NEW YORK – June 18, 2015 – Hotels in major North American markets experienced positive growth in rate and occupancy according to data from the June 2015 TravelClick North American Hospitality Review (NAHR).

“As we move into the peak of the summer season, travelers are making the most of the warm weather and their budgets by shopping for the best combination of rate and overall value,” said John Hach, Senior Industry Analyst at TravelClick.

12 Month Outlook (June 2015 – May 2016)

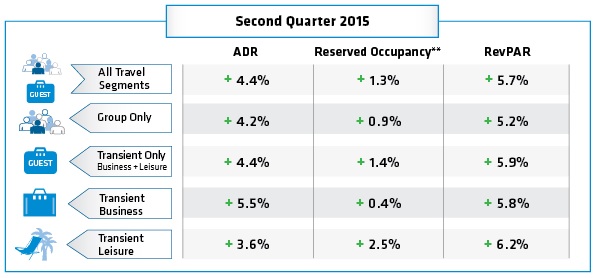

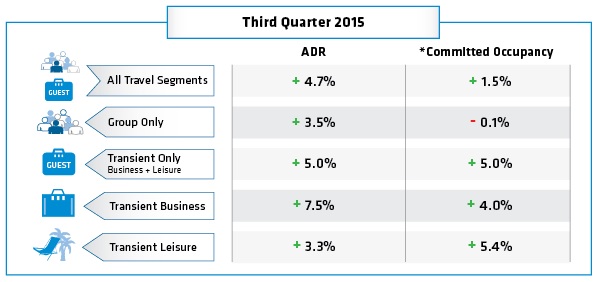

For the next 12 months (June 2015 – May 2016), overall committed occupancy* is up 2.5 percent when compared to the same time last year. Average daily rate (ADR) is up 4.9 percent based on reservations currently on the books. Transient bookings (individual reservations made by business and leisure travelers) are up 3.9 percent year-over-year and ADR for this segment is up 5.1 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is showing occupancy gains of 4.8 percent and ADR gains of 3.6 percent. The transient business (negotiated and retail) segment occupancy is up 2.6 percent and ADR is up 6.8 percent. Group segment occupancy is up 1.9 percent and ADR has increased to 4.3 percent, compared to the same time last year.

Hach added, “We are continuing to see hoteliers shift focus to increasing ADR to achieve revenue per available room (RevPAR) objectives as ADR continues to show strong growth in 90 percent of the top North American markets. Additionally, there is an acceleration of group commitments going into the fourth quarter; this bodes well for hoteliers finishing out the year on a strong upward pace.”

The June NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by May 28, 2015 from the period of June 2015 to May 2016.

*Committed Occupancy – (Transient rooms reserved + group rooms committed)/capacity

**Reserved Occupancy – Total number of rooms reserved/capacity

The second quarter combines historical (April – May) and forward looking data (June) and third quarter forward looking data (July – September)