|

News for the Hospitality Executive |

|

By Darius

Hatami

May 2013 The following is the second in a three-part series that examines the state of the golf industry today. The first article explored the history and examined the issues challenging the golf industry. This second article explores the impacts to Golf Facility Financials and Value, while the third article will look to the future of the industry and the issues that will shape its health moving forward. Credit must be given to the large number of industry professionals at the Golf Industry Show who were speakers and whose thoughts, ideas and concerns I am liberally using. These insights are a direct result of their expertise and experience, and I would like to thank them for their input. Golf Facility Financials and Value Overbuilding – The sole cause of financial distress? As was noted in the Part 1 of this series, overbuilding in the industry contributed to its latest cycle. While the supply of golf courses was increasing, the growth of golfers to play on these courses was lagging. The declining golfer to course ratio has resulted in a loss of demand and presented a buyer’s market for golfers. The extent of the decline in golfers per course means that the market share of each golf course has been diluted to the point where a large number of golf facilities are now financially distressed. This intense competition has created a predatory environment, and along with the growth of third-party tee time sellers, has created a market in which the third-party sellers and the customer have more power than the golf course. It is our perspective at HVS that the overdevelopment of golf courses during the current cycle did come economic factors lying outside of the golf industry. These factors include developers using the golf course to sell real estate, government agencies using golf as a tool for economic development, and resorts using the golf course to sell rooms. However, the financial problems of many of the golf courses were also due to the fact that golf course developers in all sectors did not devote sufficient resources to understanding the long-term financial implications of golf course ownership. Many developers failed to have a plan or exit strategy for the golf facilities after the real estate sales process was completed. While many developers recognized the fact that the golf course or club was a loss leader for real estate sales, many had disregard for the economics of supply and demand for golf courses within their local markets and within their projects, and ignored the potential financial implications of this imbalance. This lack of attention often resulted in the inability to execute an exit strategy for the golf facility or club asset when the development was completed. This same oversight also led to:

The Cascading Impacts to the Bottom Line While the overbuilding of the golf course industry was becoming evident in 2005 and 2006 due to declining golfer to course ratios, other changes including the fallout of the great recession dictated additional financial difficulties for the industry. On the revenue side, the golf facilities were also being impacted due to the evaporation of the financial resources of its patrons, resulting in a loss of clients or frequency of play, a loss in the sales of peripherals including carts, practice range usage, food and retail items. The continued growth of national hard goods sellers also fostered additional difficulties for sales in the pro shop. Further, many courses suffered from a lack of a sophisticated understanding of the markets in which they operate. The golf industry lacks a sophistcated and comprehensive database that monitors the health and financial performance of the golf and club facilities, and this lack of adequate data is a direct cause for poor decision making by the owners. As the demand declined, course owners reacted by slashing green fees, bundling food or beverages with rounds, and searching for any way to save market share. The result was a significant decline in the average yield and an overall decline in REVPATT (Revenue per Available Tee Time) for all golf courses. The lack of sufficient competitive data to understand the context of their price cutting, dictated that in many cases, the golfers had more knowledge than the operators, and the operators lost control of pricing power. Market intelligence and control of pricing are also being impacted by the advent of third-party tee time sellers. The golf industry, like the hotel industry, has resorted to third parties to sell off-peak tee times, and as these sellers start gaining market share, they are also gaining market intelligence in terms of what is happening in the larger market. This superior intelligence is allowing the third party resellers to better understand the pricing in the market and therefore to garner larger shares of the market. These third-party sellers are now serving as middlemen and siphoning further resources away from the golf courses. So a combination of reduction in rounds, reduction in the average rate, and a reduction in overall spending combined to produce a significant loss of revenues for many courses. Based upon our estimates, the average course lost 15% of its rounds, had a 20% reduction in average rate, and an estimated 10% loss in ancillary spending. In total, revenues declined by an estimated 35% at the average golf course from peak levels in 2005 and 2006. It is a common understanding that golf course maintenance costs are almost entirely fixed, meaning that the costs are stable no matter how many golfers play the course, so the loss of income does not have the corresponding reduction in operating costs. The increasing costs of maintaining the golf course, rises in health care costs, the rise in the costs of gasoline and gasoline-related products, and the increase in precious metals were all causing maintenance costs to grow. The increasing cost of fuel, which is used directly in operations, but also is a big component of many supplies including the irrigation piping, fertilizers and a host of other items, has meant significant inflation in operating costs. The price of copper, for wire used in the irrigation system, has also been rising. These increases have created difficulty in maintaining course costs and have directly reduced facility profits. The availability and cost of irrigation water is another wild card and in some instances has had a tremendous impact on the facilities’ financial performance. At some courses the cost of irrigation water can exceed $1.0 million a year, which may equate to 100% of the entire course maintenance budget and consume as much as 30% of gross revenues. As the scarcity of water becomes an issue nationally, the costs of water are likely to continue to rise in many areas of the country. Since golf course expenses are primarily fixed, these losses in revenue accumulate directly to the bottom line, meaning significant declines in net operating income today, and potentially into the future. The increasing quality of the golf courses built over the last decade has also raised the expectations of golfers and put pressure on existing facilities to upgrade their course and course conditions. This has created a clear understanding of the market position of many golf courses, as those that have reinvested remain solvent, while those that did not make improvements suffer from declining market share, deteriorating conditions, and are caught in a downward cycle. Defining Distress The confluence of these market conditions provides little wonder that many golf course operators have become distressed. There are nearly 16,000 golf courses in the country today, and The National Golf Foundation reports total closures of around 1,150 golf courses during the previous ten years, with approximately 665 closing in the last five years. So about 7% of the inventory of golf courses in the United States has closed during the past decade. Given the difficult economic conditions, that is a surprisingly low percentage. When golf courses do close it is typically due to following factors.

