|

Adjusted EBITDA and Adjusted EPS Exceed Company�s

Earnings Guidance and Consensus Analyst Estimate

MADISON, Wis., February 20, 2008�Great Wolf Resorts, Inc. (NASDAQ: WOLF),

North America�s leading family of indoor waterpark resorts, today reported

results for the fourth quarter ended December 31, 2007.

Highlights

-

Achieved Adjusted EBITDA of $11.5 million and Adjusted net loss per share

of $(0.05) for the 2007 fourth quarter, resulting in full year 2007 amounts

of $51.1 million of Adjusted EBITDA and $0.03 of Adjusted EPS, exceeding

both consensus analyst estimates and the top end of the company�s earnings

guidance for the quarter and the full year.

-

Generated seventh consecutive quarter of same store RevPAR improvement,

with Great Wolf Lodge® brand same store Total RevPAR up 6.6 percent

compared to the same period last year, and have seen an increase in same

store rooms sold / booked in the first quarter of 2008 compared to the

first quarter of 2007.

-

Opened the 402-suite Great Wolf Lodge resort in Grapevine, Texas in December,

featuring the state�s largest indoor waterpark. Also broke ground

on construction of a 203-suite and 20,000 square-foot meeting space expansion

to the newly-opened resort. Achieved 25,000 sold and future booked

rooms on the new resort to date.

-

Broke ground on construction of a 402-suite Great Wolf Lodge resort in

Concord, N.C. in October 2007.

-

Completed a significant expansion of the Traverse City, Mich., Great Wolf

Lodge in the 2007 fourth quarter, adding 9,000 square feet of meeting space.

-

Capitalized on increased emphasis on group sales at resorts, resulting

in a 35 percent year-over-year increase in same store total number of group

rooms sold / booked through February 18, 2008.

The company reported a 2007 fourth quarter net loss of $(7.7) million,

or $(0.25) per diluted share, compared to a net loss of $(49.0) million,

or $(1.61) per diluted share in last year�s fourth quarter. Fourth

quarter 2006 operating results included the impact of a pre-tax, $51.0

million goodwill impairment charge and the related effect on income taxes.

Fourth Quarter Operating Results

�Our portfolio of resorts continued to perform well, providing operating

results that exceeded both the top end of our earnings guidance and consensus

analyst estimates for the fourth quarter,� said John Emery, chief executive

officer. �We continued our seven-quarter string of strong year-over-year

same store revenue per available room (RevPAR) growth. We believe

this is due in large part to the impact of our targeted marketing and our

continued focus on great guest service, a feature at the core of our business.

Our fourth quarter is heavily dependent upon holiday activities, and our

business appears to have held up better than certain other companies which

are dependent on discretionary consumer spending. We believe this

clearly demonstrates the advantage of our business model: providing

a high-quality, drive-to, destination family resort experience.�

The company reported fourth quarter Adjusted EBITDA of $11.5 million

and Adjusted EPS of $(0.05), resulting in full year 2007 amounts of $51.1

million of Adjusted EBITDA and $0.03 of Adjusted EPS. The company�s

2007 fourth quarter Adjusted EBITDA increased 40 percent over the 2006

period.

The company�s newest resort, located in Grapevine, Texas, opened in

December 2007. �We are pleased with the early consumer demand for

our new resort in Grapevine,� Emery commented. �The initial booking

patterns for the resort have been strong, with Grapevine having the second

highest total bookings among our resorts in January. To date, we

have approximately 25,000 rooms sold or on the books for Grapevine since

its mid-December opening, a pace significantly ahead of the totals for

our Williamsburg and Mason resorts for the same time periods following

their respective openings.

�Our Grapevine resort reflects the continuing evolution of our brand

to encompass an increasingly wide array of activities designed to entertain

all members of the family,� Emery added. The Grapevine resort includes

the company�s newest amenity, gr8_space�, a 1,200 square-foot interactive

family tech center. gr8_space features multiple computer stations

offering family-friendly Internet access, docking stations for digital

music players, as well as multiple gaming stations. Additionally,

gr8_space features family events, like rock star karaoke and family challenge

games. �We are excited to add this gr8_space concept in Grapevine

and we expect to incorporate it into our future resorts as well,� Emery

said. �We think the presentation of technology in a family-friendly

atmosphere further increases the attractiveness of our resort to �tweens�

who visit our resort.� The company is evaluating adding the gr8_space

amenity to existing resorts, with plans to add it to its Williamsburg resort

in 2008.

