|

|

|

|

|

|

|

U.S. Hotels Answered the Marketing Investment Question During the Industry Recession |

| By Robert Mandelbaum

May 2004 The struggles of the U.S. hotel industry during the past few years are well known. From 2000 through 2003, total revenue for the average U.S. hotel dropped 13.7 percent. Given such difficult operating conditions, any and all operating expenses were examined for potential efficiency enhancements or outright elimination. Hotel managers were able to cut their operating expenses 6.4 percent; however, with the decline in revenue outpacing the drop in operating costs, unit level profitability fell 28.6 percent. When looking up and down a hotel�s financial statement in search of expense cuts, most managers immediately focus on the fixed costs that are frequently found in the Undistributed Operating departments. It is believed that cutting these costs has the most immediate beneficial effect on the bottom line, with the least direct effect on guest service. The marketing department is classified as an Undistributed Operating department on a hotel�s financial statement. Hotel owners and operators constantly struggle with the thought of cutting marketing expenses during a downturn in business. On the one hand, a lot of marketing expenses are fixed, and the dollars cut will have an immediate positive impact on profitability. On the other hand, investing in marketing is needed to maintain, or limit the decline, in revenues. To examine how U.S. hotels answered the marketing investment question during the recent industry recession, we analyzed data from our firm�s Trends in the Hotel Industry database. Each year, The Hospitality Research Group of PKF Consulting (HRG) collects financial statements from approximately 4,000 hotels across the U.S. The results of the survey are presented in the firm�s annual Trends in the Hotel Industry report. The following charts highlight the findings of our analysis.

Marketing Department Expenses

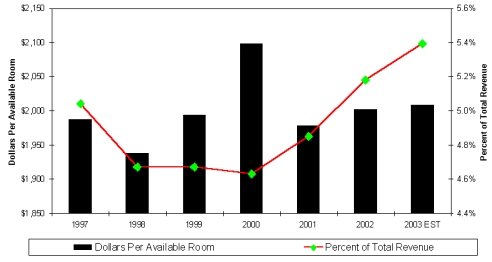

Cut, But Not Obliterated As shown in Chart A, dramatic cuts were made in total marketing expenses from 2000 to 2001. During this period, marketing expenses measured on a dollar per available room basis declined from $2,098 to $1,978. (Note: This does not include any franchise fees or assessments). For reference purposes, the 5.7 percent decline in marketing expenses in 2001 compares to a 5.3 percent cut in all operating expenses for the year. With revenues dropping 9.9 percent in 2001, marketing expenses measured as a percent of total revenue grew from 4.6 percent in 2000 to 4.8 percent in 2001. Since 2001, marketing expenditures have been on the rise in U.S. hotels. For year-end 2003, we estimate the average U.S. hotel spent $2,008 per available room for marketing expenses, still less than the $2,098 spent in 2000, but 1.5 percent more than the $1,978 spent in 2001. Again, with revenue growth on the decline, marketing expenses as a percent of total revenue continues to increase. Chart B

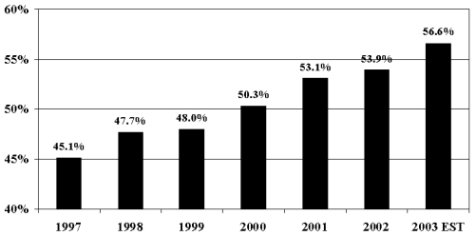

Selling, Not Advertising Labor-related expenses are the most significant expenditure within a �staffed� marketing department. For the average hotel in our 2002 Trends sample (most current actual data), payroll and related expenses comprised 53.9 percent of all marketing-related expenditures, exclusive of franchise-related fees and assessments. It should be noted that most limited-service hotels do not employ any full-time sales employees. Therefore, the marketing expenses for these limited-service properties consist solely of the costs associated with such items as brochures, billboards, and advertisements. In accordance with the Ninth edition of the Uniform System of Accounts

for the Lodging Industry, we separate marketing expenses into three categories:

advertising/merchandising, selling, and other. Analyzing the changes

in these specific line items in recent years, we have observed increases

in the dollars spent on selling, while the dollars spent on advertising/merchandising

have declined.

Payroll and Related Costs as a Percent of Total Marketing Expenses

Source: The Hospitality Research Group of PKF Consulting . Chart D Change in Payroll and Related Costs Marketing Department vs All Hotel Departments

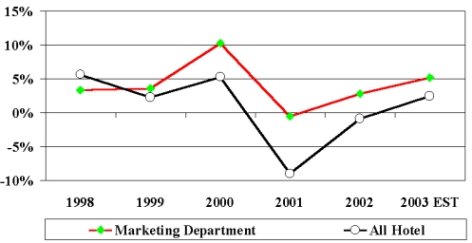

Source: The Hospitality Research Group of PKF Consulting . Consistent with the expenditure patterns related to �selling,� hotel marketing payrolls have experienced limited declines in 2001 and growth in recent years. As a percent of total marketing expenses, labor costs have increasingly become a greater percentage of total costs from 1997 through 2003. In recent years, marketing department payrolls have experienced greater growth than all hotel labor costs combined. From 1997 through 2003, marketing department payrolls have increased at a compound annual rate of 3.8 percent. This compares to a 1.5 percent growth rate for all hotel labor costs. A major contributor to the difference in labor growth rates is the payroll reductions made in 2001. In that year, total hotel labor costs were reduced 6.6 percent, while marketing labor costs were cut only 0.5 percent. Given the increases (or lack of reductions) in selling and labor costs within the marketing department, it is apparent that hotel owners and operators believe the best return on investment for marketing dollars lies in people and personal sales efforts, as opposed to advertising and merchandising. In addition, it can be assumed that hotel owners and managers believe that retention of strong sales personnel during a recession is important for the long-term. In summary, it appears that hotel marketing departments have been relatively insulated from some of the drastic cost reductions implemented by hotels during the recent recession. While costs have been cut relative to pre-2000 levels, the magnitude of the decline is far less than the cuts experienced by other departments. The implication is clear: over the past few years, hotel owners and operators have viewed marketing expenses as an investment worthy of protecting. Robert Mandelbaum is the Director of Research Information Services for The Hospitality Research Group of PKF Consulting. For more information on benchmarking the marketing costs of your hotel, please call (404) 842-1150, ext 237. |

| Contact:

Robert Mandelbaum

|

.