It is clear that a large portion of the industry is in the first stage of distress, this includes:

The majority of the golf courses built in the last

development cycle were driven by residential developments, and the fate

of the

golf courses often rested with the solvency of the development. Many of

these

facilities were at greater risk as the operation was still dependent on

developer subsidies, the

facilities were built in more remote and rural locations, and they were

often

overbuilt in terms of the size and function of the clubhouse. The

distress in

this sector is more severe, and likely a higher portion of these golf

courses

are in distress. The majority of the golf courses built in the last

development cycle were driven by residential developments, and the fate

of the

golf courses often rested with the solvency of the development. Many of

these

facilities were at greater risk as the operation was still dependent on

developer subsidies, the

facilities were built in more remote and rural locations, and they were

often

overbuilt in terms of the size and function of the clubhouse. The

distress in

this sector is more severe, and likely a higher portion of these golf

courses

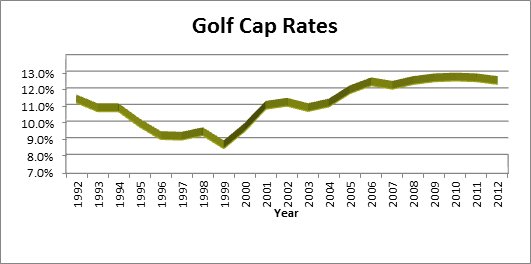

are in distress.By looking at approximately 1,300 transactions of golf course since 2007, it is clear that daily fee and semi-private courses are transcating at greater rates than other facilities. Real estate-related courses are also transacting at a very high rate, while municipal golf courses are not transacting frequently. While this data presents some interesting conclusions, clearly municipal golf courses have been suffering as well, although this distress is not leading to trasactions. The combination of golf course closures and golf transactions would imply that about 15% of all golf facilites have had distress so great that it has caused a change of use or a change of ownership in this time period. While bankruptcies, foreclosures, the sale of bank notes, the change in the business model of a club and other forms of distress are not addressed, it is clear that at least 20% to25% of the golf facilities have had severe distress and a much larger percentage have suffered from lesser degrees of distress. The Financial Markets and Impacts to Value In conjunction with the drop in the net income of the golf facility or club, the financial markets combined to create additional difficulties. Shortly after the collapse of Lehman Brothers started the current great recession, the major national lenders to the golf facility industry stepped away from lending on golf courses. These companies included Textron, GE, and Capmark. Thus, total capital available to the industry dropped precipitously, creating a vacuum in terms of debt financing and raising the overall costs for golf finance. This point is best illustrated by examining capitalization rates for golf facilities. A study of capitalization rates for golf courses since the early 1990’s, as provided by Realtyrates.com, illustrates several important points. Capitalization rates were between 11% and 12% in the early 1990’s, before the emergence of the national golf course lenders. Golf course cap rates peaked at around 8% in 1999, but with the loss of these national lenders, the recession, and the remaining oversupply of golf courses, capitalization rates are now back to 12%. The change in cap rates from 1999 to today amounts to roughly 33%, dictating that a golf facility generating the same net income now as it was in 1999 is currently valued at 2/3rds of what it was based on growth of capitalization rates alone. But as was illustrated in Part 1, with revenues down by 35% and expenses rising, the reality is that market-wide golf course values are likely closer to about 33% of what they were during the peak.  Source: Realty