�We continue to look for ways to enhance our existing properties,� Emery

noted. �For example, in the 2007 fourth quarter, we completed the

last phase of enhancements to our Traverse City resort. This included

the completion of a 9,000 square-foot, full-service conference facility,

capable of handling groups ranging from 10 - 270. We believe this

will generate more mid-week group business, as well as support reunions

and other large family and social get-togethers.�

The company also noted its continuing emphasis on growing group business

throughout its resorts as a complement to its core leisure business.

�Group sales are an attractive opportunity for us to build mid-week occupancy

rates,� Emery commented. �Through today, our system-wide group rooms

sold or booked are running more than 13,000 rooms, or 35 percent, ahead

of last year, with the largest increases coming from Mason (6,500 rooms,

up 164 percent), Traverse City (2,300 rooms, up 48 percent) and Sheboygan

(1,700 rooms, up 20 percent).�

The company added the interactive, live-action, fantasy adventure game,

MagiQuest�, to its Mason resort in the fourth quarter, bringing to six

the number of resorts that offer the popular attraction. Earlier

in 2007, the company made an investment in Creative Kingdoms, LLC, developers

of MagiQuest. �Throughout the past year, we have been constantly

refining and upgrading our product offering within our resort portfolio,�

Emery said. �As we develop our new resorts, we will look to incorporate

our various enhancements � such as the gr8_space family tech center, Scooops

® Kid Spa, minigolf, increased meeting space, larger food and beverage

and retail outlets, and MagiQuest � to provide an increasingly robust experience

for all of our guests.�

The company noted that the operating environment at its upper Midwest

properties continues to be impacted by ongoing difficulties of the U.S.

automobile industry companies. �We expect a few of our markets, particularly

those for our Sandusky and Traverse City locations, will continue to feel

the effects of the auto industry problems and remain difficult for at least

the next few quarters,� Emery noted.

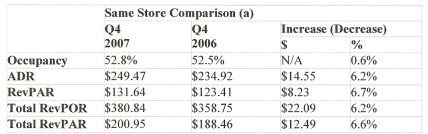

Fourth quarter 2007 operating statistics for the company�s portfolio

of Great Wolf Lodge resorts were as follows:

Same store comparison includes only Great Wolf Lodge

resorts that were open for all of both Q4 2007 and Q4 2006.

Construction Update

The company hosted the grand opening of its 402-suite Great Wolf Lodge

in Grapevine, Texas on January 10, 2008. In November 2007, the company

broke ground on a 203-suite addition and a 20,000 square-foot meeting facility

at the Grapevine resort. �Much of the resort�s initial infrastructure

was designed to support 600+ suites because of the significant size of

the Dallas/Ft. Worth metropolitan market,� Emery commented. �Based upon

our forecasts of market demand, we accelerated the construction of the

planned expansion.� The addition is a connecting wing to the existing

resort structure and is being built without disruption to current guests.

�We expect the first phase of the expansion to open in December 2008,�

Emery added.

The 398-suite Great Wolf Lodge in Grand Mound, Wash., remains on schedule

to open in March 2008. That resort is owned by a joint venture between

a subsidiary of Great Wolf Resorts and the Confederated Tribes of the Chehalis

Reservation. The resort is located adjacent to Interstate 5, the

major highway link between Portland and Seattle/Tacoma. �This is

the first major indoor waterpark resort in that region,� Emery said.

�Pre-opening interest is strong, especially since we expect to open just

before the region�s spring break period.�

In the fourth quarter, the company broke ground on the 402-suite Great

Wolf Lodge resort in Concord, N.C., near Charlotte, off of Speedway Boulevard

and Interstate 85 and near the Lowes Motor Speedway and Concord Mills Mall.

The resort will include a 98,000 square-foot indoor entertainment area,

featuring what will be the state�s largest indoor waterpark; 20,000 square

feet of meeting space; multiple food outlets; a confectionary café;

a spa and Scooops Kid Spa; a children�s craft and activity room; a game

arcade; MagiQuest; an 18-hole outdoor miniature golf course; gr8_space;

a fitness room; a gift emporium; and an animated clock tower. The

property is expected to open in Spring 2009. �The nearby Lowes Motor

Speedway recently announced it will invest $200 million to expand its facilities,�

Emery said. �We believe this will further enhance the destination

aspects of the area and create more year-round events which will attract

more leisure travelers to the area and increase demand for our resort.�

The company noted that the pace of construction cost increases on its

projects that commenced in 2007 appears to have moderated somewhat.

