Pebblebrook Hotel Trust Acquires the 337-suite Embassy Suites

San Diego Bay – Downtown for $112.5 Million

To Be Managed by HEI Hotels and Resorts

BETHESDA, Md.-January 30, 2013--Pebblebrook Hotel

Trust (NYSE: PEB) (the “Company”) today announced that it has acquired

the Embassy Suites San Diego Bay – Downtown for $112.5 million. The

337-suite, urban, upper upscale, full service hotel is located in

downtown San Diego, California. The property will be managed by HEI

Hotels and Resorts (“HEI”). As a part of this transaction, the Company

is assuming a $66.8 million secured, non-recourse loan, with the

balance of the purchase price being funded by the Company with

available cash. BETHESDA, Md.-January 30, 2013--Pebblebrook Hotel

Trust (NYSE: PEB) (the “Company”) today announced that it has acquired

the Embassy Suites San Diego Bay – Downtown for $112.5 million. The

337-suite, urban, upper upscale, full service hotel is located in

downtown San Diego, California. The property will be managed by HEI

Hotels and Resorts (“HEI”). As a part of this transaction, the Company

is assuming a $66.8 million secured, non-recourse loan, with the

balance of the purchase price being funded by the Company with

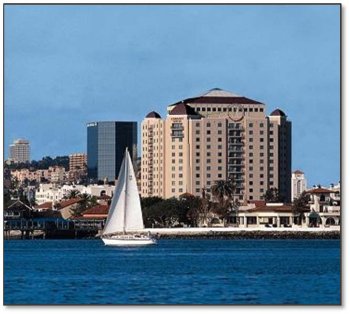

available cash.“We’re very excited about the acquisition of the Embassy Suites San Diego Bay – Downtown and the opportunity to further expand our presence in the highly desirable downtown San Diego market,” said Jon Bortz, Chairman and Chief Executive Officer of Pebblebrook Hotel Trust. “The hotel is extremely well located at the corner of Harbor Drive and Pacific Highway, just steps away from Seaport Village and the waterfront. This ideal location is only four blocks from the San Diego Convention Center, and six blocks from Westfield Horton Plaza Shopping Mall, as well as a variety of restaurant and entertainment options in the vibrant Gaslamp Quarter. The strong leisure, group and convention demand for San Diego, particularly in this location along the waterfront, makes the Embassy Suites San Diego Bay – Downtown an excellent investment for our company.” The 337-suite Embassy Suites San Diego Bay – Downtown benefits from a highly visible and easily accessible location at the intersection of Harbor Drive and Pacific Highway in downtown San Diego, just blocks away from the Company’s recently renovated Westin Gaslamp Quarter. The location is ideal for convention and leisure travelers alike, within walking distance of the city’s leading attractions and demand generators, including the San Diego Convention Center, Seaport Village, San Diego Trolley Station, Horton Plaza Shopping Mall, the U.S.S. Midway Aircraft Carrier Museum, PETCO Park and countless restaurants and entertainment options in the historic Gaslamp Quarter. The hotel is also located minutes from the renowned San Diego Zoo, Sea World, Coronado Island, Balboa Park Museums, Old Town, Qualcomm Stadium, the San Diego Sports Arena, San Diego Naval Pier, San Diego State University, University of California at San Diego and University of San Diego.  Built in 1988, the hotel was fully renovated in 2006 and

completed a $3.5 million guest suites renovation in May 2012. The hotel

features a 12-story atrium and panoramic views of San Diego Bay and the

city. Standard suite amenities include two separate rooms, 37- or

42-inch flat screen high-definition televisions, microwave, mini

refrigerator, coffee maker, dining table and chairs, sofa bed and

high-speed wireless internet access. The hotel features approximately

5,000 square feet of meeting space, including the 2,032 square foot

Monterrey Ballroom, an indoor heated swimming pool and whirlpool and

3,411 square feet of leased retail space located on the ground floor.

The hotel also offers PFC Bar & Grill, open daily from 11:00am

until midnight, serving fresh seafood and offering a wide selection of

spirits, wine and beer, including many of San Diego’s famous locally

produced microbrews. Built in 1988, the hotel was fully renovated in 2006 and

completed a $3.5 million guest suites renovation in May 2012. The hotel

features a 12-story atrium and panoramic views of San Diego Bay and the

city. Standard suite amenities include two separate rooms, 37- or

42-inch flat screen high-definition televisions, microwave, mini

refrigerator, coffee maker, dining table and chairs, sofa bed and

high-speed wireless internet access. The hotel features approximately

5,000 square feet of meeting space, including the 2,032 square foot

Monterrey Ballroom, an indoor heated swimming pool and whirlpool and

3,411 square feet of leased retail space located on the ground floor.

