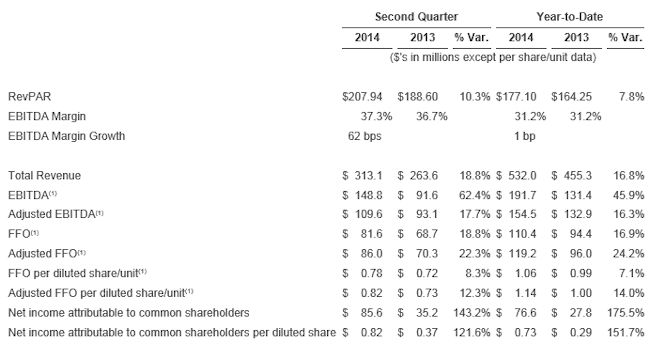

Second Quarter RevPAR improved 10.3%

Achieves highest-ever quarterly hotel EBITDA margin of 37.3%

Adjusted EBITDA grew 17.7% and Adjusted FFO per share increased 12.3%

BETHESDA, Md.–LaSalle Hotel Properties (NYSE: LHO) today announced results for the quarter ended June 30, 2014. The Company’s results include the following:

1) See tables later in press release, which list adjustments that reconcile net income to earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted EBITDA, funds from operations (“FFO”), FFO per share/unit, adjusted FFO, adjusted FFO per share/unit and hotel EBITDA. EBITDA, adjusted EBITDA, FFO, FFO per share/unit, adjusted FFO, adjusted FFO per share/unit and hotel EBITDA are non-GAAP financial measures. See further discussion of these non-GAAP measures and reconciliations to net income later in this press release.

Second Quarter Results and Activities

- RevPAR: Room revenue per available room (“RevPAR”) for the quarter ended June 30, 2014 increased 10.3 percent to $207.94, as a result of a 6.6 percent increase in average daily rate (“ADR”) to $241.08 and a 3.4 percent improvement in occupancy to 86.3 percent.

- Hotel EBITDA Margin: The Company’s hotel EBITDA margin for the second quarter increased 62 basis points from the comparable prior year period to 37.3 percent, its highest-ever quarterly hotel EBITDA margin.

- Adjusted EBITDA: The Company’s adjusted EBITDA was $109.6 million, an increase of 17.7 percent over the second quarter of 2013. Second quarter adjusted EBITDA was negatively impacted by an estimated $0.5 million of EBITDA as a result of the sale of Hilton Alexandria Old Town prior to the end of the quarter.

- Adjusted FFO: The Company generated second quarter adjusted FFO of $86.0 million, or $0.82 per diluted share/unit, compared to $70.3 million or $0.73 per diluted share/unit for the comparable prior year period, an increase of 12.3 percent.

- Hotel Acquisition: On April 2, the Company acquired the 200-room Hotel Vitale in San Francisco, CA for $130.0 million. Hotel Vitale is located on the Embarcadero, overlooking the San Francisco Bay.

- Dividend: On April 23, the Company increased its dividend 34 percent to $0.375 per common share for the quarter ended June 30, 2014. The dividend represents an annual run rate of $1.50 per share and a 4.2 percent yield based on the closing share price on July 22, 2014.

- Debt Repayment: On May 1, the Company repaid the $8.7 million outstanding mortgage, secured by Hotel Deca in Seattle, Washington. The Company has no remaining debt maturities in 2014.

- Hotel Disposition: On June 17, the Company sold Hilton Alexandria Old Town for $93.4 million.

- Preferred Redemption: During the second quarter, the Company announced that it would redeem all of its outstanding 7.25 percent Series G Preferred Shares for $58.7 million plus accrued dividends through the redemption date. The redemption closed on July 3.

- Capital Investments: The Company invested $22.4 million of capital in its hotels, including the completion of the Terrace Lounge at WestHouse in New York and a lobby and lounge renovation at The Grafton on Sunset in Los Angeles.

“Our portfolio delivered very strong second quarter results,” said Michael D. Barnello, President and Chief Executive Officer of LaSalle Hotel Properties. “RevPAR and margins were above the high end of our outlook. Adjusted EBITDA and FFO also exceeded our outlook, despite impact from the sale of Hilton Alexandria Old Town.”

“Overall, the operating environment remains favorable. Industry demand growth has been robust and fundamentals remain strong.”

“In addition, the sale of Hilton Alexandria Old Town capped off a terrific investment for us, which generated a 13.5 percent unleveraged IRR over 10 plus years. We used a portion of the proceeds to redeem our outstanding Series G Preferred Shares, further reducing our cost of capital.”

Year-to-date Results

For the six months ended June 30, 2014, RevPAR increased 7.8 percent to $177.10, with occupancy growth of 1.1 percent to 79.3 percent and ADR improvement of 6.7 percent to $223.44. The Company’s hotel EBITDA margin was 31.2 percent, which was flat compared to the same prior year period.

Balance Sheet

As of June 30, 2014, the Company had total outstanding debt of $1.2 billion, including $197.0 million outstanding on its senior unsecured credit facility. Total net debt to trailing 12 month Corporate EBITDA (as defined in the Company’s senior unsecured credit facility) was 3.7 times as of June 30, 2014 and its fixed charge coverage ratio was 3.7 times. For the second quarter, the Company’s weighted average interest rate was 3.6 percent. As of June 30, 2014, the Company had capacity of $575 million available on its credit facilities.

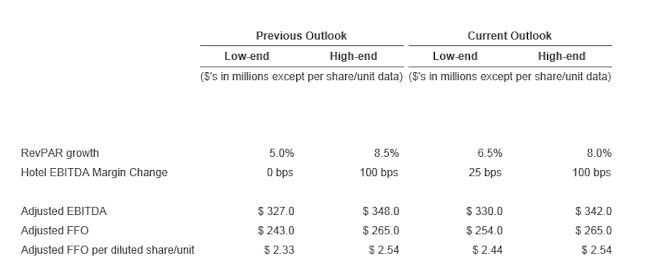

2014 Outlook

The Company is updating its 2014 outlook to incorporate its recent activities and to reflect its performance-to-date. The sale of Hilton Alexandria Old Town has the impact of reducing our full year adjusted EBITDA outlook by approximately $4.0 million, of which $0.5 million occurred during the second quarter. The outlook is based on an economic environment that continues to improve and assumes no additional acquisitions, dispositions or capital markets activities. The Company’s RevPAR growth and financial expectations for 2014 are as follows:

Third Quarter 2014 Outlook

The Company expects third quarter RevPAR to increase 5.0 percent to 8.5 percent and hotel EBITDA margins to range from approximately flat to an increase of 125 basis points relative to the same prior year period. The Company expects its portfolio to generate adjusted EBITDA of $99.0 million to $105.0 million and adjusted FFO per share/unit of $0.73 to $0.79.

Earnings Call

The Company will conduct its quarterly conference call on Thursday, July 24, 2014 at 9:30 AM eastern time. To participate in the conference call, please dial (877) 795-3638. Additionally, a live webcast of the conference call will be available through the Company’s website. To access, log on to http://www.lasallehotels.com. A replay of the conference call will be archived and available online through the Investor Relations section of http://www.lasallehotels.com.

To view corresponding tables for this release please visit:

http://media.corporate-ir.net/media_files/IROL/63/63030/LHO%20Q2’14%20Earnings%20Release_FINAL.PDF