�As we have noted in the past and similar to other companies involved in

the construction of large commercial projects, we have seen steeply increased

construction costs over the past two-three years,� Emery noted. �We

are focused on and committed to controlling and mitigating these construction

cost increases in our construction and development projects. Our

current projection of construction costs for our projects that commenced

in the fourth quarter � our Concord resort and Grapevine expansion -- are

still in line with our initial estimates.

�Even in the recent rising construction cost environment, our portfolio

returns continued to be healthy� Emery added. �For our Great Wolf

Lodge brand consolidated resorts open more than 18 months as of December

31, 2007, we achieved an unlevered return (calculated as Adjusted EBITDA

divided by the average net book value of property and equipment) of more

than 14 percent for 2007. For 2008, we project a portfolio unlevered

return on those same resorts of approximately 16 percent, assuming the

mid-point of our full-year earnings guidance. We are targeting for

our newer assets to eventually achieve reasonably similar returns following

their ramp-up.�

Development Update

�We continue to work on the development of several projects which are

currently under letters of intent,� Emery said. These include: a

Great Wolf Lodge resort at the Mall of America®, located in Bloomington,

Minn.; a joint venture with the Mashantucket Pequot Tribal Nation to develop

a Great Wolf Lodge resort of up to 700 suites on tribal-owned land near

its southeast Connecticut reservation and Foxwoods Resort Casino; and a

Great Wolf Lodge resort on the shores of Lake Lanier, near Atlanta, Ga.

�All three of these projects, along with others in our development pipeline,

are in the early planning stages. We continue to be focused on high-quality

opportunities like these, although it is difficult to predict the precise

timing or approval of these potential projects as they move through the

development process and into the construction phase,� he added.

The company�s domestic development is concentrated primarily on the

East and West Coasts in markets near large population centers. International

development opportunities are currently focused principally on Canada,

Europe and Asia. The company�s preferred model for international

development is for third-party ownership of international projects, with

the company licensing its brand concept to third-party owners, as well

as possibly management and other consulting assignments.

Emery noted that, at any one time, the company has identified approximately

two dozen potential development sites and is in the due diligence process

on a number of them. �Our resorts are large and complex, so we are

working with a number of different governmental agencies in the entitlement

process, which takes time. We continue to feel that unit growth is

the best way to expand our brand presence more rapidly. But we will

only pursue opportunities where we feel that both marketplace demand is

sufficient and we can reasonably expect to obtain capital funding for the

debt and equity portions of the project.

�We believe we are well-positioned despite the recent constraints in

the capital markets,� he continued. �The fallout from the subprime

loan crisis has constricted borrowing opportunities for smaller companies

and may benefit us by limiting the entry of competition. This impact

on potential new competition allows us to continue to build our brand recognition,

which we believe may provide us a long-term competitive advantage by helping

us create national awareness for our resorts.�

Capital Structure and Liquidity

In February 2008, the company obtained a $55 million mortgage loan secured

by its Great Wolf Lodge resort in Williamsburg. The loan has a one-year

term and bears interest at a floating rate of LIBOR plus 300 basis points,

with a minimum rate of 6.50 percent per annum.

�We closed on this loan to add liquidity to our balance sheet,� said

James A. Calder, chief financial officer. �We think closing on a

loan like this in a tough debt market is a positive reflection on our company.

As we have noted previously, our strategy continues to be ensuring that

our liquidity is more than sufficient to achieve our current development

objectives.�

�As we have mentioned before, given the number of development opportunities

we have, we expect to use joint ventures or licensing arrangements for

certain projects,� Emery noted. �We feel that our Grand Mound and

Niagara Falls properties have shown the benefits of incorporating the joint

venture and licensing strategies into our business model. We are

currently in discussions on possible joint venture arrangements for each

of our planned future resorts. We believe joint venture and licensing

strategies provide a good opportunity for us to continue to meet our brand

growth objectives, even in the current constrained capital environment.�

�Our current construction projects are the expansion of our existing

Grapevine resort (first phase expected to open at the end of 2008) and

our new Concord resort (expected to open in Spring 2009),� Calder said.

