By Jason Wight

Jun 11, 2015

Helping Investors Understand Oil-Dependent Lodging Markets in Canada.

After three years of stable oil prices, the energy sector was thrown into a tailspin when oil prices plummeted in the second half of 2014—dropping about 40% in a very short time. This rapid decline is having a profound impact on Canadian lodging markets that depend on lodging demand from oil production.

For these markets, the low price of oil presents significant operational challenges. Lower demand means lower revenues. Moreover, the preceding era of high oil prices—and the robust lodging demand associated with those high prices—lasted for so long that the upswing in the cycle was taken for granted, making the sudden negative shift in market fundamentals seem even more severe.

Oil-dependent lodging markets fall into four different categories that are responding in distinct ways to the low oil-price environment. After examining each category in detail, we will consider two market vulnerabilities that can compound the negative effects of the downturn. Lastly, we will examine the cycles in oil commodity prices and capital investments to try to get a handle on what hoteliers invested in these oil-dependent markets can expect in the short and medium terms.

Four Market Types

The timing and severity of the impact of low oil prices on lodging markets will depend on the type of oil-related activity driving the market. There are generally four types of oil-production activity around which lodging markets are formed: the oil sands, conventional oil, upgrading and processing facilities, and corporate operations and planning. Each type of oil-production activity generates distinct forms of lodging demand and responds uniquely to the low price of oil.

Oil Sands

In the oil sands, lodging demand is mainly generated from the construction of major capital projects. The oil sands have benefitted from billions of dollars of investment over the past few years, but as these capital projects are completed and become operational, the lodging demand associated with construction subsides. As was the case during the global recession, oil sands companies are now postponing or cancelling their major capital projects, focussing instead on existing operations. This will have a major impact on lodging demand in these markets.

Given the dependence on construction crews, project managers, and consultants as a source of demand, the near-term outlook for lodging demand in oil sands markets is bleak. The established operations do generate some lodging demand from mining and in-situ operations personnel, companies involved in maintaining upgrader facilities, transportation and logistics companies, and corporate travel, but without construction activity the demand for lodging will be weak in the immediate future. Once oil prices increase to a level where the economics of the postponed projects become viable again, development activity will likely return and revive demand for lodging facilities.

Conventional Wells

For conventional oil resource projects, the activity surrounding oil or gas wells is the primary generator of lodging demand. A single well has the ability to generate a number of room nights for local hotels throughout the well’s life. Pipeline construction, transport services, surveyors, and other professional services also generate local lodging demand.

All three phases of well development generate lodging demand: exploration and seismic crews seeking to locate the appropriate areas to drill wells; well drilling (which involves three to four crews of four to five people needing accommodation from the start of the drilling to its completion); and then well operation. Although each company approaches scheduling differently, crews typically work two weeks of 12-hour days and then get a week off. Most crews work away from home and therefore require lodging.

Given the high intensity and flexibility engendered in the relatively small scale of these operations, well operators are incredibly responsive to changes in the price of oil. For this reason, the impact of low oil prices hits these lodging markets much more rapidly than other oil-dependent markets. Once oil prices drop to a point where it does not make economic sense to continue to develop additional wells, oil companies simply limit their drilling programs, and the workers associated with the drilling activity leave the market. However, once oil prices recover to a level that makes drilling and the development of wells viable again, lodging demand quickly bounces back.

Oil Upgrading and Processing Facilities

Some lodging markets are oriented towards refineries, upgraders, and processing plants for the oil and gas industry. In these markets, a lot of lodging demand is generated from plant maintenance activity. Every couple of years, these facilities go through a process called a “turnaround.” Turnarounds are necessary maintenance periods that allow time for the upkeep of operating units to maintain safe and efficient operations. To conduct a turnaround, specialized contract crews come to the facilities to perform the necessary maintenance work. During this time, the lodging facilities in the market are typically full for the entire length of the turnaround, and the crews often require additional rooms in nearby markets.

These processing facilities will continue to operate through the economic downturn and will require ongoing maintenance regardless of the price of oil. As such, the impact of the drop in the price of oil on lodging markets associated with these facilities will be minimal in comparison to markets whose lodging demand depends on other sources of oil-related activity.

Corporate Operations and Planning

The larger cities that are close to oil-producing regions—Calgary, Edmonton, and Regina—are home to companies that own, operate, and service oil developments. In these markets, lodging demand is generated from business activities related to the operation of oil companies, the planning of future projects, and the manufacturing of goods for the oil sector.

The decline in the price of oil has had a negative impact on these companies, and has resulted in layoffs and financial difficulty for the smaller operations. However, the negative impact of the decline in oil prices on large city lodging markets will not be as significant as it is for markets that rely directly on activity related to oil extraction. This is due in part to the economic diversification of large cities.

Compounding Factors: New Supply and Rates Wars

The fallout from the low price of oil harbours two additional dangers that go beyond a simple drop in demand: new supply coinciding with low demand, and rate wars.

New Supply

The recent energy boom spurred a lot of interest in hotel development in markets both large and small. Many of these hotel projects are now under construction and will be opening for business over the next couple of years. The addition of more guestrooms to a market will compound the impact of a drop in demand on occupancy levels. With the decline in demand, the overall pie gets smaller, but the addition of the new hotels adds more players wanting a piece of that pie. The end result is a highly competitive environment in which no one gets a satisfying amount of the pie—except the guest, who will likely get lodgings at a significant discount.

