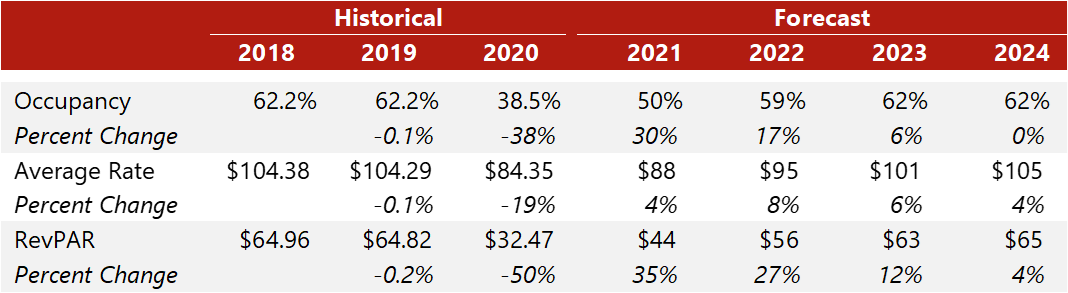

Amid a worldwide pandemic, the lodging industry faced a downturn that was greater than the past two lodging-market declines combined; fortunately, most markets have begun to recover in both occupancy and average daily rate (ADR). Prior to the pandemic, Kansas City had undergone an extended period of strong economic growth, with the urban core amid redevelopment and revitalization. These factors supported the strengthening of the lodging market last decade, which in turn drew attention from hotel developers. Approximately 1,300 hotel rooms across 13 hotels opened in 2018 and 2019, and as the market was absorbing these supply additions, both occupancy and ADR remained stable. However, with the impact of COVID-19, occupancy dropped roughly 24 points, while ADR fell 19% ($104 to $84) in 2020. We have forecast market occupancy to recover to 2019 levels by 2023, with ADR surpassing the previous peak in 2024.

Kansas City 2020–2024 Forecast

Major factors contributing to our forecast are summarized as follows:

Supply and Demand Factors

- On March 21, 2020, Kansas City and Jackson County, Missouri, officials implemented stay-at-home orders, imposed limits on gatherings and business activity, and limited travel to essential activities only. Hotel demand plummeted in late March, causing numerous hotels to suspend operations. Despite the reduced supply, occupancy remained below 30% throughout April and May 2020. ADR levels also declined by over 35% during that period, as higher-rated corporate, meeting, and event demand evaporated. Although stay-at-home orders were lifted on May 15, 2020, restrictions on business activity and group gatherings remained in place until early June 2021. Most of the hotels that initially suspended operations reopened throughout 2020; however, the 720-room Sheraton Crown Center did not reopen until late June 2021. Furthermore, several other smaller properties throughout the region were closed indefinitely in 2020, with their respective owners considering alternative-use or redevelopment opportunities. On the other hand, multiple new hotels were completed and opened in the market in 2020.

- Although hotel occupancy levels improved over the summer of 2020 to around 40%, occupancy levels dropped to the mid-30s in the 2020/21 winter months given the increase in rooms inventory and the return of some business restrictions during these months, compounded by the underlying low seasonal demand. Occupancy levels began to improve in the late winter and early spring of 2021; however, ADR registered at approximately 80% of 2019 levels, with a slow recovery evident. While market demand remains substantially below pre-pandemic levels, a recovery is expected to accelerate now that restrictions have been fully relaxed with the widespread distribution of vaccines. We anticipate 2021 occupancy levels to reach the low-to-mid 60s across the Kansas City market, despite the supply headwinds as the full inventory of rooms come online. Beyond 2021, supply levels should remain in check for a few years, and the demand outlook is strong; as such, the market is forecast to recover to 2019 occupancy levels by 2023.

- The number of events at the Kansas City Convention Center in 2020 was down approximately 76% from 2019, while the number of room nights generated by conventions in 2020 was down approximately 82% from 2019. Restrictions on large public gatherings caused cancellations, postponements, and modifications throughout 2020 and into the first half of 2021, including the July 2020 Shriners International Imperial Session and the Planet Comicon Kansas City. Recently, the convention center has started to host more sporting events, including the Big 12 Men’s and Women’s Basketball Tournaments in March 2021 and several large volleyball tournaments in early April 2021 (more than 15,000 attendees over the first two weekends of the month). Representatives of the Kansas City Convention Center are tentatively projecting a modest recovery in 2021, with the majority of the recovery beginning in the third and fourth quarters of 2021; officials reported that, as of April 2021, about half of the number of room nights had been booked for the year than the number achieved in 2019. The convention calendar for 2022 and 2023 should support a stronger recovery for the Downtown submarket during those years, buoyed by the June 2020 addition of the Loews convention headquarters hotel. Although the 800-room property has created a drag on market-wide occupancy during the recent periods of low demand, local CVB officials indicate that the new luxury property is an attractive selling point, as meeting planners are scheduling events for the next few years.

- Given that meeting and social-distancing restrictions have been eased, corporate demand is expected to rebound relatively swiftly in the next twelve months. Although the struggle of some employers to re-hire, as well as travel and supply-chain bottlenecks, may present some headwinds, we anticipate that pent-up demand for client meetings and in-person training will foster a healthy rebound in the region’s commercial demand base. Overall, the market’s diversity of employment sectors, with concentrations in government, manufacturing, healthcare, automotive, agri-business, and transportation, should provide a strong base for continuing economic growth, allowing commercial demand to recover by 2022.

