The 2006 World Ranking; 10 Largest Hotel Groups

and 20 Largest Brands

Paris, June 8, 2007

-

With 150,000 new rooms opened by hoteliers in the year 2006, the world

supply of corporate chains posts heretofore unattained growth. On January

1, 2007 the worldwide supply of the top 200 groups reached 43,000 hotels

and 5.5 million rooms. Since 2005, the acceleration of development has

been confirmed.

-

This movement is sustained by a record year in terms of activity: the recovery

of demand generates solid improvement in the RevPAR (+9.4%). The turnover

in the hotel industry worldwide posts double-digit growth (+12.4%) and

it has never been so high (230 billion euros).

-

Capital movement continues to intensify. Investment funds are increasingly

present and compete over the hotel assets worldwide. Hotel groups feed

the many rumors about transactions and mergers / acquisitions.

Worldwide hotel ranking 2007

� final results

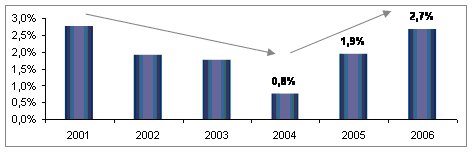

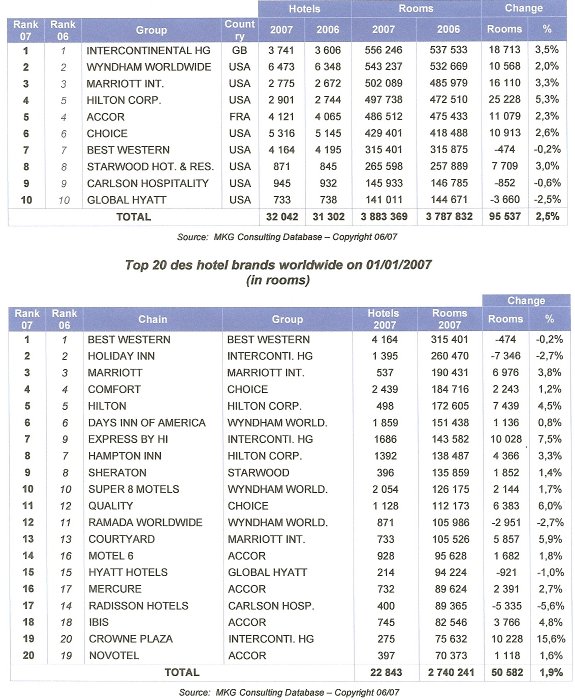

Top 10 hotel groups worldwide in 01/01/2007

(in rooms)

