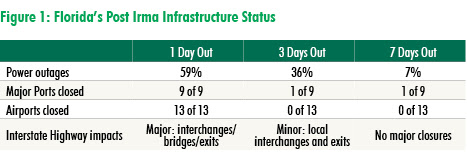

Less than one week after the storm, almost 100% of Florida's mainland power grid and infrastructure (major ports, airports, roads and commercial districts) were operational. The relatively quick recovery minimized business losses.

Despite the hurricane's strength, initial damage assessments suggest that quick and decisive state and local government action, an emphasis on preparedness and upgraded construction standards minimized the potential long-term economic impact on Florida.

Florida's legislature estimates initial damage at between $25 billion and $45 billion. Tourism and agriculture, both strong drivers of the state's economy, were impacted by the storm. The impact on agriculture likely will be more severe due to destruction of crops. Florida's thriving tourist industry likely will see a much shorter-term lull. Overall, Florida's economy will remain largely unaffected by Hurricane Irma over the long-term, as there was minimal commercial property damage and no long-term loss of power.

Prior to Irma, Florida recorded year-over-year job growth of 2.6%—almost double the national average—and had an unemployment rate of 4%. This strong economic environment going into the storm will likely lessen disruptions within the labor market.

Florida's building code may have been the X factor

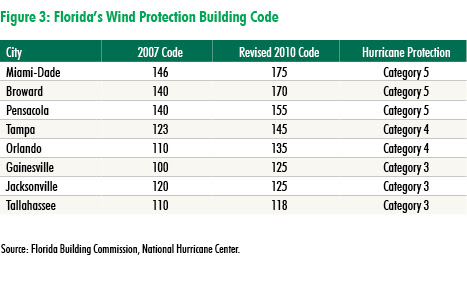

Florida's preparation for a major hurricane has been more than 20 years in the making. Since Hurricane Andrew in 1992, the state has worked diligently to upgrade its building codes in order to protect real estate assets from hurricanes. The state now has the strongest building codes in the U.S. that are a benchmark for hurricane protection nationally. Construction standards have been enacted to withstand wind speeds of up to 175 miles per hour or a Category 5 hurricane.

In addition to wind speed standards, South Florida has invested heavily in pump systems and building standards that enable easy and efficient flood drainage. Irma hit parts of South Florida, including Miami's Brickell CBD, during a high tide that exacerbated the storm surge. Nonetheless, by the end of the first day of the storm, Brickell had no standing water. Upgraded building standards ensured complete drainage by the next day, and businesses reopenedwithin three days after the storm.

Minimal office damage reported

Florida office buildings withstood Hurricane Irma relatively well. From wind-resistant glass, to sump and discharge pumps, to strategic placement of vital building systems, the office sector was well-prepared. According to many of the state's top office landlords, major Florida markets largely experienced minimal building damage: fallen trees, landscaping issues and minor leakage through window seals and roofing from heavy rains and wind. CBRE Research findings indicate that most damage was minor, with repair costs likely to be less than the insurance deductible for many properties. Additionally, CBRE Asset Services reported that 95% of its 240 managed office buildings in Florida were back in service after power restoration and repair of minor damagewithin 48 hours after the storm. The remaining 5% were operational within 72 hours.

According to CoreLogic's 2017 Storm Surge Report, of the top 10 metropolitan areas most at risk for storm surge, six are in the state of Florida. Office inventory in these Core Based Statistical Areas (CBSA's) accounts for approximately 43% of the total office inventory in the state. Despite this risk, and the temporary storm surges that occurred in several of these CBSAs, resiliency strategies employed in these markets proved overwhelmingly effective in the face of a seemingly catastrophic event.

Given that there was no major tenant displacement and only minor business disruption due to extensive power outages, no near-term increases in short-term leases are expected. Tenants who experienced the greatest disruptions were those who had not established the proper fault-tolerant networks and built-in redundancy plans to ensure business continuity in the face of prolonged power outages. On the capital markets front, sales transactions are moving forward following some minor delays due to the impending storm and subsequent assessment of impact.

Industrial supply chain infrastructure back in business

Most of the state's industrial buildings had little to no damage. CBRE 's assessment, as well as surveys conducted by several publicly-traded REITs, found no major storm damage to major industrial portfolios, including those held by Prologis (173 buildings), DCT Industrial (34) and EastGroup Properties (23).

Florida's industrial market had an average vacancy rate of 5% in Q2 2017, which is expected to fall further in the short term due to post-storm demand from disaster relief agencies and building supply companies.