Rates.com

If that were

not trouble enough, loan to value requirements increased, further

making

financing difficult. While this point

was made in part 1 of this article series, a large number of golf loans

were

financed at 3- to5-year terms, and the lack of lenders and lending when

these

notes came due precipitated additional difficulties in securing

finance. What

this means is that even a golf facility that generated positive

operating

income and has always been current on their mortgage cannot refinance

due to

changes to the values and more stringent financing conditions. So for

many

owners, the golf course value was below the existing loan amount or

loan to

value requirement, and therefore the ability to refinance depended on

providing

additional equity to meet the new higher loan to value ratios required

in the

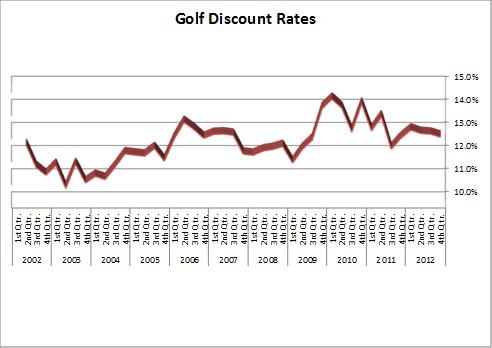

current market for refinancing.It seems as though the operating income for golf courses is never really stabilized; but is always variabletherefore, using capitalization rates can lead to vastly varying estimates of value. This leads to the conclusion that the sale of a golf course inevitably includes some type of story relating to problems with how the golf course was operated, and how the new capital will turnaround the operation. Even prior to the current distress in the market, the purchase and refinance of the golf facilities almost always included a story on how the facility can be repositioned and fare better in the future. In today’s market it seems as though buyers and lenders have become more skeptical of these types of turnarounds by golf courses, and the underwriting of the golf courses based upon pro-forma income as opposed to historical income have also been impacted. The utilization of discount rates to determine value is necessiatated by the changing income from the golf course. According to data provided by Realtyrates.com, the discount rates for golf courses peaked at 10.5% in 2003, and are now around 12.5%. This dictates that financing a turn around is a more difficult story in the current market, as less weight is given to future increases in revenue.  Source: Realty

Rates.com

Given the

perfect storm of compression of revenues, rising expenses, a loss of

capital,

decreasing value and more stringent lending conditions, it is of little

surprise that the golf industry is in a painful period of

distress. Golf course values are down, lending is still

difficult, and the ability of the industry to alter these constraints

is going

to be tested in the years to come.So while most of the bad news is now on the table, the third part of this series relates potential optimism for the future of the golf course industry and the value of golf facilities.  About the author: About the author:Darius Hatami is Managing Director of HVS Golf Services, based in Boulder, Colorado. Darius is a graduate of the University of Colorado and has been involved in various aspects of golf and community development for over 20 years. In 1995, Darius became part of the HVS family, and provided studies to hundreds of golf and resort community clients throughout the United States, Canada, Mexico, the Caribbean, Central America, Asia and Europe. His expertise encompasses valuation and feasibility studies as well as strategic, financial, residential economic planning, membership planning as well as integrating golf with residential and resort aspects of master planned communities. About HVS HVS is the world’s leading consulting and services organization focused on the hotel, mixed-use, shared ownership, gaming, and leisure industries. Established in 1980, the company performs 4500+ assignments each year for hotel and real estate owners, operators, and developers worldwide. HVS principals are regarded as the leading experts in their respective regions of the globe. Through a network of more than 30 offices and 450 professionals, HVS provides an unparalleled range of complementary services for the hospitality industry. www.hvs.com Superior Results through Unrivalled Hospitality Intelligence. Everywhere. www.hvs.com. HVS Golf Services HVS Golf, Residential and Resort Community Consulting and Valuation Services, established in 2004 with headquarters in Boulder, CO, specializes in the market and financial analysis of golf, club, residential and resort communities. This division of HVS is charged with consulting and valuation services that evaluate the macro economic and financial environment surrounding the golf, real estate and resort development. Services include appraisal, valuation, feasibility, litigation support. For specific information on the division, please visit www.hvsgolf.com. |

|

Contact: Darius Hatami [email protected] Leora Lanz HVS Director of Marketing Tel: +1 (516) 248-8828 ext. 278 [email protected] |

| Also See: |

Thoughts from the Golf Industry Show: Part One of Three / Darius Hatami / April 2013 |