DALLAS, Oct. 9, 2018 —

Acquisition Highlights:

- Iconic boutique resort located in the affluent and high barriers-to-entry Santa Fe, New Mexicomarket proximate to the historic Santa Fe Plaza

- Exceptional amenities including four food & beverage outlets, an award-winning full-service spa and 7,800 square feet of indoor/outdoor meeting space

- Revenue per available room (RevPAR) of $155 for the 12 months ended August 31, 2018

- The Property is a member of Marriott's Tribute Portfolio

- Property is in excellent physical condition with limited capex needs

- In connection with this acquisition, Ashford Inc. has committed to provide Ashford Trust with approximately $5 million under the terms of the Enhanced Return Funding Program ("ERFP")

Ashford Hospitality Trust, Inc. (NYSE: AHT) ("Ashford Trust" or the "Company") today announced that it has entered into a definitive agreement to acquire the 157-room La Posada de Santa Fe in Santa Fe, New Mexico ("La Posada" or the "Property") for $50 million. The acquisition is expected to close in late October, but because the transaction is subject to customary closing conditions, the Company can give no assurance that the purchase will be consummated by such date, or at all.

La Posada is located on over five beautifully landscaped acres three blocks from the historic Santa Fe Plaza. With its strong brand affiliation and world-class amenities, the boutique hotel is positioned as one of the leading properties in a lodging market with very high barriers to entry. Located in northern New Mexico approximately 60 miles north of Albuquerque, Santa Fe is one of the country's most prominent, popular and dynamic leisure destinations. Beyond the first-class hotel experience, guests have easy access to the Santa Fe area's many amenities and activities, including over 250 art galleries, boutiques and restaurants. Additionally, the Property is proximate to the area's most renowned tourist demand generators, including the world-famous Santa Fe Opera House, Georgia O'Keefe Museum, Museum Hill, Dale Ball Trails and La Tierra Trails, among others.

La Posada has 157 luxurious and spacious rooms, including 30 suites, spread across 26 structures throughout the resort. The Property also offers an array of amenities, including the award-winning 4,500 sq. ft. full-service Spa Sage, four food and beverage outlets, including the acclaimed Julia – Spirited Restaurant & Bar, 7,800 sq. ft. of flexible indoor/outdoor meeting space, an outdoor pool, 24-hour state-of-the-art fitness club as well as an on-site curator service with prominent paintings and sculptures displayed for sale throughout the property. The Property is in excellent physical condition after having received over $6 million in capital improvements during the past few years. Post-closing, the property will be managed by Remington Lodging, who also manages the Hilton Santa Fe owned by Ashford Trust. The Company expects to realize synergies from the joint management of La Posada and the Hilton Santa Fe including the clustering of revenue management resources, consolidating accounting functions as well as sharing various positions in sales and human resources.

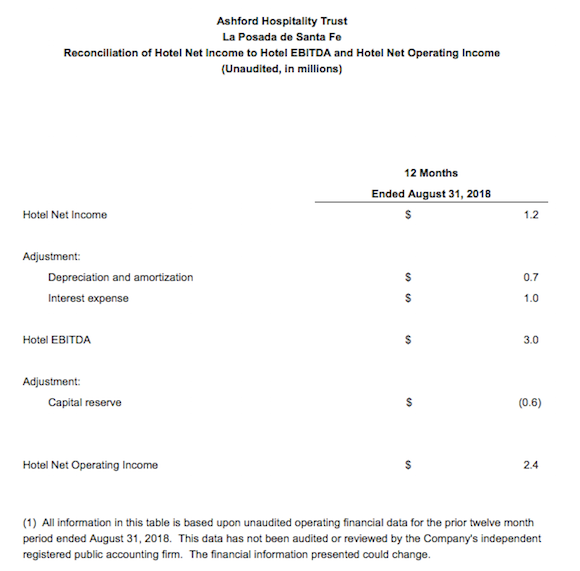

Inclusive of the funds provided by Ashford Inc. under the ERFP, and assuming the Ashford Inc. funding were to occur at closing, the adjusted net purchase price equates to approximately $287,000 per key and represents, as of August 31, 2018, a trailing 12-month capitalization rate of 5.3% on hotel net operating income of $2.4 million and a trailing 12-month 15.2x Hotel EBITDA multiple, according to the Company's preliminary estimates based on unaudited operating financial data provided by the sellers. Inclusive of the ERFP funds, the adjusted net purchase price equates to a forward 12-month capitalization rate of 7.3% and a forward 12-month Hotel EBITDA multiple of 11.7x. The Company currently forecasts the five-year, leverage-neutral IRR on this investment to be approximately 24% based upon various underwriting, pricing, and timing assumptions, which are subject to change, and include among other factors property level mortgage financing, equity investment, corporate preferred issuance, and ERFP funding. On a trailing 12-month basis as of August 31, 2018, the Property achieved RevPAR of $155, with 74% occupancy and an average daily rate (ADR) of $210, according to unaudited operating financial data provided by the sellers. A reconciliation of non-GAAP financial measures is included in the financial table below.

"The acquisition of La Posada provides us the opportunity to own another high-quality asset in this attractive market where we have been a long-time owner of the Hilton Santa Fe," said Douglas A. Kessler, Ashford Trust's President and Chief Executive Officer. "We believe that by installing Remington as manager at La Posada we should be able to realize significant operational synergies given our existing hotel in the market that should benefit both properties. Additionally, the ERFP contribution by Ashford Inc. should serve to increase the returns on this investment for our shareholders."

Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing opportunistically in the hospitality industry in upper upscale, full-service hotels.

Ashford has created an Ashford App for the hospitality REIT investor community. The Ashford App is available for free download at Apple's App Store and the Google Play Store by searching "Ashford."