Florida's supply chain was put to the test in the week before and the week after Hurricane Irma. There are no refineries or pipelines providing the state with direct access to petroleum products; rather, the state relies on fuel deliveries from ports. All of Florida's major ports were reopenedwithin two days after the storm, bringing needed fuel to the state.

Retail sales expected to increase for key goods

A dramatic increase in gas and food sales is expected to continue for the next two months of an active hurricane season. Big-box stores should perform well in the short term. Home goods, building supply, discount and sporting goods stores all provide needed supplies to help state residents and businesses withstand large storms. Building-supply companies should see an uptick in sales and a challenge in maintaining inventory, as repairs to residential structures begin.

Property damage to retail buildings across the state was mainly comprised of downed trees, debris, minor leakage and damaged signage. Impacts to retail property are based on CBRE's managed properties as well as assessments by several publicly-traded REITs. Other than power outages, there was no major damage reported by Kimco Realty (63-building retail portfolio), DDR Corp. (60 buildings), Kite Realty Group Trust (35) and Weingarten Realty (31).

While most of the state's retail properties did not incur significant damage, retailers in certain areas of Jacksonville and the Florida Keys were impacted to a greater degree. In the San Marco area of Jacksonville, many local shops and restaurants were flooded, with shutdowns from a few days to ongoing. In the Florida Keys, many businesses remain shuttered or destroyed. Florida Governor Rick Scott is providing additional support to this area, with the ambitious goal of having the Keys open for business by the end of October.

Extensive single-family sector damage will increase multifamily demand

Extensive single-family sector damage will increase multifamily demand Single-family residential properties bore the brunt of Hurricane Irma's destruction. According to the Florida Office of Insurance Regulation, as of September 19, a total of 452,205 Hurricane Irma claims were filed with estimated insured losses of $2.7 billion. Of those claims, 392,967 or 86.9% were for residential property. The highest number of claims have come from south, central and northeast Florida. Much of the media coverage has suggested that a majority of the damage has occurred in low-rise apartment buildings and has run the gamut from minor water intrusion to lost roofs and partial wall collapses.

Increased demand for multifamily product is expected due to the extensive single-family home damage. Prior to the hurricane, Florida's six primary MSAs had year-over-year rent growth, led by Orlando (4.8%), Tampa (1.8%) and Miami/South Florida (1.7%), according to CBRE Research. The short-term increased demand, coupled with any completion delays, should keep rent growth positive across Florida's major markets.

Demand for temporary housing of construction workers will further buoy apartment absorption, especially in the hardest hit areas. Prior to the storm, the state had a shortage of high-skill construction workers, which was increasing labor costs. Florida's Construction Workforce Taskforce reports that prior to the hurricane, many contractors and subcontractors in search of higher margins left the single-family housing market and focused on luxury multifamily projects. The increased demand on the single-family side will put further strain on the construction sector but may encourage additional in-migration to fill these in-demand roles, which in turn will increase multifamily demand.

Hotels likely to get a near-term boost

The hotel industry is exposed not only to the physical risk of property damage, but the economic risk of a decline in tourism due to natural disasters. South Florida's economy is highly dependent on tourism. Areas most heavily affected, like the Florida Keys, face the danger of stigmatization by tourists for some time. In the near term, hotels are uniquely positioned to provide shelter for those displaced by the storm.

The Florida Keys had approximately 10,000 hotel rooms before Hurricane Irma. Since then, the Keys remain closed to tourists, but many hotels hope to reopen in time for the busy fall and winter seasons. Officials hope to fully reopen the Keys for tourism by late October. Most hotels in Naples and Marco Island are closed while operators assess damage and make repairs. Most hotels in Jacksonville, St. Petersburg, Tampa, Ft. Myers, most of Miami, Miami Beach and the Orlando area have reopened and are accepting guests.

Looking at hotel data from four comparable disasters, we find that demand rose by 10% to 40% in the surrounding markets in the month after the event. Demand was still up an average of 15% four months after the event because of displaced residents, FEMA staff, emergency personnel and construction workers needing accommodations. Growth rates by market will vary from Hurricane Irma's aftermath, with Miami likely to see the largest increase in demand. Nearby cities like Orlando, Ft. Lauderdale and Palm Beach may also see demand from displaced residents.

An important long-term risk to the hotel industry following disasters is stigma related to traveling to a disaster-ravaged area. Stigma results in the reduction in lodging demand because of psychological and emotional barriers to travel. Markets may be stigmatized for protracted periods of time. After hurricanes Andrew and Katrina, demand fell below previous levels for extended periods. While some of this effect may be a result of economics and/or reduced lodging capacity, it is also likely that stigma negatively impacted people's choices to travel.