�Through the Concord resort construction timeline, assuming no other borrowings

from this point other than the expected construction loan for Concord,

our primary sources of capital to fund these projects are a combination

of cash on hand, cash provided by operations and the Concord construction

loan. We expect these potential sources to exceed $200 million through

the completion of the Concord resort. Our expected remaining cash

requirements for these two projects over the same period total approximately

$150 million. With more than $50 million of expected sources of capital

in excess of expected uses, we feel we are well-positioned to execute our

current projects.�

�Additionally, we believe we will have, over the next 12-18 months,

more than $100 million of liquidity through borrowing capacity on our unlevered

or lower-levered assets,� Emery noted. �We believe this potential

additional liquidity source provides us with a comfortable cushion as we

navigate through the choppy current capital market environment.�

�We are currently working with our lead lender to finalize a construction

loan of approximately $90 million for our Concord resort,� Calder noted.

�The lead lender on this loan has historically been the largest construction

lender in the indoor waterpark industry. The Concord construction

loan is the fourth resort financing we have done with this lender.

Their process to complete the financing is moving forward as anticipated

and we expect to close on the loan within the next 60 days.�

At year-end 2007, the company had $18.6 million of unrestricted cash.

More than 83 percent of the company�s long-term debt was effectively fixed

with a weighted average interest rate of 7.1 percent and an average debt

maturity of 9.0 years.

Key Financial Data

As of December 31, 2007, Great Wolf Resorts had:

-

Total cash, cash equivalents and restricted cash of $20.9 million

-

Total secured debt of $315.8 million.

-

Total unsecured debt of $80.6 million.

-

Weighted average cost of total debt of 7.1 percent.

-

Weighted average debt maturity of 9.0 years.

-

Total construction in progress for consolidated resorts and other projects

currently under construction but not yet opened of $19.7 million

Outlook and Guidance

�Our resort portfolio continues to produce year-over-year, same-store

RevPAR growth,� Emery said. �We think our product offering may have

greater recession resistance than other entertainment venues. We

believe our resorts can continue to be a reasonably-priced, convenient

family vacation alternative. The all-in cost for a family vacation

at one of our resorts is substantially lower than flying to a destination

resort with a major entertainment component, and weather is not an issue.�

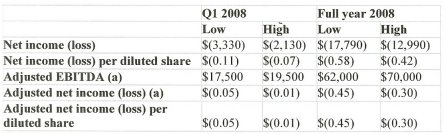

The company provides the following outlook and earnings guidance for

the 2008 first quarter and full year 2008 (amounts in thousands, except

per share data). The outlook and earnings guidance information is

based on the company�s current outlook of business conditions, including

consumer demand and discretionary spending trends, as of February 20, 2008.

As in the past, the company does not anticipate updating its guidance again

until next quarter�s earnings release. The company may, however,

update any portion of its business outlook at any time as conditions dictate:

(a)For reconciliations of Adjusted EBITDA and Adjusted

net income (loss), see tables accompanying this press release.

Net income (loss), net income (loss) per diluted share, adjusted net

income (loss), and adjusted net income (loss) per diluted share for 2008

are significantly affected by increases in depreciation and amortization

and interest expense, primarily for properties that are still in their

ramp-up stages.

Adjusted EBITDA and Adjusted net income are non-GAAP financial measures

within the meaning of the Securities and Exchange Commission (SEC) regulations.

See the discussion below in the �Non-GAAP Financial Measures� section of

this press release. Reconciliations of Adjusted EBITDA and Adjusted

net income are provided in the tables of this press release.

Great Wolf Resorts will hold a conference call to discuss its 2007 fourth

quarter results today, February 20, at 10 a.m. Eastern Time. Stockholders

and other interested parties may listen to a simultaneous webcast of the

conference call on the Internet by logging onto the company�s Web site,

www.greatwolf.com, or www.streetevents.com, or may call (800) 218-8862,

reference number 11108380. A recording of the call will be available

by telephone until midnight on Wednesday, February 27, 2008, by dialing

(800) 405-2236, reference number 11108380. A replay of the conference

call will be posted on the company�s Web site through March 20, 2008.