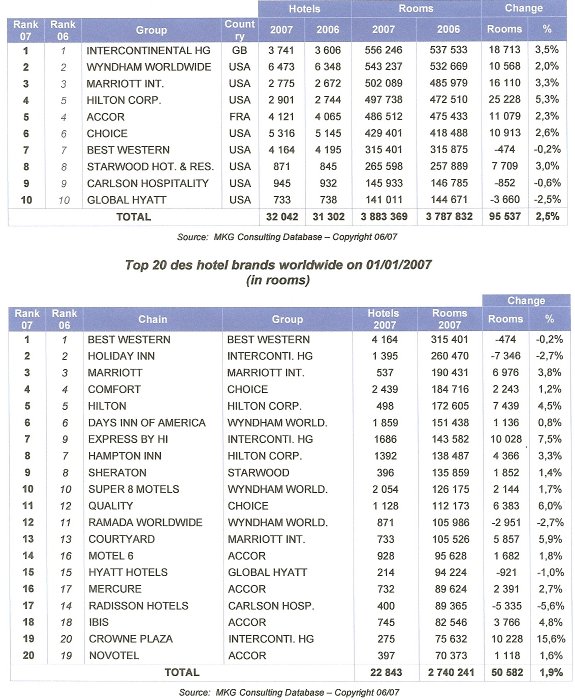

BEST WESTERN BEST WESTERN HOLIDAY

INN MARRIOTT MARRIOTT INT COMFORT CHOICE HILTON HILTON CORP DAYS INN OF

AMERICA WYNDHAM WORLD EXPRESS BY HI INTERCONTI. HG HAMPTON INN HILTON CORP

SHERATON STARWOOD SUPER 8 MOTELS WYNDHAM WORLD QUALITY CHOICE RAMADA WORLDWIDE

WYNDHAM WORLD COURTYARD MARRIOTT INT MOTEL 6 ACCOR HYATT HOTELS GLOBAL

HYATT MERCURE ACCOR RADISSON HOTELS CARLSON HOSP IBIS ACCOR CROWNE PLAZA

INTERCONTI. HG NOVOTEL ACCOR

Development picks up its pace...

-

In its Worldwide Hotel Activity Report, on January 1, 2007 MKG Consulting

counts 43,000 corporate operated hotels worldwide and 5.5 million rooms.

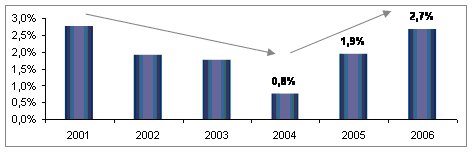

Growth in the year is established at 2.7% for nearly 150,000 rooms. This

is the highest growth ever recorded.

-

Until 2004, the growth of the supply worldwide slowed. Since then, the

development of chains has gained speed and resumed a rate comparable to

the one observed in 2001. In two years, the supply of corporate chains

worldwide grew by nearly 250,000 rooms, which is the nearly the equivalent

of the chain hotel supply in a country such as France (268,368 on January

1, 2007), despite being the number-one destination worldwide in terms of

number of visitors.

The growth rate of the hotel supply at

corporate chains worldwide from 2001 to 2006

Source: MKG Consulting Database � Copyright 06/07

-

The 10 leading groups confirm their ranking. They post growth in their

cumulated supply by nearly 100,000 rooms, up by 2.5%. Among them, the first

6 post growth in their supply by more than 10,000 rooms each, widening

the gap with competing groups.

-

InterContinental Hotels Group (IHG) affirms its position for the fourth

consecutive year as the world leader of the hotel industry. With growth

in its offer by more than 18,000 rooms, the group is increasing its lead

over its immediate competitors.

-

But the movement to grow networks does not concern only the weight of the

sector. Of the 100 first groups worldwide, 61 see their park expand on

January 1, 2007.

...under the influence of a very favorable economic situation

-

Economic growth worldwide pursues its strong trend. The tourism sector

fully benefits from this dynamic. With the return to growth in international

travel, demand for hotel products is intensifying. The global depression

that marked the beginning of this decade is abating.

-

Hotel performance worldwide falls into a very strong dynamic. After 3 consecutive

years of recession at the beginning of the decade, from 2001 to 2003, the

recovery of the RevPAR (revenue per available room) is spectacular. In

the course of the year 2006, the RevPAR grew by 9.4%. The improvement of

the occupancy rate by 1 point accompanied a strong recovery of average

daily rates by 7.9%. The upscale hotel segment, which has more cyclical

results than the economic or mid-scale categories, benefits fully from

the dynamism of international demand: +9.6% growth in the RevPAR for the

upscale segment and +12.5% for the upper upscale segment.

-

These results suggest the beginning of a new cycle of growth in demand

on a global scale. The improvement of hotel performance over a period growth

in supply betrays a significant increase in business volumes: the worldwide

turnover of chains is up by 12.4% in 2006, to around 230 billion dollars.

It is a new record.

Change in the RevPAR of corporate chains

from 2001 to 2006

Source: MKG Consulting Database � Copyright

06/07

Excellent prospects�

-

With the improvement of performances, investors are increasingly interested

by the hotel sector. Volumes of transactions grow. The year 2006 was marked

by an intensification of real estate asset sales programs. Extended Stay

Hotels was acquired by Lightstone for 8 billion dollars. ANA Hotels was

bought by Morgan Stanley Real Estate for 2.4 billion dollars. Morgan Stanley

also finalized the acquisition of CNL Hotels & Resorts for 6.6 billion

dollars.

