|

|

|

|

|

|

|

|

|

|

| By Robert Mandelbaum and David Murff - September 2005

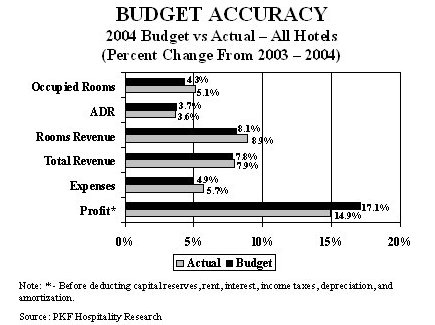

Going into 2004, most U.S. hotel managers were hopeful for a continuation of the industry turnaround that began in the third quarter of 2003. After three consecutive years of declining revenues and profits, hotel operators were quite optimistic and anticipated strong increases in revenues leading to double-digit growth in profits for 2004. Were these expectations met, or do hotel managers need to scrape the paint off their rose colored glasses? As general managers, controllers, and directors of sales begin the process of preparing their 2006 budgets and marketing plans, we thought we�d take a look back at the historical budgeting accuracy of U.S. hotel operators. From PKF Consulting�s Trends in the Hotel Industry database of 5,000 hotel financial statements for 2004, we identified approximately 1,000 statements that contained 2004 budget data. Based on these statements, we compared the revenues and expenses projected for 2004 with what was actually earned and spent. Topping The Top-Line Looking towards 2004, hotel managers were hoping for moderate gains

in both occupancy and ADR. The average 2004 budget called for a 4.3

percent increase in occupied rooms, combined with a 3.7 percent gain in

ADR. The net result was a fairly aggressive forecast of 8.1 percent

growth in rooms revenue.

Fortunately for the hotels in the study sample, rooms revenue actually grew 8.9 percent for the year, or nearly 10 percent more than the budgeted dollar amount. The primary driver of this surplus rooms revenue growth was the return of business travelers and conventioneers. The number of rooms occupied in the sample hotels actually grew 5.1 percent, a pace that beat the budget. While the actual growth in ADR was slightly less than the budgeted amount, it was within 0.1 percentage points � a very accurate forecast. Due to the influence of the strong gains in rooms revenue, the sample hotels also surpassed their budgets in terms of total revenue growth. The 2004 budgets called for a total revenue increase of 7.8 percent. By year-end 2004, total revenue had increased 7.9, just slightly more than the forecasted growth rate. While total revenue did exceed expectations, it is apparent that the 2004 revenue increases for the food, beverage, and other income sources did not meet the projected growth rates contained in the 2004 budgets. Short On The Bottom-Line According to their 2004 budgets, U.S. hotel managers hoped to turn their

7.8 percent gain in total revenue into a 17.1 increase in hotel profits.

For the purpose of this analysis, profits are defined as income before

deductions for capital reserves, rent, interest, income taxes, depreciation,

and amortization.

At year�s end, 2004 hotel profits had grown 14.9 percent over 2003. While 14.9 percent growth in a historically high figure, it did fall 12.9 percent short of the budgeted dollars for the year. The primary reason for the budgeted profit shortfall appears to be excessive spending. Hotel management had allotted for a 4.9 percent increase in operating expenses for 2004. When all was said and done, they had spent 5.7 percent more to operate their hotels. This overexpenditure in 2004 is consistent with a separate analysis conducted by PKF Consulting that found hotel operating expenses to spike in the first few years coming out of a recession. Clairvoyant Resort Mangers Our analysis found that resort hotel managers were not only the most

aggressive budgeters in 2003, but also the most accurate. Resort

operators forecasted increases of 10.3 percent for total revenue and 21.1

percent for profits in 2004. Fortunately, the actual growth rates

for the year were 10.5 percent and 21.3 percent, respectively.

The operators of America�s large convention hotels were the least accurate budgeters, missing their 2004 revenue and profit projects by more than 50 percent. All-suite managers were the most conservative prognosticators. They budgeted for the least growth in revenue and expenses, and therefore beat both measurements handily. Both full-service and limited-service management were able to beat or meet their revenue expectations, but fell short of their profit forecasts. Looking Good As the saying goes, �Everyone looks smarter when they are making money.� Our analysis found the 2004 hotel budgets prepared back in 2003 to be much more accurate than the budgets prepared for the previous three years. Obviously, no one could have foreseen the catastrophic events of 2001. However, U.S. hotel managers were decidedly inaccurate projecting the losses that occurred in 2002 and 2003. Maybe this was just a result of another business idiom � �Never budget for a loss.� Looking forward to 2006, most industry analysts are quite optimistic and projecting continued increases in both revenues and profits. Given recent history, this does portend for more accurate budgets. It will be interesting to see how aggressive hotel managers are when budgeting their revenue, expense, and profit growth rates for 2006. Robert Mandelbaum and David Murff are Directors with PKF Hospitality

Research (PKF-HR), the research affiliate of PKF Consulting. PKF-HR

offers hotel managers several tools and reports to assist them in the preparation

of their 2006 budgets. For more information, please visit the PKF

website at www.pkfc.com, or call Claude

Vargo toll free at (866) 842-8754.

|

| Contact:

Robert Mandelbaum

|