Non-GAAP Financial Measures

Included in this press release are certain �non-GAAP financial measures,�

which are measures of the company�s historical or future performance that

are different from measures calculated and presented in accordance with

GAAP, within the meaning of applicable SEC rules, that Great Wolf Resorts

believes are useful to investors. They are as follows: (i) Adjusted

EBITDA and (ii) Adjusted net income (loss). The following discussion

defines these terms and presents the reasons the company believes they

are useful measures of its performance.

Great Wolf Resorts defines Adjusted EBITDA as net income plus (a) interest

expense, net, (b) income taxes, (c) depreciation and amortization, (d)

non-cash employee compensation, (e) costs associated with early extinguishment

of debt or postponement of debt offerings, (f) opening costs of resorts

under development, (g) shareholder litigation expenses, (h) equity in earnings

(loss) of affiliates, (i) loss on disposition of assets, (j) impairment

charges, (k) other unusual or non-recurring items, and (l) minority interests.

The company defines Adjusted net income (loss) as net income without the

effects of (a) non-cash employee compensation, (b) costs associated with

early extinguishment of debt or postponement of debt offerings, (c) opening

costs of resorts under development (including costs incurred by unconsolidated

joint ventures), (d) shareholder litigation expenses, (e) loss on disposition

of assets, (f) impairment charges, (g) other unusual or non-recurring items,

and (h) the effect of non-normalized income tax expense.

Adjusted EBITDA and Adjusted net income (loss) as calculated by the

company are not necessarily comparable to similarly titled measures by

other companies. In addition, Adjusted EBITDA (a) does not represent

net income or cash flows from operations as defined by GAAP, (b) is not

necessarily indicative of cash available to fund the company�s cash flow

needs, and (c) should not be considered as an alternative to net income,

operating income, cash flows from operating activities or the company�s

other financial information as determined under GAAP. Also, Adjusted

net income does not represent net income as defined by GAAP.

Management believes Adjusted EBITDA is useful to an investor in evaluating

the company�s operating performance because a significant portion of its

assets consists of property and equipment that are depreciated over their

remaining useful lives in accordance with GAAP. Because depreciation and

amortization are non-cash items, management believes that presentation

of Adjusted EBITDA is a useful measure of the company�s operating performance.

Also, management believes measures such as Adjusted EBITDA are widely used

in the hospitality and entertainment industries to measure operating performance.

Similarly, management believes Adjusted net income (loss) is a useful

performance measure because certain items included in the calculation of

net income may either mask or exaggerate trends in the company�s ongoing

operating performance. Furthermore, performance measures that include

these types of items may not be indicative of the continuing performance

of the company�s underlying business. Therefore, the company presents

Adjusted EBITDA and Adjusted net income (loss) because they may help investors

to compare Great Wolf Resorts� ongoing performance before the effect of

various items that do not directly affect the company�s ongoing operating

performance.

Great Wolf Resorts, Inc.

Consolidated Statements of Operations

(in thousands, except per share amounts)

Three Three

Months Months

Ended Ended Year Ended Year Ended

December December December December

31, 2007 31, 2006 31, 2007 31, 2006

---------------------------------------

Revenues:

Rooms

$24,602 $19,272 $112,261 $87,775

Food and beverage

6,968 5,236 29,588

21,930

Other hotel operations

6,094 4,973 27,085

21,207

Management and other fees

1,643 1,938 7,169

5,816

------- ------- ------- -------

39,307 31,419 176,103 136,728

Other revenue from managed

properties

2,625 2,788 11,477

11,920

------- ------- ------- -------

Total revenues

41,932 34,207 187,580 148,648

Operating expenses:

Resort departmental expenses

14,871 11,925 64,016

47,837

Selling, general and

administrative

12,375 9,388 46,757

40,961

Property operating costs

4,314 3,998 20,327

15,823

Opening costs for resorts

under

development

5,514 4,332 10,228

7,394

Debt-related costs

- 336

- 747

Loss on disposition of

property 958

114 1,286 1,066

Depreciation and amortization

9,806 6,919 36,372

25,616

Goodwill impairment

- 50,975

- 50,975

------- ------- ------- -------

47,838 87,987 178,986 190,419

Other expenses from managed

properties

2,625 2,788 11,477

11,920

------- ------- ------- -------

Total operating expenses

50,463 90,775 190,463 202,339

Operating loss

(8,531) (56,568) (2,883) (53,691)