The hotel also offers PFC Bar & Grill, open daily from 11:00am

until midnight, serving fresh seafood and offering a wide selection of

spirits, wine and beer, including many of San Diego’s famous locally

produced microbrews.In 2012, the Embassy Suites San Diego Bay – Downtown operated at 83 percent occupancy, with an average daily rate (“ADR”) of $198, room revenue per available room (“RevPAR”) of $165, earnings before interest, taxes, depreciation and amortization (“EBITDA”) of $8.8 million and net operating income after capital reserves (“NOI) of $7.8 million. For all of 2013, the Company currently forecasts that the hotel will generate EBITDA of $8.5 to $9.0 million and NOI of $7.5 to $8.0 million, both of which are before an expected $1.0 million renovation impact. In connection with the acquisition, the Company is assuming a $66.8 million secured, non-recourse loan, which is subject to a fixed interest rate of 6.275%. The loan matures in June 2016. In conjunction with the Company’s acquisition of the Embassy Suites San Diego Bay – Downtown, the Company has selected HEI as manager for the hotel. “HEI has a strong presence in the San Diego market and has a great understanding of, and excellent experience with operating all-suite upper upscale properties,” continued Mr. Bortz. “We’re delighted to be developing a strategic relationship with HEI and look forward to working with them at the Embassy Suites San Diego Bay – Downtown. With the addition of HEI, we now have 10 third party managers operating our hotels throughout our portfolio. This improves our already diverse group of hotel management companies, while also enhancing our opportunities to expand our best practices and asset management initiatives.” “We are excited to create this new partnership with Pebblebrook Hotel Trust,” said HEI’s Chief Executive Officer, Anthony Rutledge. “The Embassy Suites San Diego Bay – Downtown exhibits strong growth potential and we are eager to bring our proven industry experience to the hotel.” The Company expects to incur approximately $0.9 million of costs related to the acquisition of the hotel and $0.2 million of costs related to the transition of a new management team that will be expensed as incurred. The acquisition of the Embassy Suites San Diego Bay – Downtown brings the total number of properties in the Company’s portfolio to 26, comprising $2.1 billion of invested capital. About HEI Hotels & Resorts HEI Hotels & Resorts, headquartered in Norwalk, Connecticut with 42 properties in 16 states, creates socially responsible investment and employment opportunities through real estate portfolios of hotels and resorts throughout the United States under such well-known brand names as Marriott, Sheraton, Westin, Le Meridien, Embassy Suites, and Hilton. HEI takes a holistic approach to creating value for its investors and employees by setting the highest standards across all aspects of hotel management and operation and focusing on the central principles of excellence and continuous improvement. HEI prides itself on some of the highest employee satisfaction scores in the hospitality industry, fuels local economic prosperity by investing in communities and is committed to environmental stewardship and sustainability. For more information, please visit www.heihotels.com. About Pebblebrook Hotel Trust Pebblebrook Hotel Trust is a

publicly traded real estate investment trust (“REIT”) organized to

opportunistically acquire and invest primarily in upper upscale,

full-service hotels located in urban markets in major gateway cities.

The Company owns 26 hotels, including 20 wholly owned hotels with a

total of 4,952 guest rooms and a 49% joint venture interest in six

hotels with a total of 1,733 guest rooms. The Company owns, or has an

ownership interest in, hotels located in ten states and the District of

Columbia, including 16 markets: Los Angeles, California; San Diego,

California; San Francisco, California; Santa Monica, California; West

Hollywood, California; Miami, Florida; Buckhead, Georgia; Bethesda,

Maryland; Boston, Massachusetts; Minneapolis, Minnesota; New York, New

York; Portland, Oregon; Philadelphia, Pennsylvania; Columbia River

Gorge, Washington; Seattle, Washington; and Washington, DC. For more

information, please visit www.pebblebrookhotels.com.

This press release contains certain

“forward-looking statements” relating to, among other things, potential

property acquisitions, hotel EBITDA, hotel net operating income after

capital reserves, acquisitions costs and projected demand.

