Price

Begets Profits

|

News for the Hospitality Executive |

Price

Begets Profits

|

By:

Robert Mandelbaum,

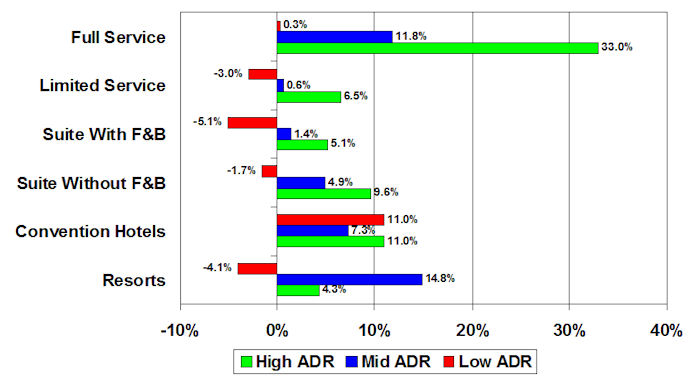

August 17, 2011 In the March 2011 edition of our monthly Hospitality Market Update newsletter, PKF Hospitality Research (PKF-HR) made the following observation: “The driving force behind revenue growth in 2011 is clearly price positioning. The higher the room rate, the greater the projected growth in ADR and, consequently, RevPAR.” After analyzing the results of the 2011 Trends® in the Hotel Industry survey, the relationship between price positioning and profits appears to be as strong as the correlation between room rates and the ability to grow revenue. In general, hotels in the highest room rate categories achieved the greatest increases in net operating income in 2010. Conversely, properties in the lowest rate categories either achieved minor increases in profit, or suffered their third consecutive year of declines on the bottom line.  Within the full-service category, those hotels in the lowest ADR category (less than $100) saw just a slight 0.3 percent increase in profits in 2010. On the other end of the spectrum, upper-upscale and luxury hotels with an ADR greater than $200 enjoyed a strong 33.0 percent gain in NOI. The 2011 edition of Trends® presents aggregate average changes in unit-level revenues, expenses, and profits from 2009 to 2010. The data comes from a sample of the 6,700 financial statements received from hotels located throughout the United States. For the Trends® report, profits are defined as net operating income (NOI) before deductions for capital reserves, rent, interest, income taxes, depreciation, and amortization. Revenue Up For Most Everyone Nearly 80 percent of all hotels in the Trends® sample enjoyed an increase in rooms occupied in 2010, but only 67 percent were able to leverage that into an increase in total revenue. On average, the hotels in the Trends® sample achieved a 6.2 percent increase in occupancy, but were unable to raise their room rates. In aggregate, ADR for the overall sample declined 0.9 percent. Given the preceding changes in occupancy and ADR, the Trends® sample averaged a 5.3 percent rise in rooms revenue in 2010. Among the other sources of revenue, food and beverage sales increased 5.6 percent and other operated department revenue rose 2.2 percent, but rentals and other income declined 10.0 percent. The net result was a 4.8 percent increase in total hotel revenue for the overall Trends® sample. Expense Growth Suppressed Given the fact that the gains in revenue were driven by growth in the number of rooms occupied, it is not surprising that the costs and expenses needed to operate a hotel also grew. Total operating expenses increased 3.4 percent in 2010. While this growth was more than double the rise in the consumer price index for the year, it is slightly less than expected given the historical expenditure patterns we have observed during the initial stages of past lodging industry recoveries. Part of the reason for the suppressed growth in operating expenses is the continued high rate of unemployment in the country. Given the persistent elevated unemployment rate and resulting lack of pressure on wage rates, labor costs for U.S. hotels increased a modest 2.7 percent from 2009 to 2010. In contrast, the amount spent to purchase all other goods and services needed to operate a hotel (excluding management fees, property taxes, and insurance) increased 5.3 percent in 2010. The greatest gains among these expenditures were seen in the rooms (6.2%) and food and beverage (9.3%) departments. These large increases in operated department costs are to be expected given that revenue growth was driven by increased business volume as opposed to a rise in prices. Facing dramatic declines in revenue in 2009, hotel managers were effective in cutting all department expenses except fixed charges (property taxes and insurance). However, as predicted in the 2010 Trends® report, the profit declines in 2009 led to decreases in property values in 2010. Accordingly, fixed charges fell 3.8 percent in 2010, the only expense category to be reduced during the year. Fewer Benefit On The Bottom While 70 percent of the hotels in the Trends® sample enjoyed an increase in total revenue, only 60 percent were able to translate that into an increase in profits. On average, unit-level NOI for the Trends® sample rose 9.8 percent in 2010. After two years of declining profits, this is welcome news, but it does not make up for the 37.9 percent cumulative loss in profits experienced during 2008 and 2009. The ability to grow profits in 2010 varied by property type. The greatest gains in NOI were achieved by full-service (+14.4%), resort (+10.4%), and convention hotels (+8.7%). Limited-service (+0.5%) and suite hotels with food and beverage (+1.8%) lagged in their ability to generate more dollars on the bottom line. This diversity of performance follows the previously described observation relating profit growth to price positioning. 2011 Outlook Based on a preliminary September 2011 Hotel Horizons® forecast, PKF-HR is forecasting that the average hotel in the U.S. will be able to increase their total revenue by 7.4 percent for the entire year. The revenue growth will come from a relatively equal contribution of increases in occupancy and ADR. Accordingly, hotel operators will need to continue their diligent efforts to control costs. Assisting management in curbing costs in 2011 will be low pressure on wages from lingering unemployment. On the other hand, the recent increases in commodity prices have already resulted in a rise in utility costs, delivery surcharges, and the cost of goods sold. Cost controls might be what begets profits in 2011.  Robert Mandelbaum is the Director of Research Information Services for PKF Hospitality Research. He is located in the firm’s Atlanta office (www.pkfc.com ). To purchase a copy the 2011 Trends® in the Hotel Industry report, please visit www.pkfc.com/buyannualtrends. |

| Contact:

Robert Mandelbaum |

| Also See: | One

Night Stands Are Expensive / Robert Mandelbaum / July 2011 |

| Hotel

Food and Beverage: Locals Up, Lounges Down / Robert Mandelbaum /

June 2011 |

|

| FREEBIES:

Hotels Give Some Things for Nothing / Robert Mandelbaum / April 2011 |

|

| Hang

Up The Phone And Hold The Starch, But Please Park The Car / Robert

Mandelbaum /February 2011 |

|

| Meeting

Planners Optimism Rising / Robert Mandelbaum / January 2011 |

|

| How

Profitable Will Your RevPAR Be In 2011? / Robert Mandelbaum /

December 2010 |

|

| No

Show – No Problem; Hotels Profit from Attrition and Cancellation Income

/ Robert Mandelbaum / November 2010 |

|

| Right

Direction - Wrong Amount: Hotel Managers Underestimated 2009 Declines

in Performance / Robert Mandelbaum / October 2010 |

|

| Surprised, or Stubborn? U.S. Hotel Managers Missed Their Budgets In 2008 / Robert Mandelbaum / October 2009 |