Investment income

(331) -

(667) -

Interest income

(394) (790) (2,758) (3,105)

Interest expense

3,783 1,770 14,887

7,169

------- ------- ------- -------

Loss before minority interests,

equity in loss of unconsolidated

related parties and income taxes

(11,589) (57,548) (14,345) (57,755)

Income tax benefit

(4,695) (8,682) (5,859) (8,764)

Minority interests, net of tax

- (388)

(452) (502)

Equity in loss of unconsolidated

related parties, net of tax

787 515 1,547

761

------- ------- ------- -------

Net loss

$(7,681) $(48,993) $(9,581) $(49,250)

======= ======= ======= =======

Net loss per share:

Basic

$(0.25) $(1.61) $(0.31) $(1.63)

Diluted

$(0.25) $(1.61) $(0.31) $(1.63)

Weighted average common shares

outstanding:

Basic

30,570 30,381 30,533

30,300

Diluted

30,570 30,381 30,533

30,300

Great Wolf Resorts, Inc.

Reconciliations of Non-GAAP Financial

Measures

(in thousands, except per share amounts)

Three Three

Months Months Year

Year

Ended Ended Ended

Ended

December December December December

31, 2007 31, 2006 31, 2007 31, 2006

-------- -------- -------- --------

Net loss

$(7,681) $(48,993) $(9,581) $(49,250)

Adjustments:

Opening costs for

resorts under

development

5,514 4,332 10,228

7,394

Litigation expenses

- 63

- 1,172

Non-cash employee

compensation 3,076

1,168 5,080 3,559

Debt-related costs

- 336

- 747

Loss on disposition

of property 958

114 1,286 1,066

Depreciation and

amortization 9,806

6,919 36,372 25,616

Interest expense,

net

3,389 980 12,129

4,064

Minority interest

expense, net of

tax

- (388) (452)

(502)

Goodwill impairment

- 50,975 -

50,975

Environmental liability

costs 320

833 320

833

Equity in loss of

unconsolidated

related parties,

net of tax 787

515 1,547 761

Income tax benefit

(4,695) (8,682) (5,859) (8,764)

------- ------- ------- -------

Adjusted EBITDA (1)

$11,474 $8,172 $51,070 $37,671

====== ====== ====== ======

Net loss

$(7,681) $(48,993) $(9,581) $(49,250)

Adjustments to net loss:

Opening costs for

resorts under

development

5,514 4,332 10,228

7,394

Litigation expenses

- 63

- 1,172

Non-cash employee

compensation 3,076

1,168 5,080 3,559

Debt-related costs

- 336

- 747

Loss on disposition

of property 958

114 1,286 1,066

Goodwill impairment

- 50,975 -

50,975

Environmental liability

costs 320

833 320

833

Equity in loss of

unconsolidated

related parties

(2)

484 -

1,161 -

Income tax rate

adjustment (3) (4,213) (8,740)

(7,517) (11,857)

------- ------- ------- --------

Adjusted net income (loss) (1)

$(1,542) $88 $977

$4,639

======= ====== ====== ======

Adjusted net income (loss) per

share:

Basic

$(0.05) $0.00 $0.03

$0.15

Diluted

$(0.05) $0.00 $0.03

$0.15

Weighted average shares outstanding:

Basic

30,570 30,381 30,533 30,300

Diluted

30,570 30,430 30,533 30,349

Great

Wolf Resorts, Inc.

Operating Statistics - Great Wolf

Lodge Resorts

Three Months Ended Year Ended

------------------ --------------

December 31, December 31,

2007 2006 2007

2006

------ ------ ------ ------

All Great Wolf Lodge Properties

Occupancy

51.8% 52.4% 62.2%

64.0%

ADR

$245.76 $236.13 $248.66 $241.70

RevPAR

$127.36 $123.74 $154.60 $154.61

Total

RevPOR

$379.14 $361.47 $374.20 $359.57

Total

RevPAR

$196.48 $189.43 $232.66 $230.01

Great Wolf Lodge Properties - Same

Store (4)

Occupancy

52.8% 52.5% 64.7%

64.8%

ADR

$249.47 $234.92 $248.05 $240.14

RevPAR

$131.64 $123.41 $160.45 $155.68

Total

RevPOR

$380.84 $358.75 $368.59 $354.78

Total

RevPAR

$200.95 $188.46 $238.42 $230.00

The company defines its operating statistics

as follows:

Occupancy

is calculated by dividing total occupied rooms by total

available

rooms.