Hotels that were once accustomed to turning away demand midweek may now find themselves with empty rooms. New hotels may not ramp up as quickly as projected, and their time to stabilization may be prolonged. These new hotels are nevertheless positioned to compete aggressively in the markets they enter, as it is the older lodging supply that suffers the most when new lodging supply enters a market during a downturn.

Rate Wars

When hoteliers start to feel the pressure of declining occupancies, they have a tendency to shift their approach from maintaining the average room rate (a prudent operating strategy) to increasing market share through discounting rates (a counter-productive operating strategy). They hope to take demand from their competitors and see their occupancy increase and revenues rise. This short-term thinking has long-term negative consequences, as it ultimately pushes competitors to offer similar if not greater discounts to retain their demand base, setting off a rate war that benefits no one—and hurts everyone.

In a very short time, a rate war can cause the average room rate for a market to plummet, and it can take up to five years for a market to build back the rate integrity that was lost in a matter of months. With oil prices expected to increase throughout 2015 and projected to increase further in 2016, the oil sector is expected to start to recover next year. However, lodging markets that engage in rate wars will be suffering for many years beyond that.

Oil Prices, Market Cycles, and Lodging Demand

Oil prices are volatile by nature—a point that was easy to forget during the years of stable oil prices and booming oil development. Historical data show that periods of rapid and robust growth are typically followed by a drastic correction. From a lodging perspective, this means that hotels experience boom years of high occupancies and strong average rate growth, followed by bust years of low demand and an intensely competitive environment where hoteliers have to fight to sell rooms and maintain their share of the market. If properly managed, strong performance during the boom years will make up for the soft years and allow an investor to hit appropriate returns over a long-term holding period.

No two downturns are identical. Each downturn is caused by a unique set of issues related to not only supply and demand but also broader economic and political issues. The price of oil fluctuates up and down both widely and rapidly. Given these complexities, we are fundamentally unable to predict the price to which oil will recover or the timing and duration of a recovery. During the previous decline from 2008 to 2009, the price of oil dropped from a high of $134 per barrel in July 2008 to a low of $39 per barrel in February 2009 and then rebounded substantially within a 12-month period to $74 by December 2009—none of this could have been reasonably predicted beforehand.

Because predicting what the market is going to do is basically a matter of luck, it is important to avoid anticipating the market. Instead, hoteliers should implement sound operating practices to maintain rate and increase competitiveness during the downturn, seek efficiency in operations, and be patient and ready to act when the market solidifies.

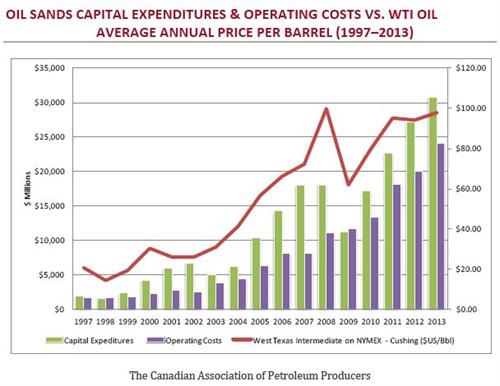

The drama of the recent plunge in oil prices may seem catastrophic, but based on past market cycles it is perfectly reasonable to expect things to improve in the not-too-distant future. The following table illustrates oil sands capital expenditures and operating costs from 1997 to 2013. The average annual price of West Texas Intermediate Oil in US dollars is provided for comparison. It should be noted that data for 2014 are not available at the time of this article.

As is clear from the above graph, the oil sands have seen a massive progressive increase in investment since 1997. There were only two brief periods of contraction, one in 2003 and the other in 2009. The major decline in 2009 was due to the global recession, which caused the price of oil to plummet. Owing to the low price of oil, many oil companies put their projects on hold until the price of oil rebounded and again reached historic highs. Capital expenditures shot back up in 2010 to nearly the level set in 2008, and then progressively surpassed all previous records each year through 2013. During the periods in which capital expenditures declined, operating costs increased progressively without interruption.

The graph also reveals that there is a correlation between high oil prices and capital spending in the oil sands. A sharp drop in the price of oil is connected with temporary cutbacks in capital spending. When the price of oil regains strength, there is an intensification of capital spending as oil companies hasten to get their shovels in the ground as soon as conditions are favourable enough to do so.

This performance history sheds some light on the likely effect of the current drop in oil prices. The lower price of oil is expected to cause temporary cutbacks in capital spending, but robust investment will likely resume once oil markets stabilize and regain strength. Depending on where the price of oil settles, the massive investment that took place from 2010 to 2013 may not be replicated for some time, as this investment was stimulated by the atypically high price of crude.

Conclusion

Stakeholders who invest in lodging markets that are heavily reliant on the energy sector need to understand what they are getting into from the start. Historically, these markets have been volatile, experiencing years of strong growth punctuated by years of drastic declines.

The hotel sector is unique in that it has to deal not only with the impact of oil-price volatility on lodging demand, but also the potential for new hotel supply and the onset of rate wars. These dynamics can contribute to the overall success or failure of a hotel investment.

As long as the current slump in oil prices continues, hotel markets that rely on demand related to oil production are likely to experience challenges. However, the pressure will likely ease over time—already, most crude oil forecasts put year-end prices at a higher level than the current price, and further increases are projected for 2016. As oil prices increase, oil companies will likely increase their capital spending (after the drastic cuts in 2015), increasing the demand for lodging facilities once again.