-

In addition to the increasingly massive involvement of real estate investment

specialists, today the sector is also characterized by many fusions and

acquisitions among hotel brands and operators. The big maneuvers mostly

concern leader groups. At the beginning of the year, Hilton Hotels announced

the resale of Scandic Hotels by EQT for 833 million euros. In April 2007,

Accor announced the sale of its American brand Red Roof for 1.3 billion

dollars.

-

Growth of the major hotel groups worldwide will continue in the years to

come. Most of them have considerable pipelines* for the next 3 to 4 years:

from 80,000 to 150,000 room depending on the group, or even 158,000 rooms

for IHG which intends to firmly defend its leadership. Starwood Hotels

and Resorts announces the opening of more than 80 new hotels in the year

2007 across all its brands. 420 units for more than 100,000 rooms are already

in its pipeline*.

� almost everywhere in the world

-

The perspectives for growth are good on all the continents. North America

remains the favored continent in the corporate hotel chain industry. Nearly

6 in 10 rooms (56.9%) in the world are located there, for nearly 3.2 million

rooms. The United States have the most advanced development cycle of chains.

They amount to nearly 70% of the country�s global supply. After a period

of declining volumes of openings, the outlook for a drop in building costs

should nonetheless result in wider operating margins to increase hotel

projects.

-

In contrast with chains in the United States, hotel brands in Europe (less

than 25% for the entire continent) still have a considerable amount of

room for development. And all the more so since it is the number-one tourist

destination worldwide.

-

In 2006, Asia posts the most growth in the corporate hotel chain supply

in terms of both growth rate (+10.5%) and volume (around 60,000 additional

rooms). The penetration rate of chains in the zone is just 15%, and the

race to Asia, already well on its way, shall continue. China and India

are the priority targets. These countries present many vast agglomerations

with large pools of customers. China in particular attracts large international

hotel groups. The country also sees the consolidation of major hotel groups

whose development accompanies the growth of the domestic economy such as

Jin Jiang or Home Inns. These groups post some of the strongest growth

rates in supply worldwide. Hotel groups are multiplying financial and real

estate partnerships (such as Deutsche Asset Management and HQ Asia Pacific

for Hilton Corp. in China, or EMAAR Properties and InterGlobe for Accor

in India). The major international groups will take advantage of their

renown in order to benefit from these supply markets. Accor, IHG and Starwood

Hotels & Resorts are thus particularly well positioned in Asia.

-

Finally, all lights are green, stimulating the investor�s appetites and

rumors about acquisitions regarding groups in the Top 10 worldwide are

multiplying. After IHG in the past few months, recent speculations concern

Starwood Hotels and Resorts, Wyndham Worldwide and Marriott International

is the latest to date.

Methodology

Created in 1985 by Georges Panayotis, MKG Consulting is

the European leader in consulting for the hotel, tourism and restaurant

sector and has the largest hotel database in the world outside the United

States, with good representation of all hotel segments. The monthly observatory

of MKG Consulting�s Database is based on a sample of 10,000 corporate chain

hotels, accounting for 1,000,000 rooms.

Since September 2004, MKG Consulting�s Database offers

a program that makes it possible to monitor activity indicators hotel by

hotel on a daily basis. This program includes 1,500 hotels and 125,000

rooms in France making it the largest daily statistics observatory in Europe.

- All the data of the Worldwide Hotel Activity Report,

realized by MKG Consulting each year, is published in issue 146/147 for

May/June 2007 of HTR Magazine;

- The 2007 edition of the �European Hospitality Report�

is now available. This study presents the hotel ranking worldwide and constitutes

the most comprehensive and detailed global and market-by-market analysis

on the hotel sector in Europe.

* Pipeline: hotel development projects |