Forward-looking statements are generally identifiable by use of

forward-looking terminology such as “may,” “will,” “should,”

“potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,”

“approximately,” “believe,” “could,” “project,” “predict,” “forecast,”

“continue,” “plan” or other similar words or expressions.

Forward-looking statements are based on certain assumptions and can

include future expectations, future plans and strategies, financial and

operating projections or other forward-looking information. Examples of

forward-looking statements include the following: projections of

hotel-level EBITDA and net operating income after capital reserves;

projections of acquisition costs; descriptions of the Company’s plans

or objectives for future operations, acquisitions or services;

forecasts of future economic performance; and descriptions of

assumptions underlying or relating to any of the foregoing expectations

regarding the timing of their occurrence. These forward-looking

statements are subject to various risks and uncertainties, many of

which are beyond the Company’s control, which could cause actual

results to differ materially from such statements. These risks and

uncertainties include, but are not limited to, the state of the U.S.

economy, supply and demand in the hotel industry and other factors as

are described in greater detail in the Company’s filings with the

Securities and Exchange Commission (“SEC”), including, without

limitation, the Company’s Annual Report on Form 10-K for the year ended

December 31, 2011. Unless legally required, the Company disclaims any

obligation to update any forward-looking statements, whether as a

result of new information, future events or otherwise.

For further information about the Company’s business and financial results, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s SEC filings, including, but not limited to, its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, copies of which may be obtained at the Investor Relations section of the Company’s website at www.pebblebrookhotels.com and at www.sec.gov. All information in this release is as of January 29, 2013. The Company undertakes no duty to update the statements in this release to conform the statements to actual results or changes in the Company’s expectations. The Company assumes no responsibility for the contents or accuracy of the information on any of the non-Company websites mentioned herein, which are included solely for ease of reference. For additional information or to receive press releases via email, please visit our website at www.pebblebrookhotels.com.

(1)

Depreciation and amortization have been estimated based

on a preliminary purchase price allocation. A change, if any, in the

allocation

will affect the amount of depreciation and amortization and the

resulting

change may be material.

(2) Hotel EBITDA and Hotel Net Operating Income are both before an expected $1.0 million renovation impact. This press release includes certain non-GAAP financial measures as defined under Securities and Exchange Commission (SEC) Rules. These measures are not in accordance with, or an alternative to, measures prepared in accordance with U.S. generally accepted accounting principles, or GAAP, and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the hotel’s results of operations determined in accordance with GAAP. The Company has presented forecasted hotel EBITDA and forecasted hotel net operating income after capital reserves, because it believes these measures provide investors and analysts with an understanding of the hotel-level operating performance. These non-GAAP measures do not represent amounts available for management’s discretionary use, because of needed capital replacement or expansion, debt service obligations or other commitments and uncertainties, nor are they indicative of funds available to fund the Company’s cash needs, including its ability to make distributions. The Company’s presentation of the hotel’s forecasted EBITDA and forecasted net operating income after capital reserves should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of the hotel’s financial performance. The table above is a reconciliation of the hotel’s forecasted EBITDA and net operating income after capital reserves calculations to net income in accordance with GAAP.

These historical hotel operating results include information from the following hotels: DoubleTree by Hilton Bethesda-Washington DC; Sir Francis Drake; InterContinental Buckhead; Hotel Monaco Washington, DC; Grand Hotel Minneapolis; Skamania Lodge; Sheraton Delfina; Sofitel Philadelphia; Argonaut Hotel; Westin Gaslamp Quarter San Diego; Hotel Monaco Seattle; Mondrian Los Angeles; Viceroy Miami; W Boston; Hotel Vintage Park Seattle; Hotel Vintage Plaza Portland; W Los Angeles - Westwood; Hotel Palomar San Francisco; Embassy Suites San Diego Bay – Downtown; and the 6 hotel properties in the Manhattan Collection. This schedule excludes the historical operating results of the Hotel Milano. The hotel operating results for the Manhattan Collection only include 49% of the results for the 6 hotel properties to reflect the Company's 49% ownership interest in the hotels. These historical operating results include periods prior to the Company's ownership of the hotels. The Company expects to include historical operating results for Hotel Milano after the Company has owned the hotel for one year. The information above does not reflect the Company's corporate general and administrative expense, interest expense, property acquisition costs, depreciation and amortization, taxes and other expenses. The information above has not been audited and has been presented only for comparison purposes. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

.