- Within the greater market, the impact of the pandemic on individual hotels and the outlook for recovery spans a wide spectrum. In general, the area’s budget/economy and extended-stay hotels have been less affected than other hotel types, showing some resiliency due to their typical demand bases. Hotels that have been able to maintain a somewhat stable demand mix have typically experienced more limited rate declines. On the other hand, full-service properties, particularly those in the urban core, have generally experienced the most severe effects of the downturn, due primarily to these properties’ reliance on demand from corporate sources and group events, which have been the most limited. These hotels have been forced to discount rates to attract demand from leisure travelers and lower-rated commercial accounts. As demand from higher-rated corporate sources and large events returns, full-service hotels (and the market in general) should experience strong ADR recovery; however, ADR growth is expected to lag occupancy recovery as hoteliers continue to discount rates to attract demand.

Transaction Activity

- The transactions market had virtually ground to a halt in Greater Kansas City, with just one closed transaction in the second and third quarters of 2020. The Holiday Inn at the Plaza sold in July 2020; however, as of the writing of this article, the hotel remained closed with no confirmed plans if or when it would reopen as hotel supply.

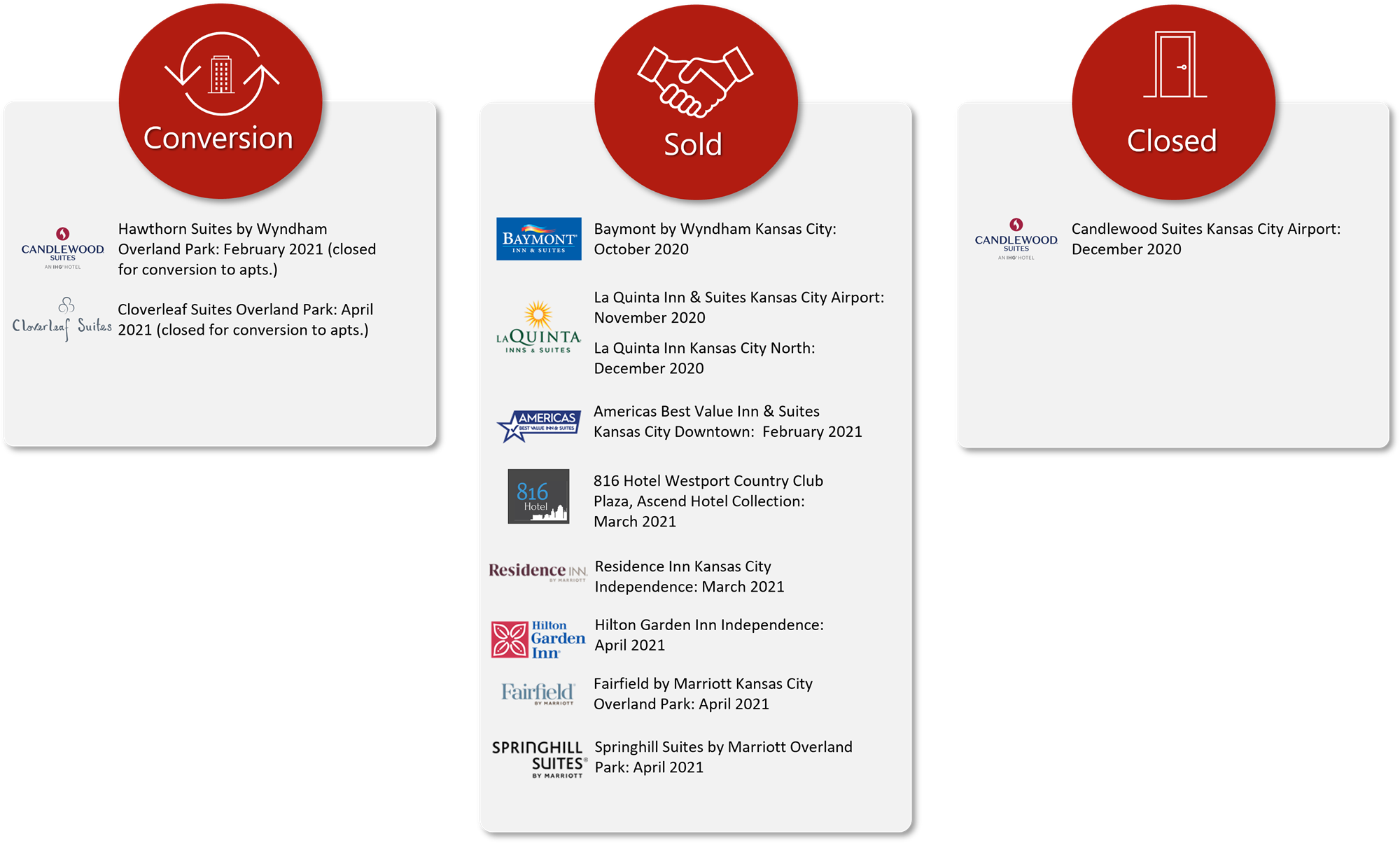

- Numerous transactions occurred in late 2020 and early 2021, primarily representing lower- or mid-market assets that escaped the most severe impact of the pandemic or that were purchased for conversion to alternative use. These are illustrated below.

Conclusion

Greater Kansas City is well positioned for a healthy recovery once the pandemic is fully suppressed, vaccines are distributed further, and corporate travel resumes. We continue to monitor the various factors influencing the outlook for the Kansas City lodging market, including regular conversations with participants in the region.

For more information, contact anyone on our HVS Heartland team: Daniel McCoy, Sara Olson, Zabada Abouelhana, or Justin Westad.