Average

daily rate (ADR) is the average daily room rate charged and

is calculated

by dividing total rooms revenue by total occupied

rooms.

Revenue

per available room (RevPAR) is the product of (a) occupancy

and

(b) ADR.

Total

revenue per occupied room (Total RevPOR) is calculated by

dividing

total resort revenue (including revenue from rooms, food and

beverage,

and other amenities) by total occupied rooms.

Total

revenue per available room (Total RevPAR) is the product of (a)

occupancy

and (b) Total RevPOR.

Great Wolf Resorts, Inc.

Reconciliations of Outlook Financial

Information (5)

(in thousands, except per share amounts)

Three Months

Ending Year Ending

March 31, December 31,

2008

2008

------------ ------------

Net income (loss)

$(2,730) $(15,390)

Adjustments:

Opening costs

of resorts under

development

2,500

4,000

Non-cash employee

compensation

550

2,350

Depreciation

and amortization

12,750

53,400

Interest expense,

net

6,800

24,700

Equity in

loss of unconsolidated

affiliates

450

7,200

Income tax

expense (benefit)

(1,820) (10,260)

------- --------

Adjusted EBITDA (1)

$18,500

$66,000

======

======

Net income (loss)

$(2,730) $(15,390)

Adjustments to net income (loss):

Opening costs

of resorts under

development

2,500

4,000

Non-cash employee

compensation

550

2,350

Income tax

rate adjustment (3)

(1,220)

(2,540)

-------

-------

Adjusted net income (loss) (1)

$(900) $(11,580)

====== ========

Net income (loss) per share:

Basic

$(0.09)

$(0.50)

Diluted

$(0.09)

$(0.50)

Adjusted net income (loss) per share:

Basic

$(0.03)

$(0.38)

Diluted

$(0.03)

$(0.38)

Weighted average shares outstanding:

Basic

30,600

30,800

Diluted

30,600

30,800

Great Wolf Resorts, Inc.

Calculations of Unlevered Returns

(in thousands)

Year Ended Year Ending

December 31, December 31,

2007

2008 (5)

----------- ------------

Adjusted EBITDA

- portfolio of

resorts

(6)

$45,618 $48,812

Adjusted EBITDA

- all other

operations

(7)

5,452

17,188

------

------

Total Adjusted

EBITDA

$51,070 $66,000

======

======

Net book value

of property and

equipment

of portfolio of

resorts:

December 31, 2006 (8)

$305,999

March 31, 2007 (8)

$311,721

June 30, 2007 (8)

$313,717

September 30, 2007 (8)

$311,468

December 31, 2007 (8)

$306,934 $306,934

December 31, 2008 (9)

$284,527

Average of amounts above

$309,968 $295,731

======= =======

Unlevered return

(10)

14.7%

16.5%

======= =======

(1) See discussions of Adjusted EBITDA

and Adjusted net income (loss)

located in

the "Non-GAAP Financial Measures" section of this press

release.

(2) This amount represents the company's

equity method loss recorded for

the joint

venture that owns a Great Wolf Lodge resort under

construction

in Grand Mound, Washington.

(3) This amount represents an adjustment

to recorded income tax expense

to bring the

overall effective tax rate to an estimated normalized

rate of 40%.

This effective tax rate differs from the effective tax

rates in the

company's historical statements of operations.

(4) Same store comparison includes

Great Wolf Lodge resorts that were

open for the

full periods in both 2006 and 2007.

(5) The company's outlook reconciliations

use the mid-points of its

estimates

of Adjusted EBITDA and Adjusted net income (loss).

(6) Portfolio of resorts represents

Great Wolf Lodge brand consolidated

resorts open

more than 18 months as of December 31, 2007 (that is,

the company's

Traverse City, Kansas City, Williamsburg and Pocono

Mountains

resorts).

(7) All other operations represents

(a) the company's consolidated

resorts not

included in the "Portfolio of resorts" above and (b)

corporate

activities.

(8) Net book value amount of property

and equipment represents the

amounts included

for the portfolio of resorts in the company's

historical

financial statements.

