|

News for the Hospitality Executive |

March 9, 2011 - Powered by some of the world’s fastest

growing

economies, chiefly China, India, Vietnam, and Indonesia, the Asia

Pacific

region continues to demonstrate a quick bounce-back from the global

economic

crisis. Sweeping fiscal and monetary stimulus programs mitigated

the impact of

the recession. As a result, strong economic growth of 5% or more is

expected in

many Asian countries through 2013. March 9, 2011 - Powered by some of the world’s fastest

growing

economies, chiefly China, India, Vietnam, and Indonesia, the Asia

Pacific

region continues to demonstrate a quick bounce-back from the global

economic

crisis. Sweeping fiscal and monetary stimulus programs mitigated

the impact of

the recession. As a result, strong economic growth of 5% or more is

expected in

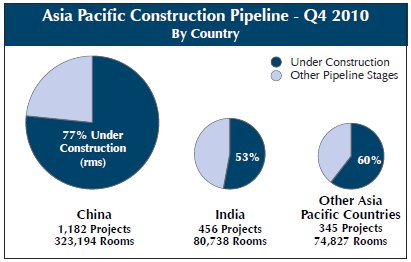

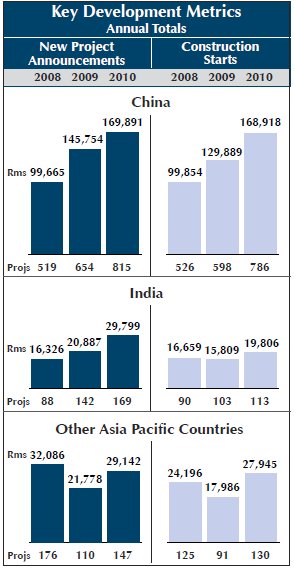

many Asian countries through 2013.Recently overtaking Japan, China is now the world’s second largest economy and the primary force in driving current global lodging development growth. At the end of Q4, China had the second largest Total Pipeline of any country at 1,182 projects/323,194 rooms. For the second consecutive quarter, China led the world in Construction Starts, with 139 projects/25,498 rooms in Q4. Also, for the first time ever, the country exceeded the United States in New Project Announcements (NPAs) into the Pipeline, with 155 projects/30,191 rooms. India’s Total Pipeline, the third largest in the world, grew for a fourth consecutive quarter to 456 projects/80,738 rooms in Q4. Like China, India’s economy is one of the fastest growing in the world, but its Pipeline totals were just 39% of China’s total projects and a distant 25% of its rooms. Most global hotel companies have a high interest in India and continue to announce growth strategies for the country, which should boost development metrics and feed Pipeline growth through mid-decade. Lodging operations have recovered substantially, with some of strongest increases off the recessionary bottom for any region worldwide. Average Rate and RevPAR in Asia Pacific recorded double-digit increases from 2009 to 2010. Occupancy was also up significantly. All three metrics will likely be fully recovered in 2011, and could potentially exceed pre-recession highs, further energizing already high development activity in the region, particularly in China and India.  ASIA PACIFIC

HIGHLIGHTS ASIA PACIFIC

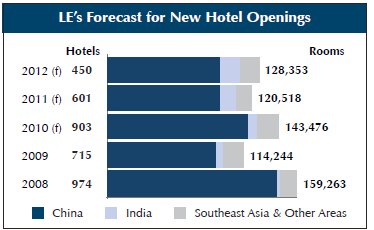

HIGHLIGHTSWith 1,182 projects/323,194 rooms, China had the second largest Total Pipeline of any country in Q4. 77% of all projects and rooms were Under Construction, one of the highest percentages in the world. China will have the highest amount of new rooms coming online as new supply over the next two years. LE’s Forecast for New Hotel Openings expects 479 new hotels/89,928 rooms to open in 2011, with an additional 292 hotels/91,924 rooms in 2012. China’s Total New Projects Announcements (NPAs) into the Pipeline continued to rise annually, growing 25% by projects and 17% by rooms from 2009 to 2010. Construction Starts for projects already in the Pipeline also rose, up 31% for both projects and rooms.  India’s Total Pipeline increased slightly from

Q3 2010 to 456 projects/80,738 rooms. With 50% of all projects and 53%

of rooms

Under Construction, LE anticipates New Hotel Openings to rise, with 95

new

hotels/14,377 rooms forecasted to open in 2011, and then increase again

in 2012

to a new cyclical high of 91 hotels/17,924 rooms. Developer activity in

India

has grown over the last three years, but at a lesser pace than seen in

China.

New Project Announcements into the Pipeline were up 19% year-over-year

by

projects, while Construction Starts were up 10%. Increasing expansion

plans by

global hotel companies will likely keep development metrics on a modest

upward

trajectory for the next few years. India’s Total Pipeline increased slightly from

Q3 2010 to 456 projects/80,738 rooms. With 50% of all projects and 53%

of rooms

Under Construction, LE anticipates New Hotel Openings to rise, with 95

new

hotels/14,377 rooms forecasted to open in 2011, and then increase again

in 2012

to a new cyclical high of 91 hotels/17,924 rooms. Developer activity in

India

has grown over the last three years, but at a lesser pace than seen in

China.

New Project Announcements into the Pipeline were up 19% year-over-year

by

projects, while Construction Starts were up 10%. Increasing expansion

plans by

global hotel companies will likely keep development metrics on a modest

upward

trajectory for the next few years.Other Asia Pacific countries, especially countries in the Southeast like Vietnam, Indonesia, Thailand, and Malaysia, saw an uptick in development activity in 2010. The Total Pipeline rose for the first time in seven quarters to 345 projects/74,827 rooms, up 12% by projects and 10% by rooms over Q3 2010. Annual totals for underlying development metrics also rebounded. In 2010, total NPAs were up 34% over 2009, with 147 projects/29,142 rooms. Construction Starts, at a total of 130 projects/27,945 rooms in 2010, were up 43% by projects and 55% by rooms, surpassing the 2008 pre-recession high in 2008. As regional governments enact stronger measures to control escalating inflation, the pace of development activity may moderate a bit, but is expected to keep trending higher through the middle of the decade. |

| Contact: Lodging Econometrics |