WASHINGTON (July 5, 2016)—Inbound travel to the U.S. took a sizable downturn even before Britain narrowly voted to leave the European Union and roiled international markets, according to the U.S. Travel Association’s Travel Trends Index (TTI).

International inbound travel continued to register negative year-on-year growth in May due to factors including a strong U.S. dollar, which will particularly weigh on travel from Canada.

Any fallout from the recent Brexit vote will begin to show in August's version of the monthly TTI, which will reflect data from June.

The Leading Travel Index (LTI), the economic indicator’s predictive component, projects a similarly dour outlook for international travel through late 2016, and posits that it will continue to trail the domestic market.

Domestic business travel also reverted to previous downward patterns in May, and the segment’s prospects for growth remain subdued through November of this year.

However, travel still grew overall in May 2016, albeit at a slower rate than the previous month, propped up by the robust domestic leisure travel market. As the international inbound travel market begins reacting to the Brexit vote and the once-strong Canadian travel market founders against the strength of the U.S. dollar, domestic travel will be relied upon heavily to drive growth—though domestic business travel is back to its previous lackluster performance. According to the association’s monthly economic indicator, domestic leisure travel is likely to continue leading the U.S. travel sector into late 2016.

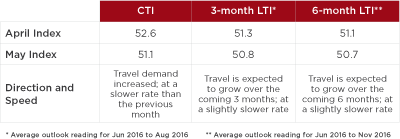

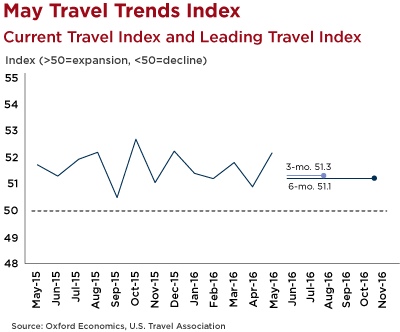

The May Current Travel Index (CTI) registered at 51.1, a number heralding growth, but still below the 6-month moving average of 51.5 (numbers above 50 indicate growth, and scores below 50 show contraction). The travel industry remains in expansion mode, as the CTI has registered above the 50 mark for 77 straight months.

In the full Travel Trends Index report, the 3- and 6-month LTI readings of 50.8 and 50.7, respectively, indicate that U.S. travel overall is expected to grow at a rate of around 1.5 percent through November 2016.

“This months’ Travel Trends Index proves yet again that American leisure travelers, who account for 60 percent of travel spending in the U.S., will likely continue their role as engines of growth for the U.S. travel industry in 2016,” said U.S. Travel Association Vice President for Research David Huether. “It will be interesting to see how global events, such as Britain’s recent vote to leave the European Union, affect these trends in the months ahead.”

The TTI consists of the Current Travel Index (CTI), which measures the number of person-trips involving hotel stays and/or flights each month, and the Leading Travel Index (LTI), which measures the likely average pace and direction of business and leisure travel, both domestic and international inbound. It assigns a numeric score to every travel segment it examines—domestic and international, leisure and business—in current, 3-month and 6-month predictive indicators. As with many indices similarly measuring industry performance, a score above 50 indicates growth, and a score below 50 indicates contraction.

The U.S. Travel Association developed the TTI in partnership with Oxford Economics, and draws from multiple data sources to develop these monthly readings. In order to compile both the CTI and LTI readings, the organization’s research team utilizes multiple unique non-personally identifiable data sets, including:

- Advance search and bookings data from ADARA and nSight;

- Passenger enplanement data from Airlines for America (A4A);

- Airline bookings data from the Airlines Reporting Corporation (ARC); and

- Hotel room demand data from STR.

Learn more about the Travel Trends Index.

Click here to read the full report.