(9) Estimated net book value amount

of property and equipment for the

portfolio

of resorts as of December 31, 2008 calculated as (a) net

book value

amount as of December 31, 2007 less (b) estimated

depreciation

expense for the year ending December 31, 2008 plus (c)

assumed capital

expenditures of 4% of budgeted 2008 total revenues.

(10)Unlevered return calculated as

(a) Adjusted EBITDA - portfolio of

resorts divided

by (b) average net book value of fixed assets of

portfolio

of resorts. |

This press release contains forward-looking statements

within the meaning of the federal securities laws. All statements,

other than statements of historical facts, including, among others, statements

regarding Great Wolf Resorts' future financial position, business strategy,

projected levels of growth, projected costs and projected performance and

financing needs, are forward-looking statements. Those statements

include statements regarding the intent, belief or current expectations

of Great Wolf Resorts, Inc. and members of its management team, as well

as the assumptions on which such statements are based, and generally are

identified by the use of words such as �may,� �will,� �seeks,� �anticipates,�

�believes,� �estimates,� �expects,� �plans,� �intends,� �should� or similar

expressions. Forward-looking statements are not guarantees of future

performance and involve risks and uncertainties that actual results may

differ materially from those contemplated by such forward-looking statements.

Many of these factors are beyond the company's ability to control or predict.

Such factors include, but are not limited to, competition in the company�s

markets, changes in family vacation patterns and consumer spending habits,

regional or national economic downturns, the company�s ability to attract

a significant number of guests from its target markets, economic conditions

in its target markets, the impact of fuel costs and other operating costs,

the company's ability to develop new resorts in desirable markets or further

develop existing resorts on a timely and cost efficient basis, the company's

ability to manage growth, including the expansion of the company�s infrastructure

and systems necessary to support growth, the company�s ability to manage

cash and obtain additional cash required for growth, the general tightening

in the U.S. lending markets as a result of the subprime loan crisis, potential

accidents or injuries at its resorts, its ability to achieve or sustain

profitability, downturns in its industry segment and extreme weather conditions,

increases in operating costs and other expense items and costs, uninsured

losses or losses in excess of the company's insurance coverage, the company's

ability to protect its intellectual property, trade secrets and the value

of its brands, current and possible future legal restrictions and requirements.

A further description of these risks, uncertainties and other matters can

be found in the company�s annual report and other reports filed from time

to time with the Securities and Exchange Commission, including but not

limited to the company�s Annual Report on Form 10-K for the year ended

December 31, 2006 filed with the Securities and Exchange Commission on

March 7, 2007. Great Wolf Resorts cautions that the foregoing list

of important factors is not complete and assumes no obligation to update

any forward-looking statement that it may make.

Management believes these forward-looking statements are

reasonable; however, undue reliance should not be placed on any forward-looking

statements, which are based on current expectations. All written

and oral forward-looking statements attributable to Great Wolf Resorts

or persons acting on its behalf are qualified in their entirety by these

cautionary statements. Further, forward-looking statements speak

only as of the date they are made, and the company undertakes no obligation

to update or revise forward-looking statements to reflect changed assumptions,

the occurrence of unanticipated events or changes to future operating results

over time unless otherwise required by law.

About Great Wolf Resorts, Inc.

Great Wolf Resorts, Inc.® (NASDAQ: WOLF), Madison,

Wis., is North America�s largest family of indoor waterpark resorts, and,

through its subsidiaries and affiliates, owns and operates its family resorts

under the Great Wolf Lodge® and Blue Harbor Resort� brands. Great

Wolf Resorts is a fully integrated resort company and owns and/or manages

Great Wolf Lodge locations in: Wisconsin Dells, Wis.; Sandusky, Ohio; Traverse

City, Mich.; Kansas City, Kan.; Williamsburg, Va.; the Pocono Mountains,

Pa.; Niagara Falls, Ontario; Mason, Ohio; and Grapevine, Texas; and Blue

Harbor Resort & Conference Center in Sheboygan, Wis. Great Wolf

Lodge properties are currently under construction in Grand Mound, Wash.;

and Concord, N.C.

The company�s resorts are family-oriented destination

facilities that generally feature 300 to 400 rooms and a large indoor entertainment

area measuring 40,000 to 100,000 square feet. The all-suite properties

offer a variety of room styles, arcade/game rooms, fitness centers, themed

restaurants, spas, supervised children�s activities and other amenities.

Additional information may be found on the company�s Web site at www.greatwolf.com. |